EBC Markets Briefing | Oil down on US-Russia talk; gold beyond $4,300

Oil prices edged lower on Friday, heading for a weekly loss, with uncertainty over global energy supplies after Trump and Putin agreed to meet in Hungary to discuss ending the war in Ukraine.

The EIA said US crude inventories increased by 3.5 million barrels last week, compared with analysts' expectation for a 288,000-barrel rise, as refining utilization dropped sharply to its lowest in eight months.

Trump has said Indian PM Modi has agreed to stop buying Russian oil, but an Indian government spokesman said he was "not aware of any conversation between the two leaders" taking place.

If G7 nations are serious, they could slash Moscow's income from overseas crude by up to $80 billion a year. That would deliver a big blow to the Kremlin's flagging economy and might even end war.

Saudi Aramco warned of a global oil shortage on the horizon, after a decade of underinvestment in the energy industry. Producers are focusing on drilling lower-cost reservoirs.

Oil prices are forecast to fall below $60 a barrel next year. However, many analysts believe that demand will be more robust than previously predicted, due to a slower switch to clean energy.

Brent crude has fallen sharply since its rally stalled close to $70. A push below $60 seems inevitable in the circumstance of de-escalation in the Middle East and potentially in Europe.

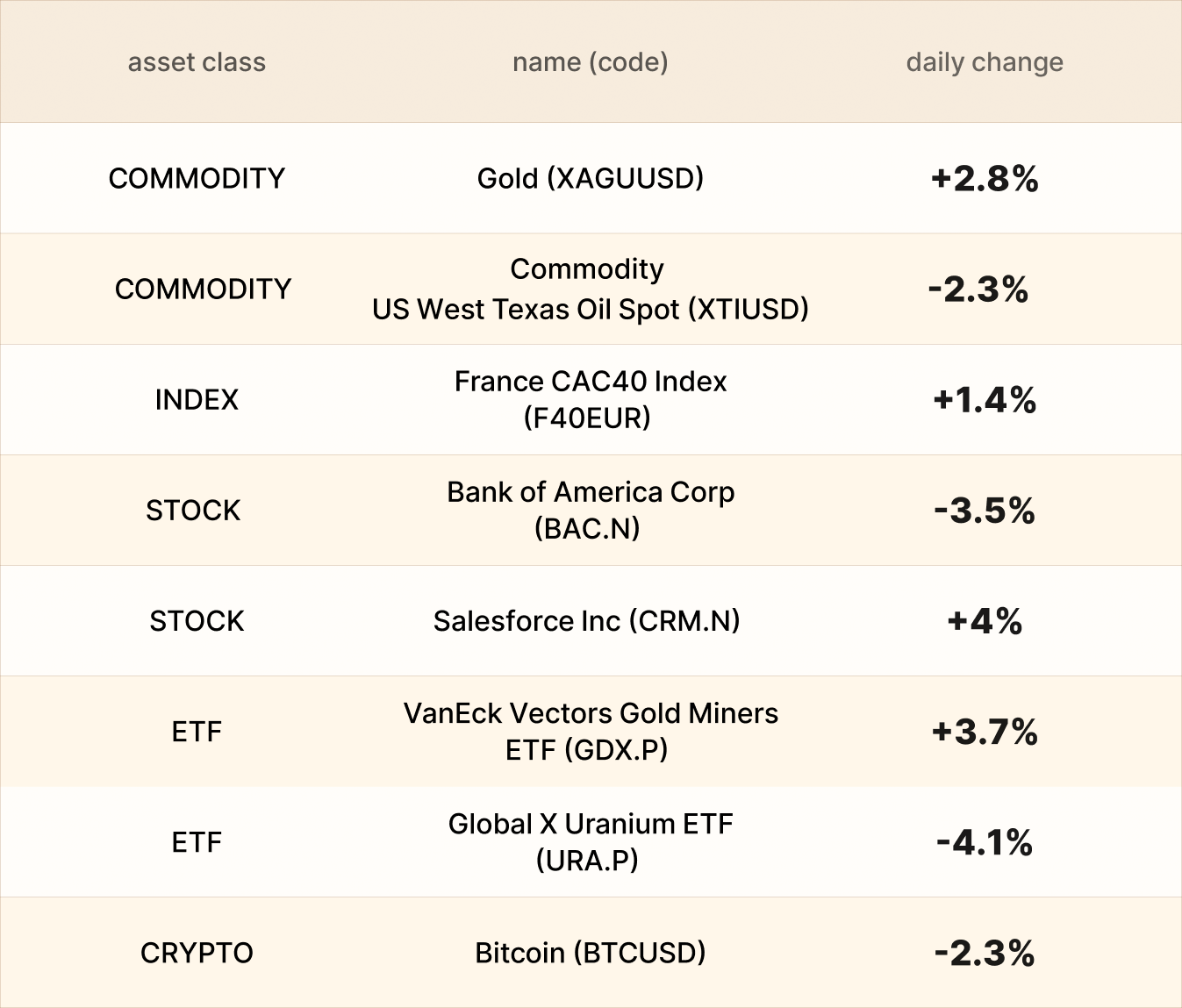

Asset recap

As of market close on 15 October, among EBC products, Salesforce shares led gains. The company expects revenue of more than $60 billion in 2030, above Wall Street estimates.

Gold is on fire, breaching the $4,300 mark effortlessly. Meanwhile, uranium prices have retreated significantly from multi-year highs, which could create a buying opportunity.

New lawsuits against BofA pointing triangle over ties to Jeffrey Epstein accuse the bank of maintaining relationships with the convicted sex offender and failing to report suspicious activities until after his 2019 death.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.