Gold’s Back in Charge: XAUUSD Reversal Sets Stage for a Rally

Ultima Markets delivers a deep dive XAUUSD breakdown for November 11, 2025, your comprehensive breakdown on what's driving gold today.

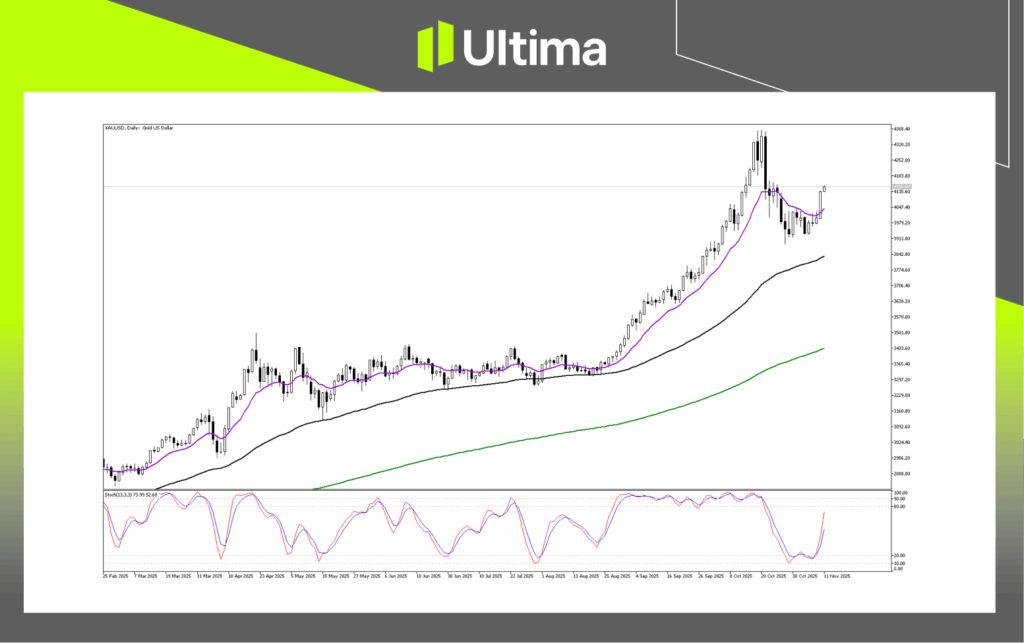

Is Gold's Daily Chart Indicating that the Correction is Over? After topping out in mid-October, price pulled back and carved out firm support near 3911, which is still above the medium-term moving average. The latest session printed a strong bullish candle, signalling that buyers are back and the correction likely wrapped up.

After topping out in mid-October, price pulled back and carved out firm support near 3911, which is still above the medium-term moving average. The latest session printed a strong bullish candle, signalling that buyers are back and the correction likely wrapped up.

And the momentum agrees. The Stochastic just crossed bullish from oversold and is accelerating, pointing to robust buying pressure.

Key levels focus on 4047 as immediate support, where the short-term moving average provides the first layer of dynamic backing, holding above keeps the near-term bias positive.

The key pivot is 3911, the correction low, whose loss would invalidate the bullish resumption and open the door to a deeper retracement. Below that, 3842 aligns with the medium-term moving average and has repeatedly absorbed pullbacks, making it a crucial line in the sand for trend followers.

