Edit Your Comment

EURGBP

Tham gia từ Oct 15, 2019

19bài viết

Oct 28, 2019 at 14:35

Tham gia từ Oct 15, 2019

19bài viết

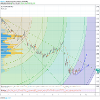

EURGBP in accumulation phase last 2 weeks

H1 chart has up trend price respect it till now

Gann Square Box show that pair in the last level of bearish major wave

volume profile show that pair should move up till HVN

H1 chart has up trend price respect it till now

Gann Square Box show that pair in the last level of bearish major wave

volume profile show that pair should move up till HVN

Tham gia từ Mar 10, 2015

24bài viết

Apr 03, 2020 at 18:29

(đã sửa Apr 03, 2020 at 18:30)

Tham gia từ Mar 10, 2015

24bài viết

This week, the Forex Market did not move badly. The main currency pairs (EURUSD, GBPUSD, EURGBP) made “long” movements. In this regard, in Friday's trading, we should expect some profit-taking by Market participants.

How to look at the Market to understand exactly how to act at the moment...?

This week, the Euro weakened against the dollar more than the British pound against the American. And, at the same time, the EURGBP pair fell heavily. This week, the Euro weakened against the dollar more than the British pound against the American. And, at the same time, the EURGBP pair fell heavily. Here it is worth saying that the Euro against the British is falling from a high, leaving behind a "kangaroo tail", or a long shadow sticking high up (monthly chart):

Of course, in the long term, the pair is expected to move down much more impressive. However, right today, on Friday, when trading is preparing to close, all pairs may form pullbacks due to the closing of positions by traders. This means two options;

Either stay out of the Market and quietly leave for the weekend, or try to use Friday's pullback to your advantage.

At the same time, there is a risk that open positions may go into negative, because in General, in any pair, the trend continues. The pandemic crisis has not yet passed, and the consequences for all economies have yet to be assessed. The hope of profit-taking may not work in a crisis. This means that the trend may continue on Friday. Without any kickbacks. Therefore, at such a crucial moment, a reasonable "conservative" trader would prefer to stay out of the Market.

Those traders who are aggressive or combative can try to conduct an attack.

For today's Friday evening, the EURGBP pair was chosen as the weapon.

Why?

The reason lies at the beginning of this article.

As it was said, during the week ending, both the Euro and the British Pound weakened against the us dollar. However, if you look more closely at the charts (for example, daily ones, for better clarity), it is clear that the single currency has weakened significantly more than the British one. So if there is some Friday (at least) pullback, then some growth of the Euro against the dollar in the EURGBP pair will look like a strengthening. in Other words, any strengthening of the Euro will be reflected in this pair as a growth, because the downward movement was very long (this can be seen well on the weekly and monthly charts). And given the strong volatility of the pair, you can count on an infinite number of points taken.

Actually, this is the main idea of this evening's trading.

If you protect your position with a tight stop in the break-even zone, then why not?

In General, the idea worked so quickly that while this article was being written, this tactic was 100% justified. It means that, indeed, the Euro is pulling back a little from the fall and this is immediately reflected in the EURGBP pair. At the moment, the tactic has already brought about 20 points, but presumably there will be more of them.

It is worth noting that such practices are very dangerous (trading against the trend). However, if you have enough experience, and a very long observation of the Market, then with the proper approach, you can take risks. In the end, no position is opened without risk In the end, without the risk of do not open any one position.

How to look at the Market to understand exactly how to act at the moment...?

This week, the Euro weakened against the dollar more than the British pound against the American. And, at the same time, the EURGBP pair fell heavily. This week, the Euro weakened against the dollar more than the British pound against the American. And, at the same time, the EURGBP pair fell heavily. Here it is worth saying that the Euro against the British is falling from a high, leaving behind a "kangaroo tail", or a long shadow sticking high up (monthly chart):

Of course, in the long term, the pair is expected to move down much more impressive. However, right today, on Friday, when trading is preparing to close, all pairs may form pullbacks due to the closing of positions by traders. This means two options;

Either stay out of the Market and quietly leave for the weekend, or try to use Friday's pullback to your advantage.

At the same time, there is a risk that open positions may go into negative, because in General, in any pair, the trend continues. The pandemic crisis has not yet passed, and the consequences for all economies have yet to be assessed. The hope of profit-taking may not work in a crisis. This means that the trend may continue on Friday. Without any kickbacks. Therefore, at such a crucial moment, a reasonable "conservative" trader would prefer to stay out of the Market.

Those traders who are aggressive or combative can try to conduct an attack.

For today's Friday evening, the EURGBP pair was chosen as the weapon.

Why?

The reason lies at the beginning of this article.

As it was said, during the week ending, both the Euro and the British Pound weakened against the us dollar. However, if you look more closely at the charts (for example, daily ones, for better clarity), it is clear that the single currency has weakened significantly more than the British one. So if there is some Friday (at least) pullback, then some growth of the Euro against the dollar in the EURGBP pair will look like a strengthening. in Other words, any strengthening of the Euro will be reflected in this pair as a growth, because the downward movement was very long (this can be seen well on the weekly and monthly charts). And given the strong volatility of the pair, you can count on an infinite number of points taken.

Actually, this is the main idea of this evening's trading.

If you protect your position with a tight stop in the break-even zone, then why not?

In General, the idea worked so quickly that while this article was being written, this tactic was 100% justified. It means that, indeed, the Euro is pulling back a little from the fall and this is immediately reflected in the EURGBP pair. At the moment, the tactic has already brought about 20 points, but presumably there will be more of them.

It is worth noting that such practices are very dangerous (trading against the trend). However, if you have enough experience, and a very long observation of the Market, then with the proper approach, you can take risks. In the end, no position is opened without risk In the end, without the risk of do not open any one position.

*Nghiêm cấm sử dụng cho mục đích thương mại và spam, nếu vi phạm có thể dẫn đến việc chấm dứt tài khoản.

Mẹo: Đăng ảnh/url youtube sẽ tự động được nhúng vào bài viết của bạn!

Mẹo: Dùng @ để tự động điền tên người dùng tham gia vào cuộc thảo luận này.