More and more central banks are fighting the Dollar’s rise

More and more central banks are fighting the Dollar’s rise

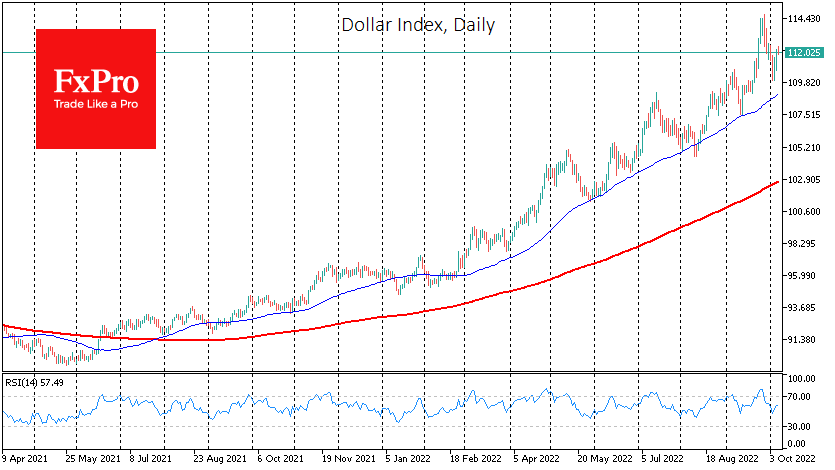

More and more of the world’s central banks are turning to currency interventions to keep their currencies from weakening. While each central bank is saving its currency, they are all working together to undermine the Dollar’s value by increasing its global supply.

For the last two weeks, Japan has been protecting the yen from further weakening by keeping the USDJPY above 145. At the same time, the Bank of Japan is not changing its ultra-soft monetary policy. Given Japan’s deep pocket of more than 1 trillion US treasuries, this promises to be an extended play, attracting speculators’ interest in buying into the pair on the downside.

The Bank of England reportedly entered the market last week to keep the pound from collapsing. Record lows in the Indian rupee also forced the country’s central bank to intervene in the market. There is little information on China, but there is also a large force there, reversing the rate on the rise above 7.20, as it has done since 2019. Hong Kong and the Czech Republic have been injecting dollars into the markets.

Bloomberg calculates that global foreign exchange reserves have fallen by 1 trillion to 12 trillion since the start of the year, only about half of which is due to a rising dollar, with the other half coming from dollar sales.

We are seeing more and more countries standing up to national currencies in an attempt to contain inflation. If this trend continues to gather momentum, multiple streams promise to become a full-flowing river, raising the overall level of dollar liquidity.

Interestingly, the trend towards defensive interventions is detrimental to Fed policy, so the latter can only strengthen and extend its active steps to tighten monetary policy. And this game is against the interests of the majority in the world, so developments promise to be fascinating.

Even if a host of smaller central banks fail to prevent the Dollar from renewing the highs reached at the end of last month, further US currency growth promises to be much more complex and slower. The 16-month dollar growth trend promises to stop being a one-way street.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)