Technical Analysis – Bitcoin slides over 5.5% to under 86,000

Bitcoin plunged more than 5.5% on Monday, slipping below 86,000 in a risk-off start to December. The move adds fresh momentum to a broad selloff that had briefly stabilized after a mild rebound late last week, when prices climbed above 90,000.

This decline extends November’s bruising close, with Bitcoin ending the month down over 17% – its steepest monthly loss since March – amid deteriorating sentiment, structural headwinds, and tight liquidity conditions. The drop was fuelled by a series of bearish developments, including a USDT downgrade, a PBOC crypto warning, and cautious Strategy Inc. commentary.

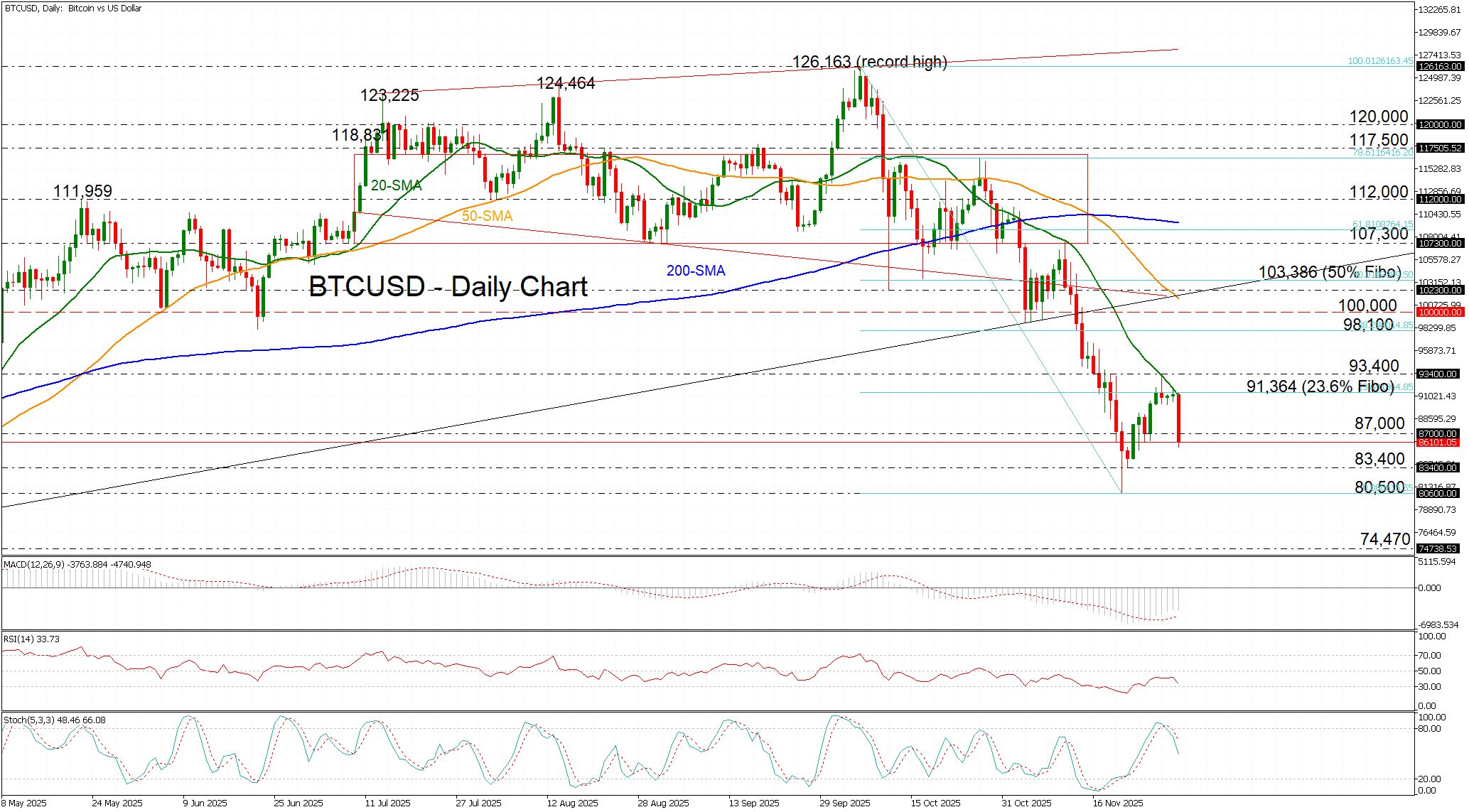

Currently, BTCUSD is trading near 86,100 after encountering strong resistance at the 20-day simple moving average (SMA), which aligns with the 23.6% Fibonacci retracement of the sharp pullback from October’s record peak to November’s monthly low at 91,364. The bears are now eyeing 83,400 and 80,500 as the next critical support levels, with a potential revisit of the April 7 low at 74,470 if selling pressure persists.

The momentum indicators reinforce the bearish outlook, with the RSI, stochastics, and the MACD remaining in negative territory, though none have yet reached oversold thresholds.

On the upside, if conditions improve, Bitcoin could rebound toward 87,000. A sustained move toward 91,364 would mark the first significant recovery signal, with a break above that level opening the door to 93,400.

In short, Bitcoin is pulling back near November lows and faces the risk of a deeper correction if the 80,500 support fails to hold, as traders await a slew of economic data for fresh catalysts.