US debt ceiling negotiations continue

OVERNIGHT

Stocks across the Asia-Pacific mostly traded higher after US President Biden reported that relations with China were expected to improve ‘very shortly’. His comments came at the G7 summit in Japan amid speculation that his administration was set to lift some sanctions that were previously imposed. Overall market sentiment, however, remains capped reflecting concerns about a possible US debt default. Talks between Congressional Republicans and the White House on raising the debt ceiling ended abruptly on Friday with both sides disagreeing over the extent of any spending cuts. However, they seem set to resume today.

THE DAY AHEAD

With developments around the US debt ceiling negotiations likely to remain the focal point for financial markets, today’s limited data and events calendar is likely to attract only limited interest. Nevertheless, a number of speeches from ECB and Fed policymakers should provide some additional insight into their respective monetary policy outlooks. For the latter, Fed policymakers Bullard, Daly, Bostic and Barkin are due to speak at various events. The Fed is still expected to ‘pause’ in June, but positive data surprises and hawkish rhetoric from rate-setters could change expectations. Last week saw rises in US Treasury yields to the upper end of recent ranges and markets are now attaching a slightly higher probability to a June hike, although a pause is still seen as most likely.

For the Eurozone, a number of ECB policymakers are due to speak today – Vujcic (09:45BST), Guindos (10:00), Holzmann (12:30), Lane (15:15), Villeroy (15:15) and de Cos (18:30). At its last meeting, the ECB reduced its hiking pace to 25 basis points suggesting that an end to tightening was in sight. For now, however, the ECB remains focused on getting inflation down and is on track to increase interest rates again next month. Speaking over the weekend, ECB President Christine Lagarde reiterated that the central bank was ‘not done yet’.

On the data front, today’s focus is limited to the Eurozone consumer confidence print for May. We look for confidence to have weakened this month, with the headline measure dropping to -18.0 from -17.5, in part reflecting the moderation in sentiment seen in other surveys such as the German ZEW and Sentix surveys.

There are no key data or events due across the UK today. However, early tomorrow morning (07:00BST) the ONS will publish the latest UK public finances report for April. Being the first month of the fiscal year, the outturn will attract some attention as market participants assess whether the UK is likely to meet (or even undershoot) its borrowing expectations in 2023/24. The OBR forecast a deficit of £24.4bn, which will be a base line estimate for forecasts.

MARKETS

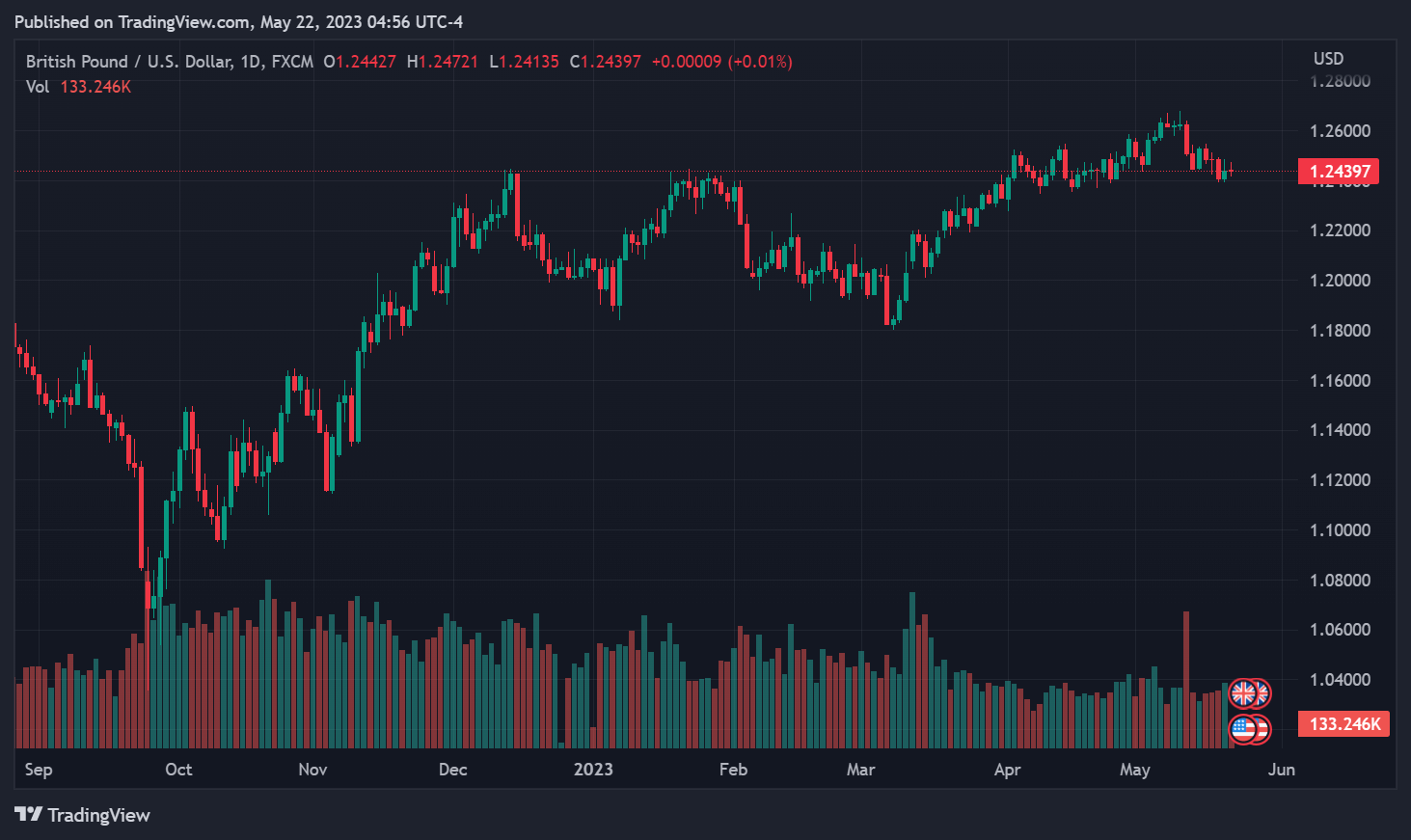

The US dollar has reversed some of its early overnight losses, albeit the Bloomberg US dollar index remains below last week’s highs. GBP/USD is broadly stable around 1.2450, while EUR/USD is mildly firmer versus Friday’s close and has moved further above the 1.08 mark.