Dollar falls as US data corroborates dovish Fed outlook

US data backs up the December Fed cut case

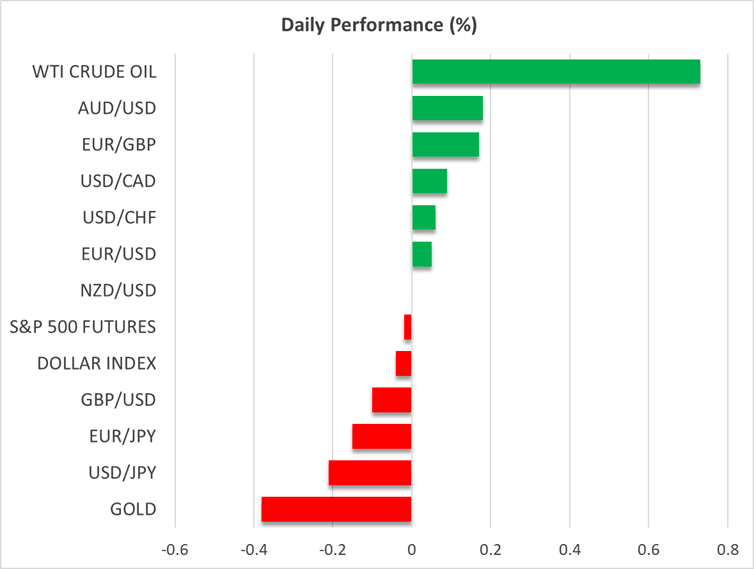

The US dollar fell against all its major peers yesterday, losing the most ground against the British pound. The greenback seems to be stabilizing today, remaining on the back foot only against the aussie.

Yesterday, the dollar was suffering ahead of any US data that was released, with the disappointing ADP private employment report allowing traders to maintain their short positions. The report revealed that private firms cut off 32k jobs in November instead of gaining 5k as the forecast suggested, with small businesses taking the biggest hit.

However, this was not a full-blown surprise and maybe that’s why Fed funds futures did not suggest a major change in expectations about the Fed’s future course of action. After all, those who paid attention to the weekly ADP data were already aware of the downside risks surrounding the monthly figure.

The probability for a rate cut by the Fed in December remained at around 85%, with investors continuing to pencil in nearly three additional quarter-point reductions by the end of 2026. Another reason why those bets were not shaken may be the improvement in the ISM non-manufacturing PMI for November. That said, the bigger-than-expected slide in the prices subcomponent may allow the Fed to stay relatively dovish at next week’s gathering and proceed with the expected rate cut.

Pound gains on revised PMI, but gains may be limited

The British pound was the currency that took most advantage of the greenback slide, with pound/dollar rising more than 1%. Perhaps the upward revision to the UK S&P Global Composite PMI for November added extra fuel to the pair.

However, with a 25bp rate cut at the Bank of England’s upcoming gathering being fully priced in, and nearly another two same sized reductions being baked into the cake for next year, any further recovery in the pound may be limited, especially against the euro.

The ECB is not projected to deliver any additional rate cuts, allowing the divergence in monetary policy expectations between the ECB and the BoE to work in favor of the euro. On top of that, the common currency may be benefitting from optimism over a possible end to the Ukraine-Russia war.

Russia announced yesterday that President Putting accepted some proposals made by the US, and although he rejected some others, he remained willing to negotiate as many times as needed to reach an accord.

Stocks rise, gold fails to take advantage of weak dollar

On Wall Street, all three of its main indices rose, with futures suggesting a higher open today, perhaps reflecting the dovish market interpretation about how the Fed will proceed from here onwards. That said, with valuations remaining stretched, the downside risks remain prominent.

For example, the Fed may indeed decide to cut interest rates by 25bps next week, but the dot plot could indicate only two rate cuts for next year. This could prove negative for stocks as it could weigh on the present values of high-growing firms that are valued by discounting expected cash flows.

Strangely, gold traders did not take advantage of the dollar’s slide, with the precious metal staying in pullback mode for a third day today. In any case, it may be a matter of time before Fed rate cut bets start to benefit gold again. After all, we’ve seen delayed responses from the metal in the recent past. For the correction to worsen, the Fed may need to appear less dovish than expected next week.