EBC Markets Briefing | Oil prices rebound as wildfires rage in Canada

Oil prices rallied on Wednesday following a tumble of about 2% to a six-week low on rising expectations of a ceasefire in Gaza and growing concerns about demand in China.

Efforts to reach a ceasefire deal between Israel and militant group Hamas under a plan outlined by US President Joe Biden in May and mediated by Egypt and Qatar, have gained momentum over the past month.

But the UN warned of a real danger of a devastating regional escalation after the first Israeli air strikes on Yemen in retaliation for Houthi drone and missile attacks on Israel.

Elsewhere wildfires in Alberta province are threatening almost 10% of the region’s oil production and forcing the evacuation of one of the country’s largest national parks during the peak summer tourist season.

Canada's oil production has remained largely stable, but the risk that wildfires pose to the industry is growing as the worst of the wildfire season is likely yet to come, Goldman Sachs said.

A cargo of North Sea crude that’s crucial to setting the world’s most important oil benchmark fetched a very low price in Asia, a sign that buying remains lacklustre.

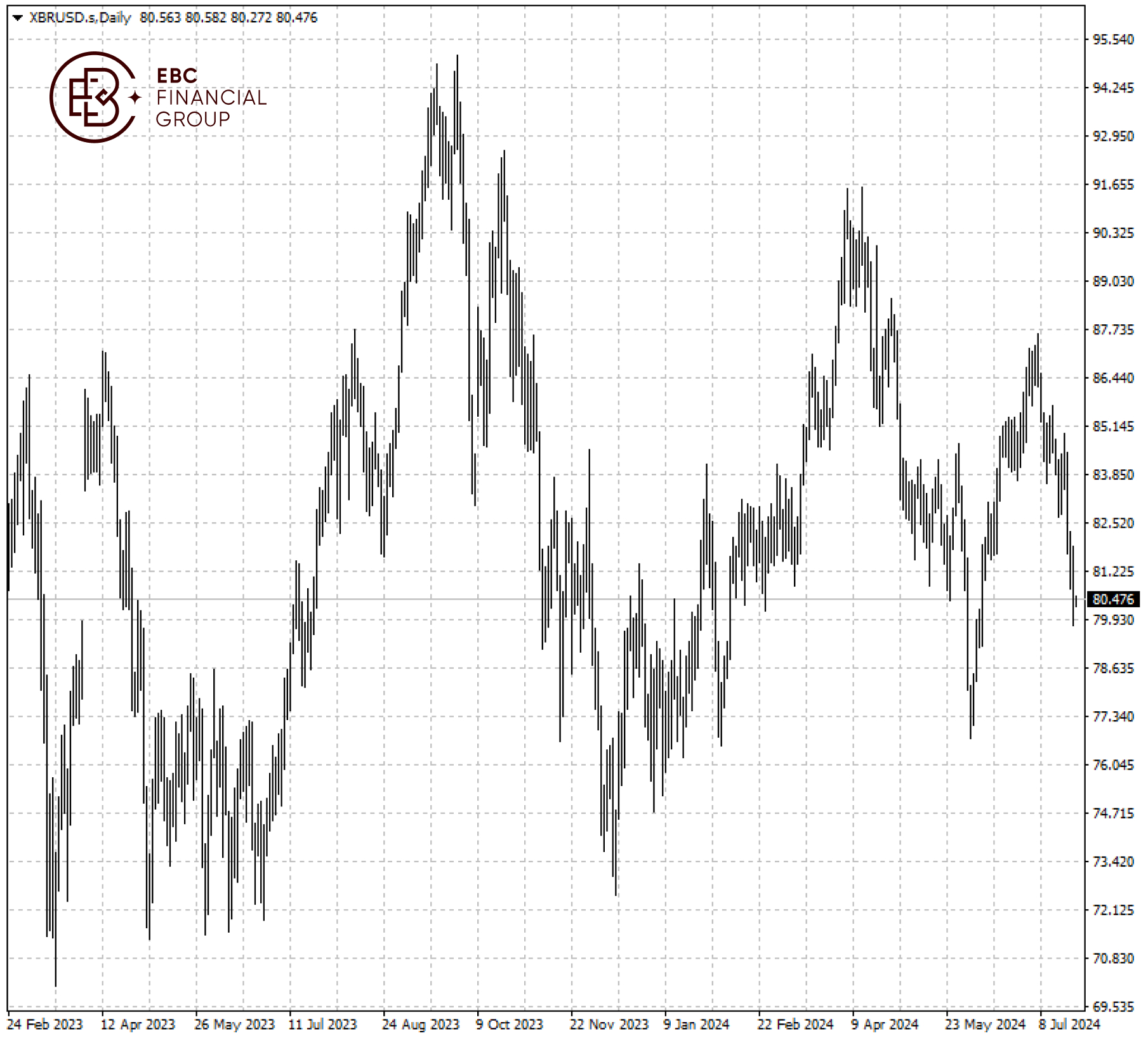

Brent crude has been on a descending trend with the key support lying at $79.4. A break above the level means it could fall further towards the low hit in early June.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.