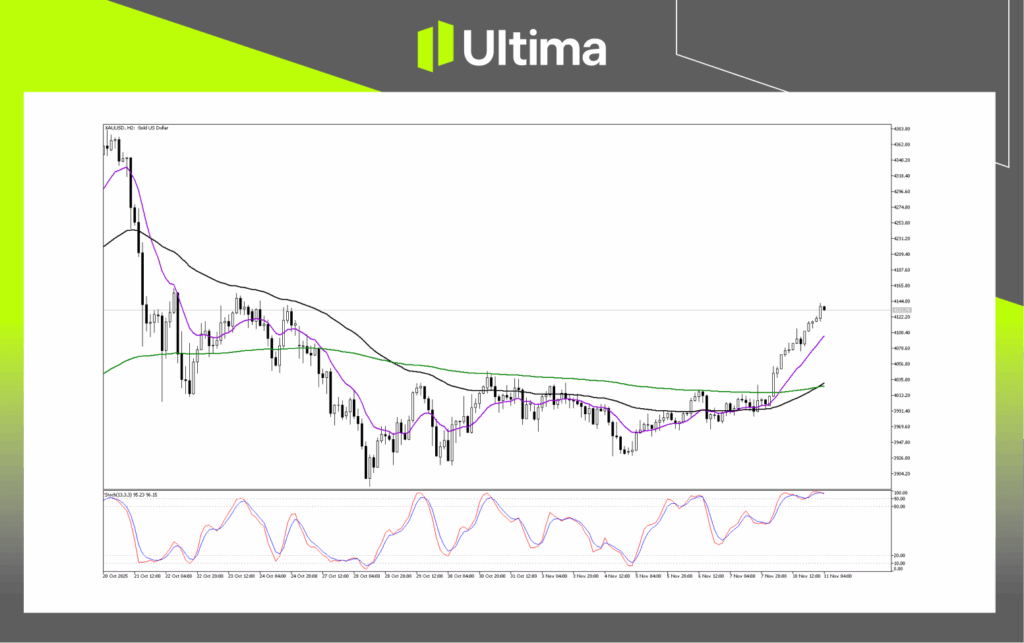

Is This the Start of a Major Breakout or Just a Short-Term Surge? Persistent bullish candles point to strong buying, with price hugging the short-term moving average and grinding higher. The Stochastic above 80 reinforces trend strength and momentum, suggesting overbought readings reflect follow-through rather than an immediate reversal.

Persistent bullish candles point to strong buying, with price hugging the short-term moving average and grinding higher. The Stochastic above 80 reinforces trend strength and momentum, suggesting overbought readings reflect follow-through rather than an immediate reversal.

In a higher-probability continuation path, momentum extends, and any shallow dips may find support at the short-term average. The next objective sits near 4187, a clean break would open room toward 4253. Alternatively, a modest pullback is plausible after the sharp run. A retreat toward the 4035 breakout area could set up a classic break-and-retest. If that zone holds and price rebounds, it would offer fresh long entries and validate the emerging uptrend.

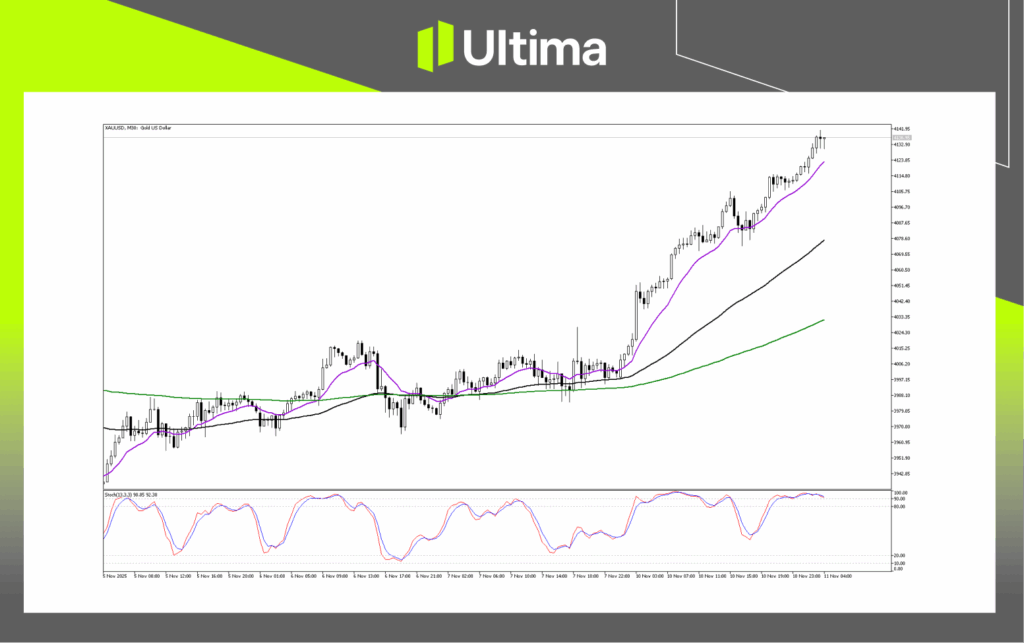

Gold’s Uptrend Strengthens: Can Bulls Keep Control? Momentum stays firm with all three moving averages aligned and rising across time frames. The Stochastic remains overbought, which, within a strong trend, signals persistent buying and sustained momentum rather than an immediate reversal. The path of least resistance remains higher.

Momentum stays firm with all three moving averages aligned and rising across time frames. The Stochastic remains overbought, which, within a strong trend, signals persistent buying and sustained momentum rather than an immediate reversal. The path of least resistance remains higher.

Bullish continuation (high probability)

Price continues to respect the short-term moving average as support and drives through the near resistance at 4141. With momentum intact, a breakout would push the chart into fresh territory on this timeframe, with traders eyeing the next psychological round numbers.

Consolidation / minor pullback (moderate probability)

After a strong run, price may pause, moving sideways or dipping to retest support near the purple moving average around 4123 or the minor horizontal shelf around 4096. Such action would be a healthy consolidation within the uptrend and could offer fresh long entries ahead of the next leg higher.

Navigating Forex with Ultima Markets

Staying informed and making data-driven decisions is important in today’s markets. Ultima Markets provides research and insights to support your trading approach across forex, indices, and commodities, with our team available to offer guidance tailored to your circumstances.

Access a comprehensive trading ecosystem with tools, education, and analysis designed to help you operate confidently. Keep an eye out for further market updates and expert commentary from Ultima Markets.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.