Edit Your Comment

EUR/USD

Membro Desde Nov 16, 2015

708 postagens

Apr 10, 2018 at 09:44

Membro Desde Nov 16, 2015

708 postagens

The single currency recorded a positive session against the US dollar on Monday. The currency pair opened at 1.2283 and the price bounced from the first support at 1.2260. After all, the euro ended at 1.2320 and if bullish sentiment continues, perhaps there will be a resistance test at 1.2370.

Membro Desde Nov 16, 2015

708 postagens

Apr 10, 2018 at 09:47

Membro Desde Nov 16, 2015

708 postagens

EUR/USD

Key levels to watch for:

Support: 1.2260; 1.2070;

Resistance: 1.2370; 1.2560;

Key levels to watch for:

Support: 1.2260; 1.2070;

Resistance: 1.2370; 1.2560;

Membro Desde Dec 10, 2017

210 postagens

Apr 10, 2018 at 11:22

Membro Desde Dec 10, 2017

210 postagens

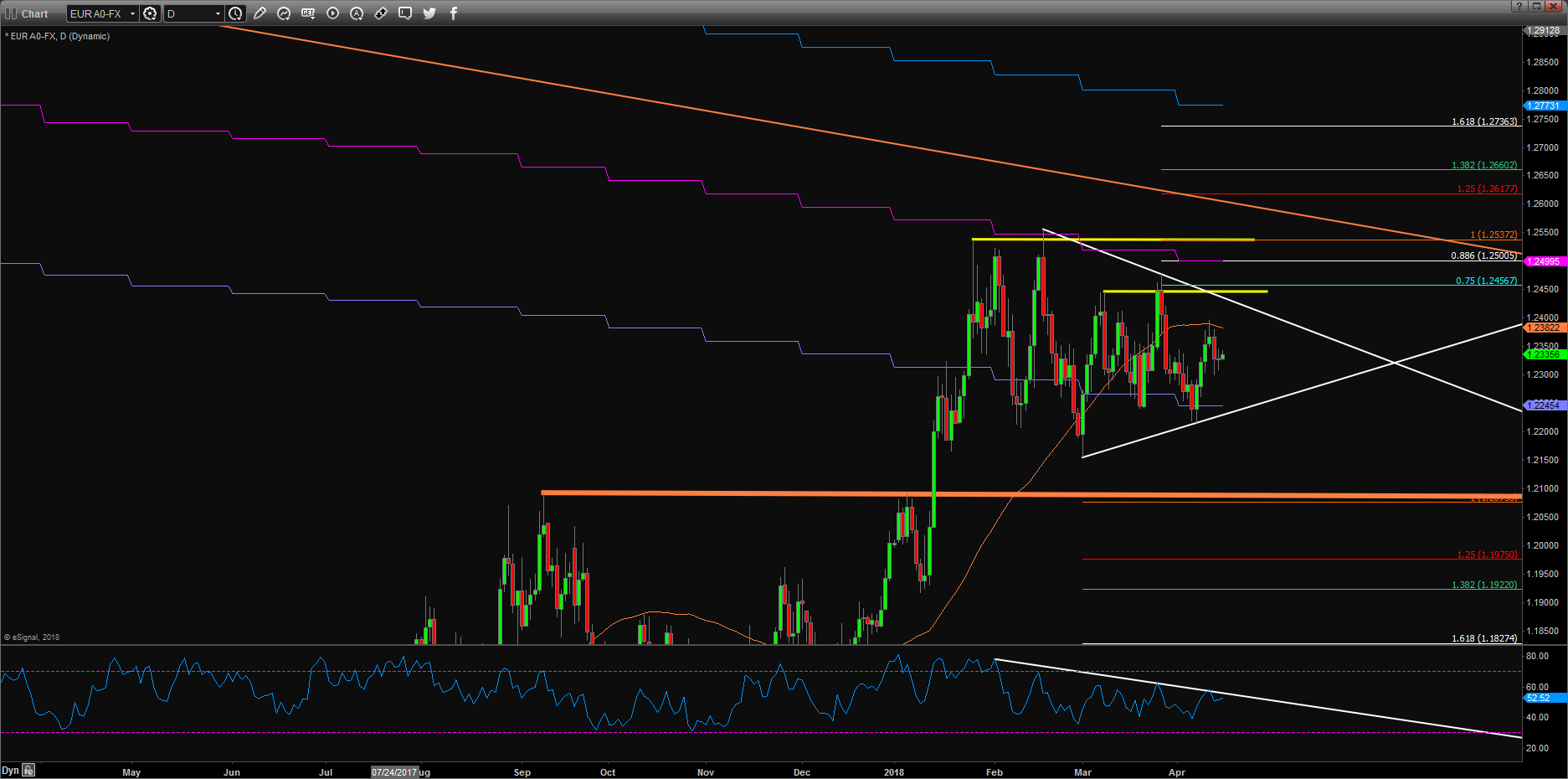

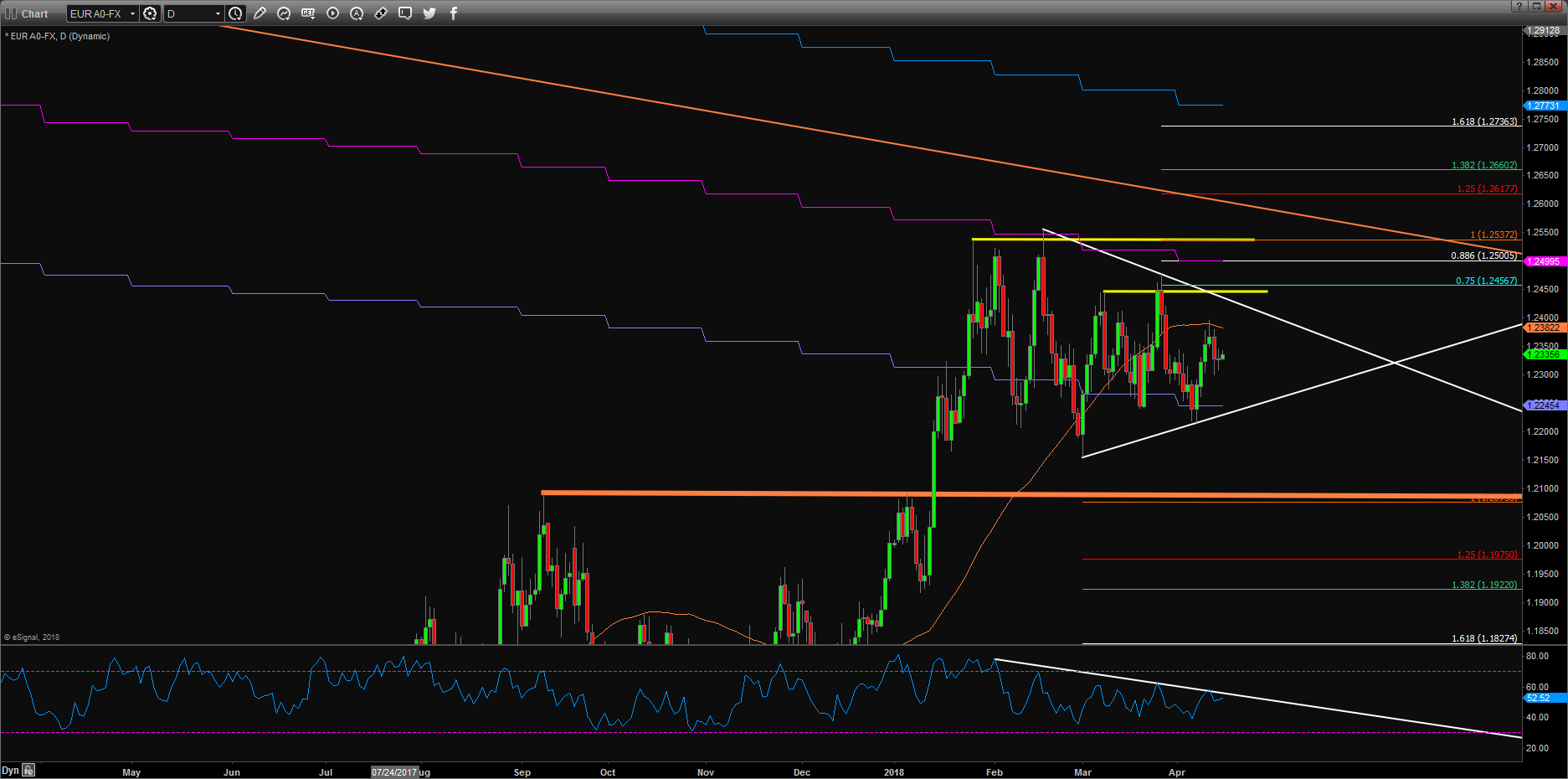

The euro/dollar had another minor move past week. On the weekly chart, we have 6 consecutive unspecified candles indicating a volatile market. Short-term expectations remain downwards for testing 1.2175. This region is a good for placing long positions with narrow stops of loss. Immediate resistance is 1.2320. A clear break above this level could lead to future upward pressure testing 1.2385. Intraday support we have at 1.2220, whose breakthrough can cause downward pressure to test 1.2175. Only a clear break under 1.2175, however, will end the major bullish prospects.

Membro Desde Apr 08, 2014

1140 postagens

Apr 11, 2018 at 10:06

Membro Desde Apr 08, 2014

1140 postagens

On yesterday session, the EURUSD went back and forward without any clear direction but managed to close near the high of the day, in addition closed above Mondays’ high, which suggests a strong bullish momentum.

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2331 (support), the 10-day moving average at 1.2302 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2331 (support), the 10-day moving average at 1.2302 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

"I trade to make money not to be right."

Membro Desde Feb 11, 2018

83 postagens

Apr 11, 2018 at 13:43

Membro Desde Feb 11, 2018

83 postagens

Membro Desde Feb 11, 2018

83 postagens

Apr 12, 2018 at 06:53

Membro Desde Feb 11, 2018

83 postagens

Membro Desde Apr 08, 2014

1140 postagens

Apr 12, 2018 at 09:27

Membro Desde Apr 08, 2014

1140 postagens

On yesterday session, the EURUSD initially rose but found enough selling pressure to trim most of its gains but closed in the green, in the middle of the daily range, in addition managed to close within Tuesdays’ range, which suggests being clearly neutral, neither side is showing control.

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2330 (support), the 10-day moving average at 1.2302 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2330 (support), the 10-day moving average at 1.2302 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

"I trade to make money not to be right."

