EBC’s Million Dollar Trading Challenge II | Rising Stars Ride the Waves as Silver Enters the Spotlight

EBC’s Million Dollar Trading Challenge II has entered day 40, and markets remain volatile following President Trump’s announcement of a 90-day delay on tariff increases for most trade partners.

This temporary reprieve triggered a sharp rebound in financial markets, leaving traders who had been enjoying short positions scrambling to adapt. By 11:00 AM, @songqiantongzi reclaimed the top spot in the Dream Squad category. Interestingly, they had been observing the market quietly since April 7th, demonstrating that patience is indeed a virtue. For copy traders, chasing constant profits can lead to impulsive signal switching, especially for those with lower risk tolerance.

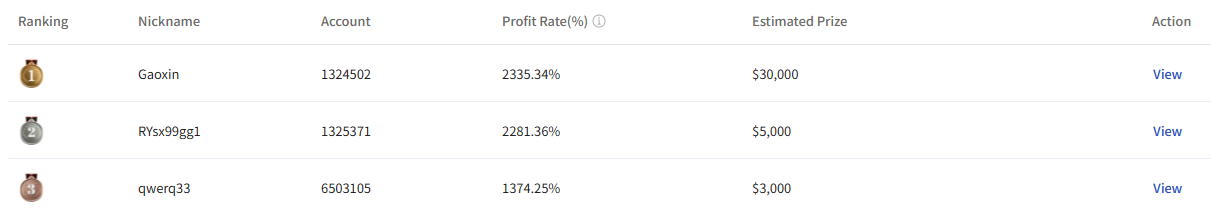

While the Dream Squad has been relatively subdued, the Rising Stars category has shown remarkable resilience. 2 traders have now achieved returns exceeding 20x, setting new records for the group. @Gaoxin capitalised on gold’s sharp declines yesterday and exited just before its subsequent rally, showcasing exceptional timing akin to dancing on a knife’s edge.

Meanwhile, second-place @RYsx99gg1 entered the competition just yesterday and has already made waves. Their portfolio includes trades in silver—a rarity among top-ranking competitors—making them a trailblazer in this year’s contest.

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.