Dollar extends rally on fresh tariff headlines

Dollar rises, propped up by new tariff headlines

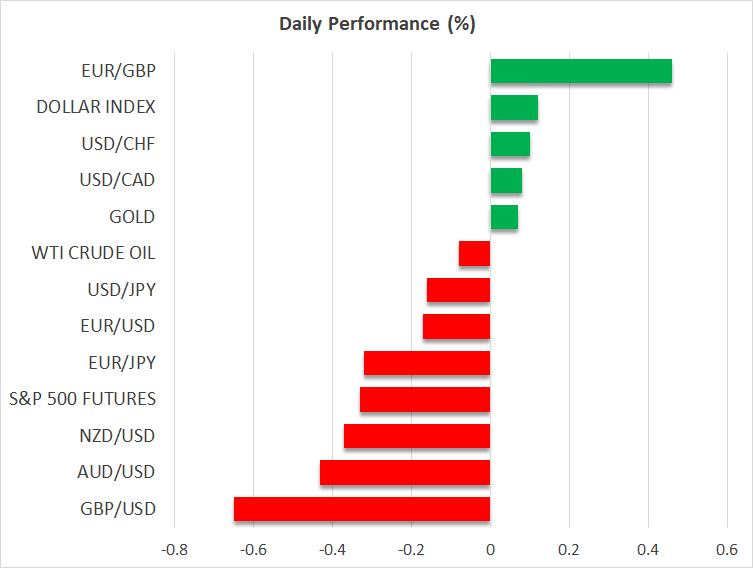

The US dollar rose for a second straight day, gaining against every other major currency following a report that President-elect Trump is considering declaring a national emergency to allow for a new tariff program.

The yield on 10-year US Treasury bonds rose to 4.73%, the highest level since April, as investors became more concerned that Trump’s tariff policies, alongside deregulation and lower taxes, could add fuel to already-sticky inflation.

Having said that though, market participants were reluctant to further scale back their Fed rate-cut bets. According to Fed funds futures, they are now penciling in 40bps worth of reductions this year, slightly more than the 38bps seen yesterday. Perhaps this was due to remarks by Fed Governor Christopher Waller, who said that inflation should continue to fall in 2025 and allow the Fed to further lower borrowing costs, though the pace remains uncertain.

The minutes of the latest Fed decision showed that officials agreed inflation is likely to continue slowing but added a rising risk that price pressures could remain sticky due to the potential effect of Trump’s policies. That said, given the outcome of the decision and the upward revision of the dot plot, this was something to be expected, and that’s maybe why Fed bets were not affected by the release.

Today, more policymakers will step onto the rostrum, including Philadelphia Fed President Patrick Harker, Kansas Fed President Jeffrey Schmid, and Fed Governor Michelle Bowman. Their remarks may impact expectations about the Fed’s future course of action, but the key event this week will be tomorrow’s NFP report.

Pound suffers on fears of new Truss episode

The currency that suffered the most yesterday was the British pound, extending its slide today to levels last seen in November 2023. The move coincided with a selloff in UK stocks and government bonds, with the 10-year gilt climbing to levels last seen back in July 2008, and the 30-year yield hitting a new 26-year high.

Although there was no obvious headline or data to spark the selloff, the excessive moves may have been the result of fears that the new UK government may need to hike taxes by more than they have already announced in the Autumn budget to fund their widening debt, something that could hurt an already wounded economy.

That said, with the BoE expected to proceed more cautiously than the ECB with rate cuts, and the UK not being a major target for Trump’s tariff plans, the euro/pound downtrend may stay intact for a while longer.

Yen takes a breather after BoJ report

The currency that is recovering some ground against the greenback today is the Japanese yen, perhaps aided by the BoJ’s assessment that a wide range of Japanese firms see the need to continue raising wages due to structural labor shortages. At the latest BoJ decision, Governor Ueda highlighted the importance of the spring labor negotiations and thus, the BoJ’s statement adds to the notion that the conditions for a near-term rate hike are falling into place.

Wall Street digests tariff headlines as well

Wall Street struggled for clear direction yesterday, with futures sliding today as investors are digesting another report related to Trump’s tariff plans. Concerns about inflation and expectations of a more cautious stance by the Fed on rate cuts are making investors reluctant to increase their risk exposure.

However, recent news relating to artificial intelligence (AI) suggested that many remain willing to price in more future growth opportunities, especially when it comes to tech giants. Therefore, new headlines about upcoming AI projects could well incentivize stock buying again.