Membro Desde Aug 16, 2016

24 postagens

Apr 12, 2018 at 13:32

Membro Desde Aug 16, 2016

24 postagens

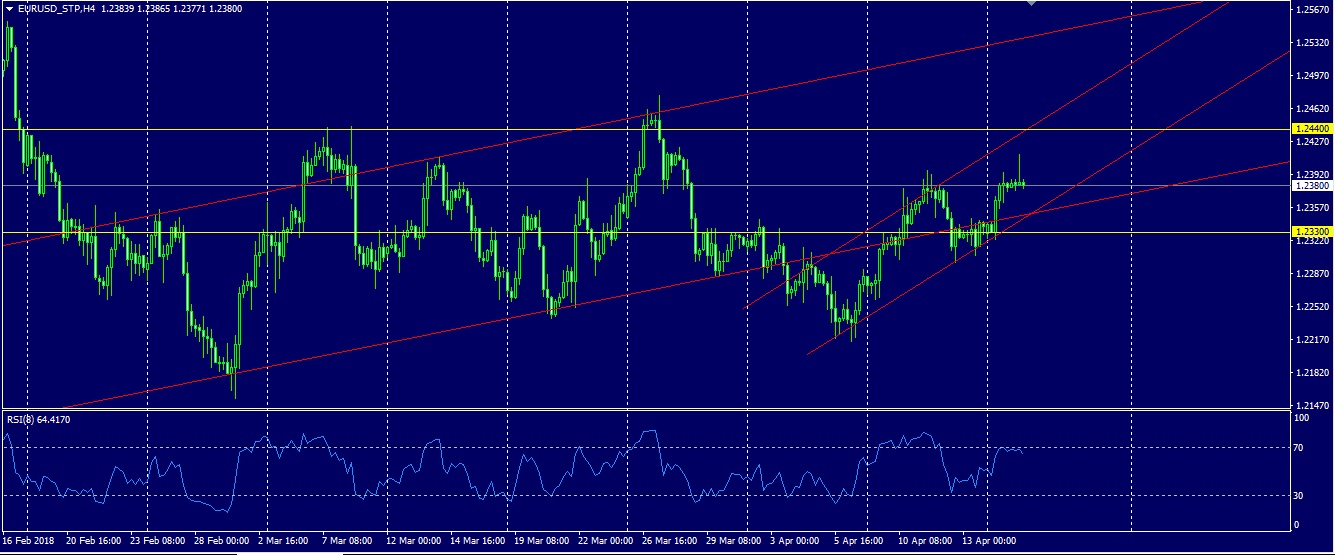

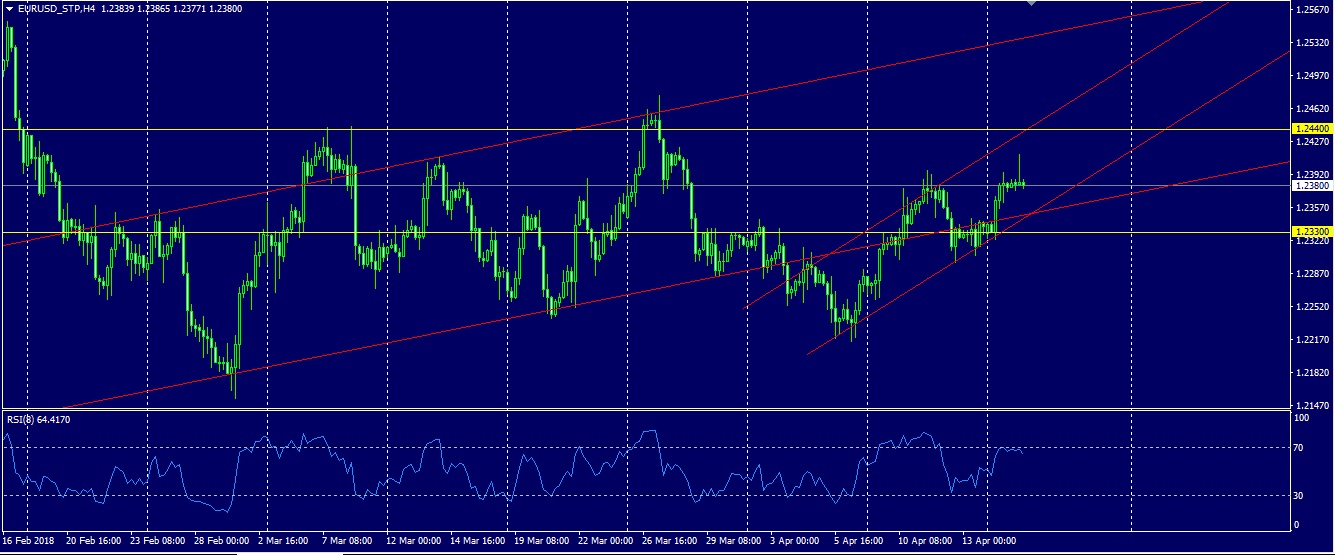

The key point for EUR/USD H4.

The price touched 1.2328 support and will now form a correction between the upper limit of the downtrend and the bottom of the upward (higher) trend.

If the upper limit of the downtrend is broken, then we can talk about the continuation of the uptrend. If the price breaks the lower level of the uptrend, then there will be a continuation of the trend down to the level of 1.2240

The price touched 1.2328 support and will now form a correction between the upper limit of the downtrend and the bottom of the upward (higher) trend.

If the upper limit of the downtrend is broken, then we can talk about the continuation of the uptrend. If the price breaks the lower level of the uptrend, then there will be a continuation of the trend down to the level of 1.2240

Membro Desde Feb 15, 2016

165 postagens

Apr 13, 2018 at 07:11

Membro Desde Feb 15, 2016

165 postagens

I believe the EU has found support and we should be heading to 1.2394 and if we close strongly above that for 1.2504,God-willing.The TA is backed by Fri NFP and the EUR news today in my view.

to turn humble investments into huge fortune with minimal risk ...

Membro Desde Feb 11, 2018

83 postagens

Apr 13, 2018 at 07:20

Membro Desde Feb 11, 2018

83 postagens

Membro Desde Apr 08, 2014

1140 postagens

Apr 13, 2018 at 08:57

Membro Desde Apr 08, 2014

1140 postagens

On yesterday session, the EURUSD fell with a wide range but found enough support near the 10-day moving average to trim some of its losses although closed near the low of the day, in addition managed to close below Wednesday’s low, which suggests a bearish momentum.

