EBC Markets Briefing | Loonie faces wild swing ahead of BOC meeting

The dollar languished near a five-month low and loonie was on a roller coaster on Wednesday, as worries about the US economy continued to simmer under Trump's unpredictable trade policies.

Small-business confidence dropped for a third straight month in February. Investors have been on edge since Trump refrained from ruling out the possibility of a recession under his trade policies in an interview.

The Republican-controlled House of Representatives voted on Tuesday to block the ability of Congress to quickly challenge US tariffs on major trading partners that have rattled financial markets.

Trump threatened to double tariffs on Canadian steel and metal imports to 50% overnight, but just hours later he halted the plan as Ontario suspended new charges of 25% on electricity that it sends to the US.

The BOC is likely to cut interest rates for a seventh straight meeting later today as the country braces for a trade war that will plunge the economy into recession unless there is a swift resolution.

In January, Macklem said monetary policy can’t repair the damage caused by a trade war. Instead, he viewed the central bank’s role as limiting the pain of the economic shock, smoothing the adjustment process.

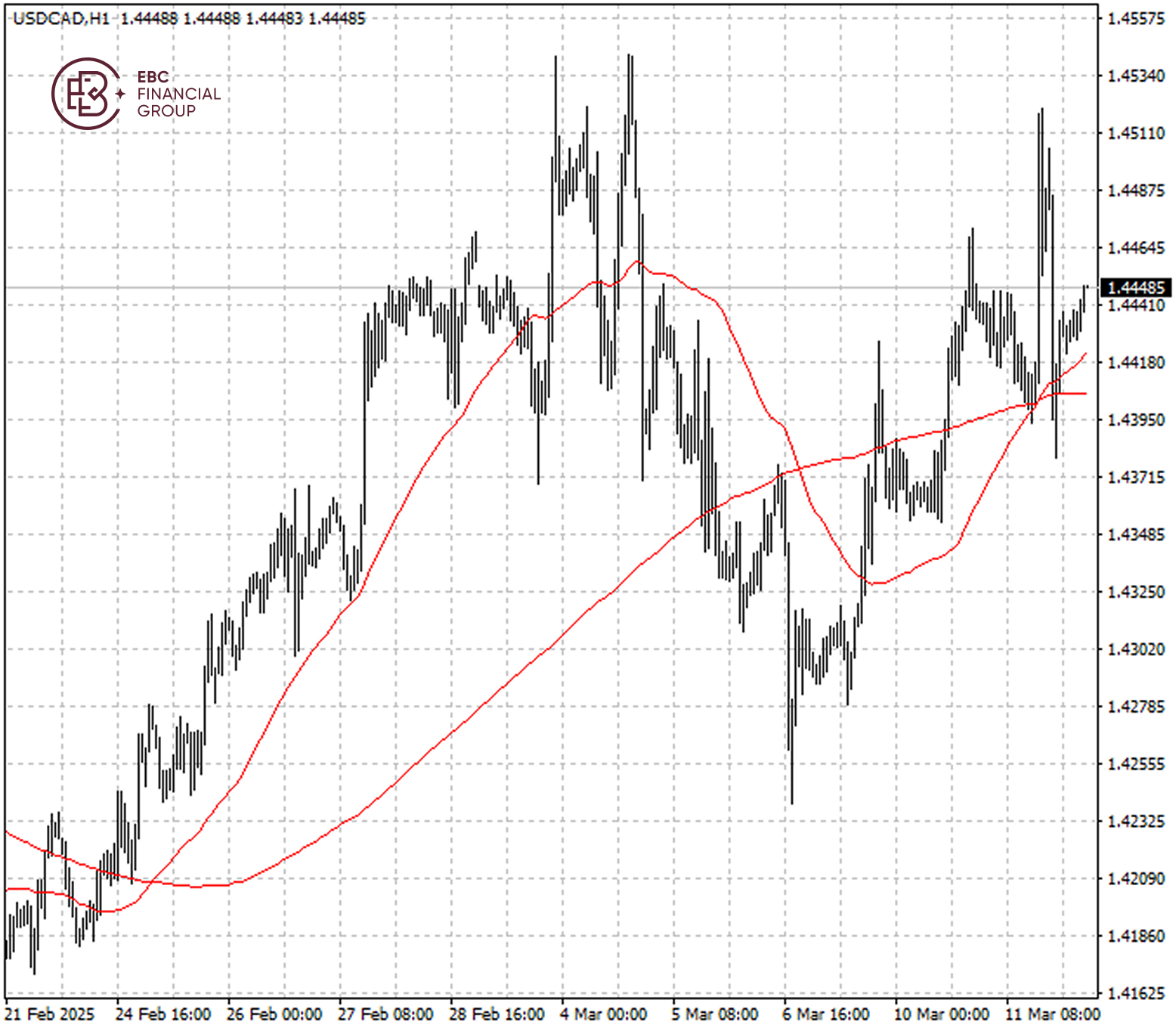

The Canadian dollar showed a death cross, signalling a long-term bear market ahead. The next hurdle is seen to lie around the low around 1.4470 per dollar hit on 10 March.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.