European PMIs weaker than analysts’ forecasts but didn’t disappoint markets

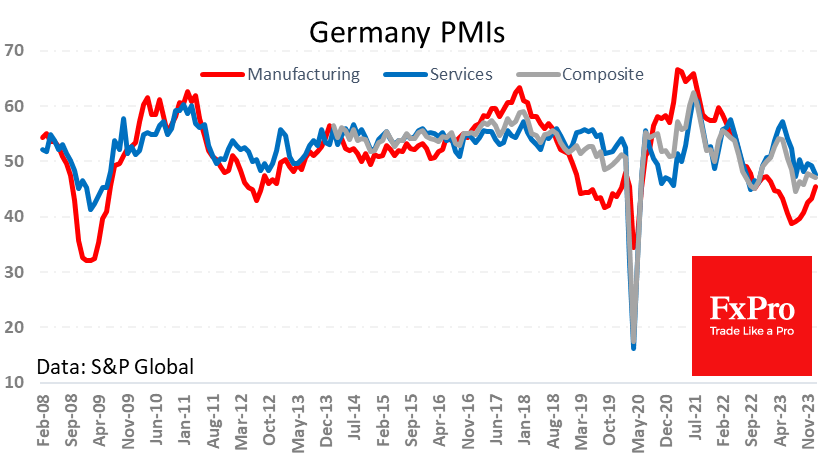

Preliminary January PMIs for Germany showed a worsening of the situation contrary to the expected improvement. The composite PMI in January was at 47.1 against 47.4 a month earlier, and there are forecasts of an increase to 47.8.

The reason for the deterioration was a dip in the services sector. The index of activity in this sector fell to 47.6 - the lowest since August - instead of the expected 49.3. Activity in Germany’s services sector has been contracting since August despite relatively low energy prices. And this could be an indication that the weight of interest rates is spreading through the economy.

Earlier, Germany’s Ifo Institute lowered its forecast for economic growth in 2024 from 0.9% to 0.7%. Some forecasters expect GDP to decline this year. These expectations and weak economic indicators reinforce expectations that the ECB will soon move to ease monetary policy, as weakness in the national economy may soften Germany’s traditionally very hawkish stance.

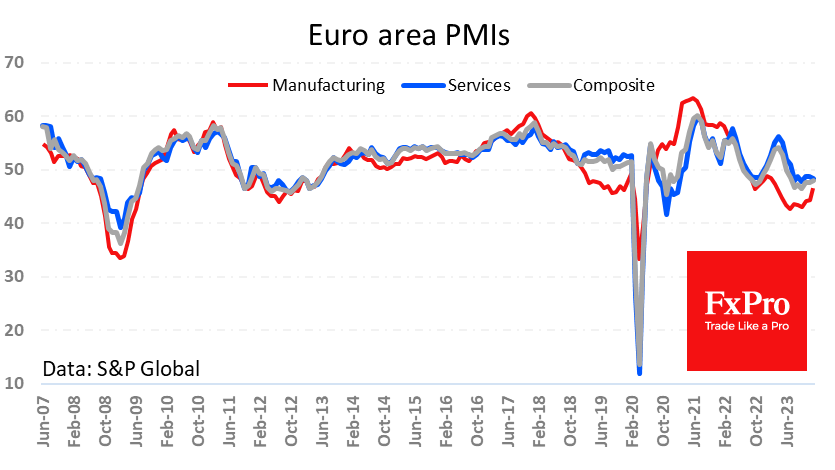

Indicators for the whole eurozone came out slightly weaker than expected. The composite PMI rose from 47.6 to 47.9 despite Germany’s failure. That said, the index remains in contractionary territory, i.e. below the 50 level.

The manufacturing sector, although presenting a relatively small share of the economy, acts as a reliable leading indicator. Both Germany and the Eurozone have seen a steady rise in Manufacturing PMI, setting the mood for an acceleration in the economy over the next couple of quarters.

The currency market was more influenced by the strength of the rest of the Eurozone data than by the disappointment with the German statistics. Optimism on the stock markets, also supported today by the positive dynamics of China, has played its role in the Euro’s purchases and return to 1.09.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)