USDCAD holds ground below 6-month high

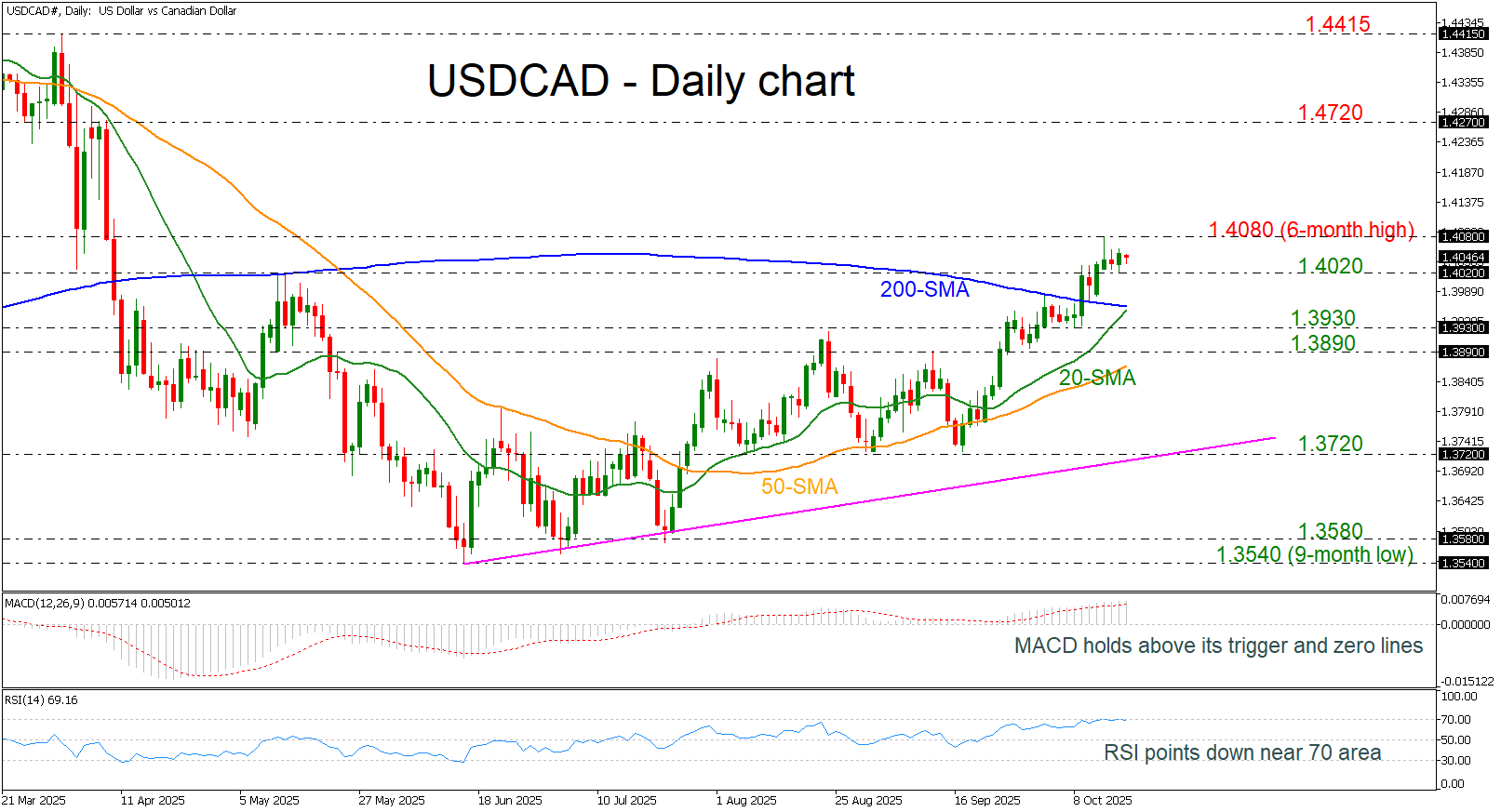

USDCAD remains capped below the six-month high of 1.4080, recorded earlier this week. The currency is under pressure from escalating US-China trade tensions, the ongoing US government shutdown, and growing market expectations for Federal Reserve interest rate cuts.

From a medium-term technical perspective, the outlook remains strongly bullish. A potential golden cross between the 20-day and 200-day simple moving averages (SMAs) is forming, typically a signal of upward momentum. However, short-term indicators suggest a pause in bullish sentiment. The MACD is hovering just above its trigger line, while the RSI is trending downward near the overbought threshold of 70, indicating possible consolidation or a corrective move.

Should bullish momentum resume, the next resistance level to watch is the April 9 peak at 1.4720. Conversely, a break below 1.4020 could expose the pair to the 20- and 200-day SMAs around 1.3960, with further downside potential toward the 1.3890–1.3930 support zone.

While the medium-term trend for USDCAD remains constructive, near-term technical signals point to a potential pullback or consolidation.

.jpg)