EBC Markets Briefing | Canadian dollar overlooks election result

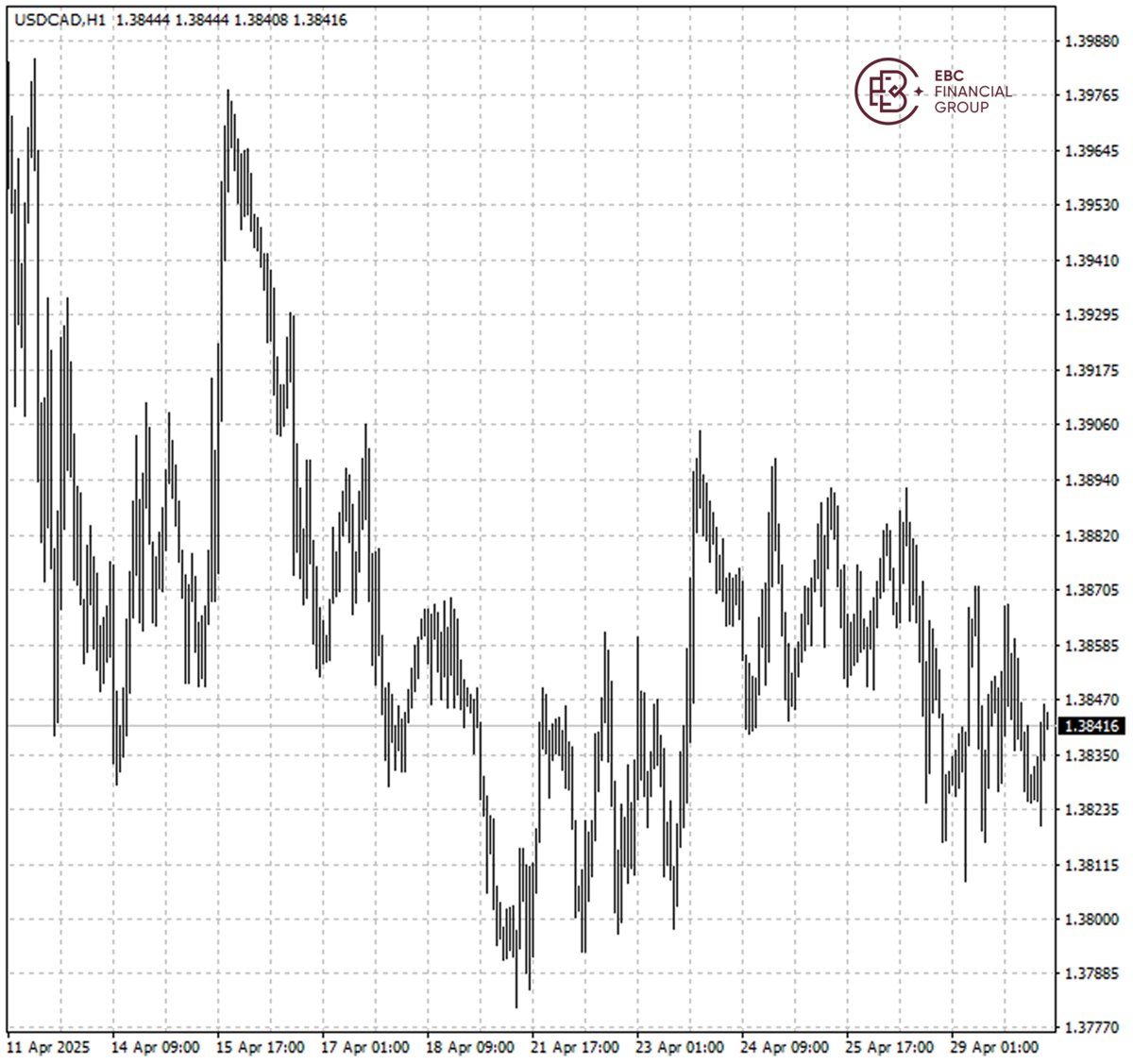

The Canadian dollar traded sideways on Wednesday as investors reacted calmly to a less conclusive outcome to the Canadian general election than had been expected and also shrugged off low oil prices.

The Liberal Party retained power but could fall short of the outright majority that polls had indicated. PM Mark Carney said his country would "never" yield to the US after he emerged victorious.

Trump on Tuesday signed an executive order softening some of the car tariffs he put into place earlier this month, as the industry grapples with regulatory uncertainty and additional costs due to the levies.

The new measures will reduce the overall tariff level on vehicle imports that had resulted from separate levies, such as an additional 25% tariffs on steel and aluminium.

Furthermore, vehicles that go through final assembly in the US will be able to qualify for partial reimbursements one additional 25% tariffs for two years. The softening stance is a tailwind for loonie.

Canadian energy producers are focusing more on natural gas as oil prices suffer the combined effects of ongoing trade tensions and OPEC+'s decision to change tack and boost output.

The Canadian dollar has broken above the resistance of 1.3840 per dollar earlier this week and hence moderate upside risk. The next hurdle is the psychological level at 1.3800 per dollar.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.