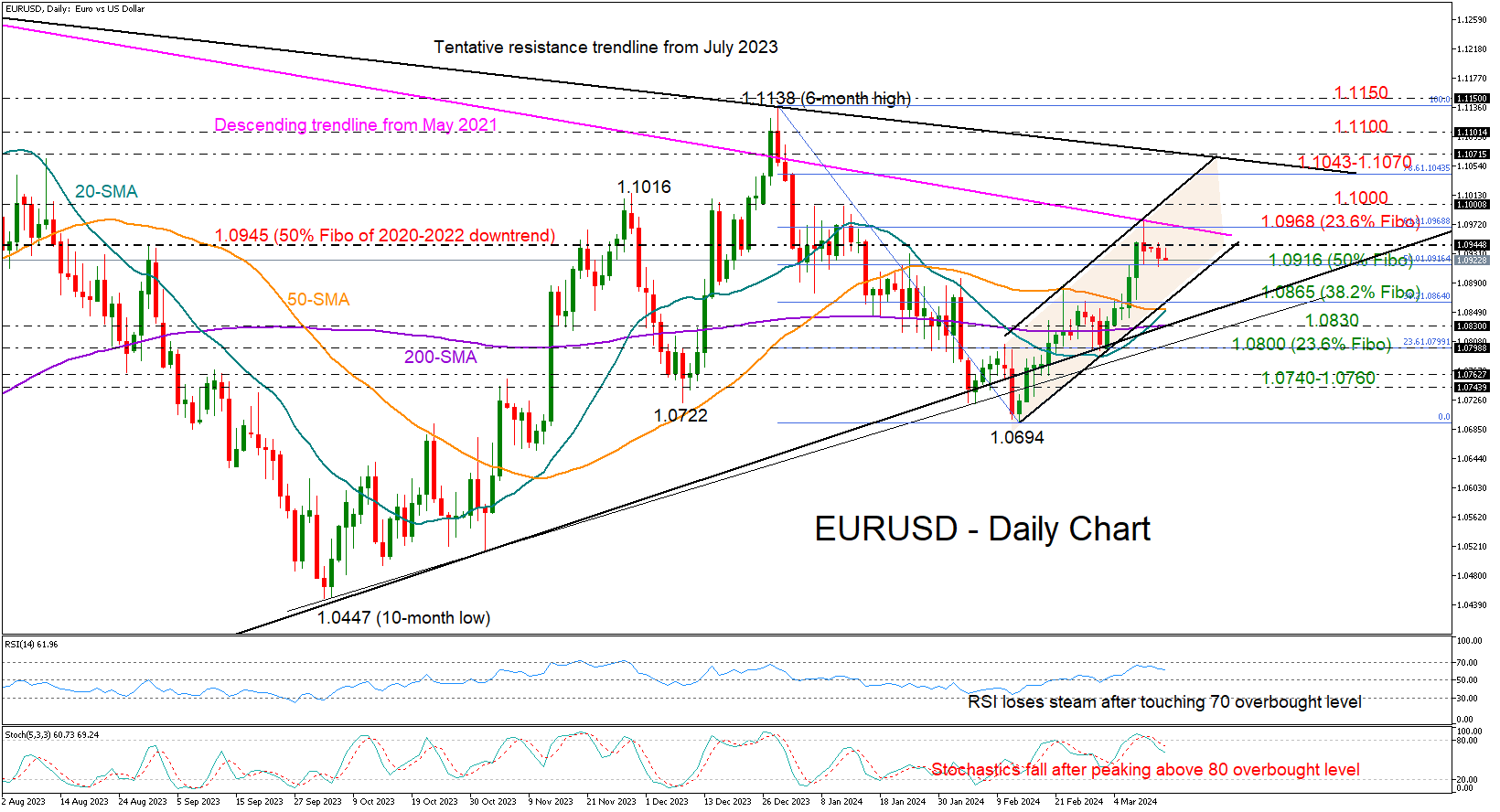

EUR/USD in the middle of 2020-2022 downtrend

EUR/USD has been capped below the 50% Fibonacci retracement of the 2020-2022 downtrend at 1.0945 since Friday's flash spike halted near the 1.0980 level and around the resistance trendline from May 2021 on Friday.

The US CPI inflation data could generate fresh volatility today at 12:30 GMT, and the protective 50% Fibonacci retracement of the latest downleg is currently feeding optimism that the next move in the price will be on the upside. That statement, however, should be taken with a pinch of salt as both the RSI and the Stochastics have shifted southwards, reflecting a weakening bullish bias. Perhaps a completed bullish cross between the 20- and 50-day simple moving averages (SMAs) could put some confidence back to the almost one-month positive trend.

If the pair goes beyond the 23.6% Fibonacci level at 1.0968 and closes above the psychological level of 1.1000, the recovery phase could continue to the range of 1.1045-1.1070. Then, the pair might push towards the 1.1100 level or higher with the scope to reach the 1.1150 area.

As an alternative outcome, a downside correction below 1.0916 could result in a move towards the 38.2% Fibonacci level at 1.0865 and the short-term support trendline. Even lower, the 200-day SMA might provide some footing along with the 2020 constraining ascending line ahead of the 23.6% Fibonacci of 1.0800. Another failure there might motivate fresh selling towards the 1.0740-1.0760 territory.

All in all, EUR/USD seems to be trading within a neutral territory. Traders could stay patient until they see a close above 1.0945-1.1000 or below 1.0916 to drive the market accordingly.

.jpg)