Gold and silver have room to fall

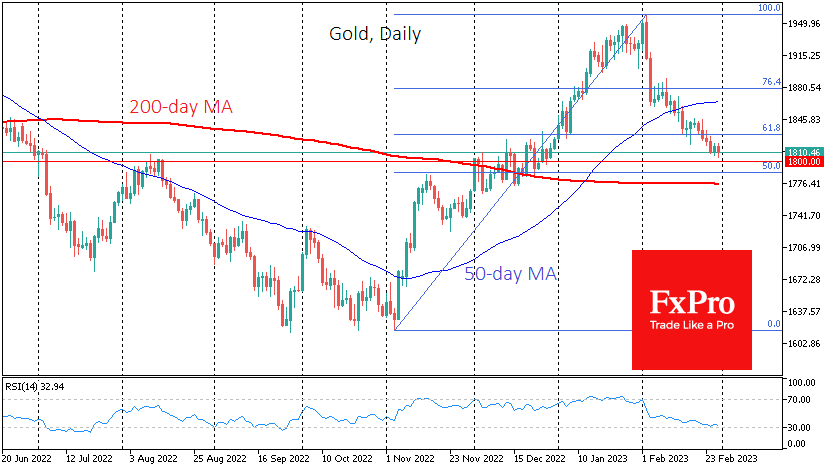

Gold continues to test the bottom and today fell back below $1810. Since the beginning of February, the dynamics suggest an almost perfect reversal of the uptrend, where the initial sharp pullback on the 2nd and 3rd was followed by a downtrend with nearly daily updates of intraday lows.

Until the middle of last week, gold's decline fit into a typical technical correction, but it is now trading below the 61.8% level of the rally from $1617 in early November to a high of $1960 on the 2nd.

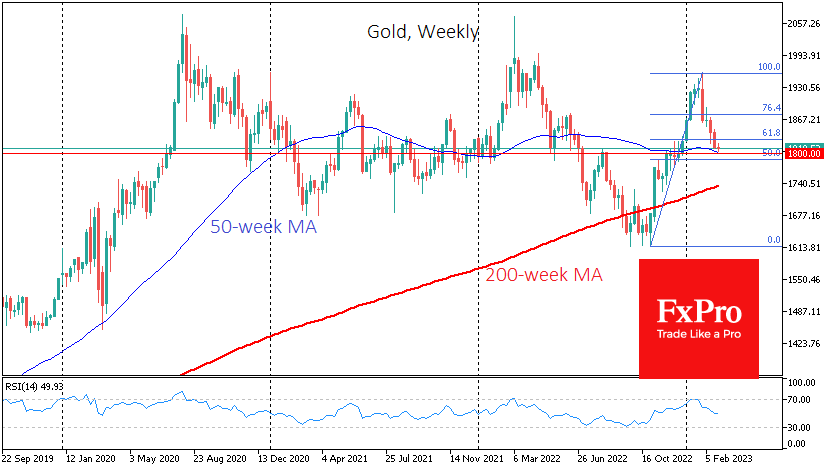

Gold's reversal began after touching the overbought region on the weekly RSI, and the latest pullback has brought the index back into the mid-range.

Technically, gold's sustained decline could continue to the $1775-1787 area for some time. The lower boundary is the 200-day moving average, while the upper boundary is the 50% retracement of the last few months' gains. The RSI on the daily timeframe has yet to enter the oversold territory, suggesting that there is room for further declines.

Although the $1800 level looks like a nice round level, there were no meaningful stops and reversals near it in December, increasing the chances that there will not be this time around.

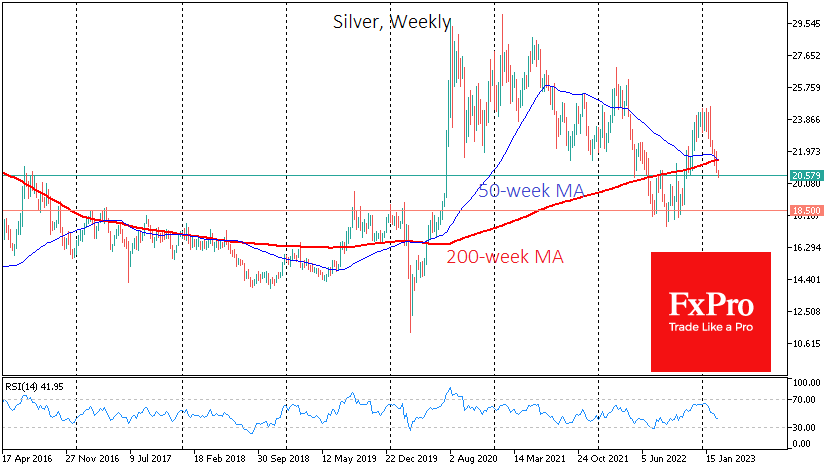

A key indicator for the gold market is silver. The pullback towards $20.60 has brought the price back below the 200 SMA, which could put additional pressure on the market. On the weekly timeframe, a death cross has formed as the 50-week moving average is below the 200-week moving average. This technical picture suggests the possibility of a decline to $18.50. This is where silver could find support from buyers, as it did last August. It is also the former multi-year resistance that turned into support last year.

By the FxPro analyst team