EBC Markets Briefing | Sterling eases before budget release; bullion tumbles

The British pound traded lower on Monday, following sharp swings at the end of last week on news that Finance Minister Reeves has no plans to raise income tax rates in the upcoming budget.

But it is reported she has U-turned on plans to raise the rate of income tax, choosing instead to stick to Labour's manifesto pledge, while other tax rises have not been ruled out.

The 10-year gilt yield saw its biggest one-day jump since July as the shift in her stance alarmed bond investors who had been anticipating austerity to help fill an expected fiscal shortfall.

The UK's economy grew a meagre 0.1% in Q3, according to preliminary figures from the ONS, marking one of the last major pieces of economic data to be released ahead of the Autumn Budget.

Tax hikes could put a dampener on consumer spending and economic activity, but the economy could get a pre-Christmas boost if the BOE cuts interest rates at its last meeting of the year.

Governor Bailey said he wanted to see another batch of inflation and labour market prints before acting. Labour costs remained a major drag on SMEs, according to a survey by the British Chambers of Commerce.

Sterling rebounded sharply from the key support around $1.3 in early November. Higher highs and higher lows suggest more gains could lie ahead, with the potential of pushing above $1.32 afresh.

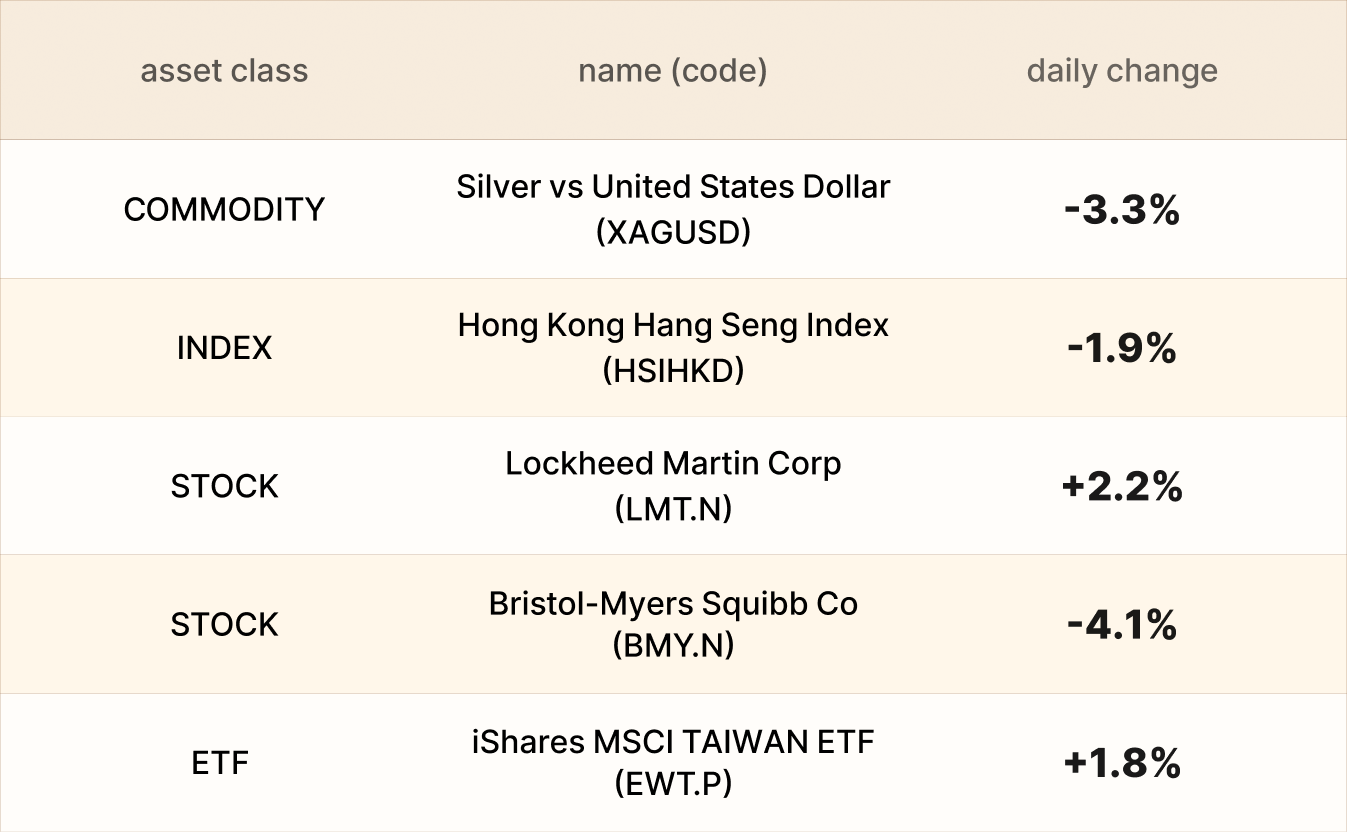

Asset recap

As of market close on 14 November, among EBC products, Lockheed Martin shares led gains. The company delivered the 750th HIMARS launcher to the US Army as part of an urgent production ramp.

Bristol Myers Squibb and Johnson & Johnson have stopped a phase 3 anticoagulant trial early for futility, closing off one avenue to market for a molecule tipped to generate multibillion-dollar sales.

Gold and silver prices slid amid a broader market sell-off sparked by fresh remarks from Fed officials that dimmed hopes of another rate cut next month.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.