Geopolitical Tensions and Oil Markets Impact Global Financial Sentiment

Global financial markets started the week on a more cautious note as the optimism that followed the recent Jackson Hole conference began to fade (I’ve made a blog explaining everything you need to know about the Jackson Hole conference here: CLICK HERE.) The U.S. Dollar weakened, signalling that investors were growing more concerned, while stock markets took a hit. This shift in mood underscores just how fragile market confidence can be, with new risks quickly shaking investor sentiment. Several factors contributed to this more guarded outlook, including rising geopolitical tensions and big swings in commodity prices, particularly in the oil sector.

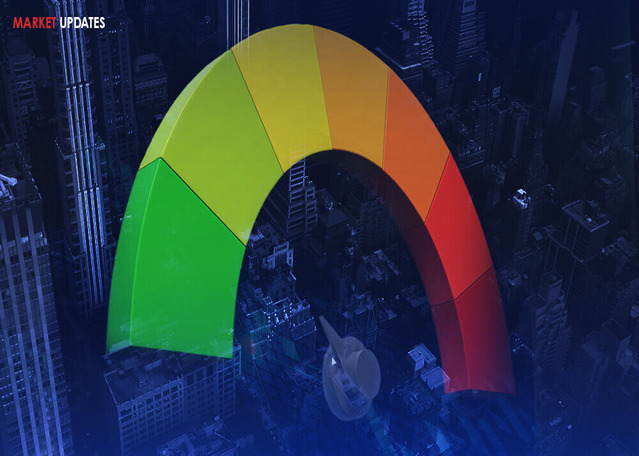

A major event driving this change was a sharp rise in oil prices. Brent crude, the global benchmark, jumped by about 4%, reaching roughly $81 per barrel. This increase is directly tied to the situation in Libya, a key player in the global oil market. The eastern faction of Libya’s government announced a complete halt in crude oil production and exports due to an ongoing leadership dispute within the central bank. With Libya producing around 1.2 million barrels of oil per day, this disruption has raised fears of supply shortages, pushing prices higher and adding another layer of uncertainty to the global economy.

Brent Oil Prices

Source: Finlogix ChartsIn the Middle East, geopolitical tensions have also heightened, adding to the unease in financial markets. Israel’s pre-emptive strike on thousands of Hezbollah missile launchers has sparked concerns about a wider conflict in the region. Although the situation has calmed slightly since the strike, the risk of further hostilities is still significant. The Middle East is crucial for global energy supplies, and any prolonged conflict could have major impacts on both oil prices and overall market stability.

On top of these geopolitical worries, recent economic data from the U.S. has also influenced market behaviour. Mary Daly, President of the San Francisco Federal Reserve, echoed the cautious tone set by Federal Reserve Chair Jerome Powell at the Jackson Hole conference. Daly suggested that while adjustments to policy might be needed in the future, it’s still too soon to say how or when these changes should happen. Despite some weaker U.S. economic indicators, like a drop in durable goods orders, the job market has stayed strong. This suggests that while the U.S. economy is facing challenges, it’s not on the verge of a major downturn.

As the week goes on, investors will be keeping a close eye on a series of upcoming economic reports that could shed more light on the global economic outlook. Key data releases include U.S. consumer confidence numbers and industrial profit reports from China. These reports will be crucial for gauging the health of the global economy, especially given the ongoing geopolitical uncertainties. Investors will be on the lookout for any signs of weakness that might lead central banks to rethink their monetary policy strategies, particularly in the current fragile market environment.

Economic Calendar

Source: Finlogix Economic CalendarIn summary, a mix of geopolitical tensions, volatile oil prices, and mixed economic data has created a complex and uncertain backdrop for global financial markets. While the initial response has been one of caution, the evolving nature of these risks means that market conditions could change quickly. Investors will need to stay alert, as the interaction between these factors could have significant consequences for market dynamics in the coming weeks.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.