The currency pair trading below the 50-day moving average that should provide dynamic resistance however, it is trading above the 10 and the 200-day moving average that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2330 (resistance), the 10-day moving average at 1.2305 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

The currency pair trading below the 50-day moving average that should provide dynamic resistance however, it is trading above the 10 and the 200-day moving average that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2330 (resistance), the 10-day moving average at 1.2305 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

"I trade to make money not to be right."

Membro Desde Oct 02, 2014

905 postagens

Apr 13, 2018 at 14:36

Membro Desde Oct 02, 2014

905 postagens

The EUR/USD did not react much to the US data published today. I expect it to continue trading to the upside with first bull target at 1.2386.

Positivity

Membro Desde Feb 11, 2018

83 postagens

Apr 16, 2018 at 07:18

Membro Desde Feb 11, 2018

83 postagens

EURUSD

Still consolidated in the triagle.

Last Friday price failed to touch or close above 1.2354/61 , but also failed to close below 1.2296.

Short term turned neutral.

If today close above current level (spot 1.2334), will generate a moderate daily buy signal according to my system.

I have closed 80% of my short position, look to add or reverse when the trend confirmed.

Still consolidated in the triagle.

Last Friday price failed to touch or close above 1.2354/61 , but also failed to close below 1.2296.

Short term turned neutral.

If today close above current level (spot 1.2334), will generate a moderate daily buy signal according to my system.

I have closed 80% of my short position, look to add or reverse when the trend confirmed.

Membro Desde Apr 08, 2014

1140 postagens

Apr 16, 2018 at 08:23

Membro Desde Apr 08, 2014

1140 postagens

On the last Friday’s session, the EURUSD went back and forward without any clear direction but closed in the middle of the daily range, in addition managed to close within Thursday’s range, which suggests being clearly neutral, neither side is showing control.

The currency pair trading below the 50-day moving average that should provide dynamic resistance however, it is trading above the 10 and the 200-day moving average that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2328 (resistance), the 10-day moving average at 1.2304 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

The currency pair trading below the 50-day moving average that should provide dynamic resistance however, it is trading above the 10 and the 200-day moving average that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 50-day moving average at 1.2328 (resistance), the 10-day moving average at 1.2304 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

"I trade to make money not to be right."

Membro Desde Feb 11, 2018

83 postagens

Apr 17, 2018 at 06:07

Membro Desde Feb 11, 2018

83 postagens

AUDUSD

After the daily shooting satr candle, Aussie is consolidated about the downtrend channel from January.

However, price already close above 200 week ma.

Also we see some positive signs on daily MACD and weekly oscillator.

Although it's too early to call a major trend reversal, I still suspect the uptrend is not over yet.

After the daily shooting satr candle, Aussie is consolidated about the downtrend channel from January.

However, price already close above 200 week ma.

Also we see some positive signs on daily MACD and weekly oscillator.

Although it's too early to call a major trend reversal, I still suspect the uptrend is not over yet.

Membro Desde Feb 11, 2018

83 postagens

Apr 17, 2018 at 06:07

Membro Desde Feb 11, 2018

83 postagens

Membro Desde Apr 08, 2014

1140 postagens

Apr 17, 2018 at 09:06

Membro Desde Apr 08, 2014

1140 postagens

On yesterday session, the EURUSD rallied with a wide range and closed near the high of the day, in addition managed to close above Friday’s high, which suggests a strong bullish momentum.

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 10-day moving average at 1.2334 (support), the 50-day moving average at 1.2323 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

The currency pair is trading above the 10, the 50 and 200-day moving averages that should provide dynamic support.

The key levels to watch: a daily resistance at 1.2510, a daily resistance at 1.2432, a key level at 1.2367 (resistance), the 10-day moving average at 1.2334 (support), the 50-day moving average at 1.2323 (support), a daily support at 1.2287, a swing low at 1.2200 (support), and a key level at 1.2165 (support).

"I trade to make money not to be right."

Membro Desde Aug 16, 2016

24 postagens

Apr 18, 2018 at 06:33

Membro Desde Aug 16, 2016

24 postagens

The US dollar is in an uncertain technical situation. In addition, it is pressured by the circumstances of the Syria conflict and Trump's statements about Russia and China of devaluing their currencies.

In the near future, there may be volatility according to an uptrend. However, at the same time, the possibility of testing 1.2330 remains.

I see resistance at 1.2440, if the resumption of growth.

RSI showed near 70 value, which means a higher probability to fall.

In the near future, there may be volatility according to an uptrend. However, at the same time, the possibility of testing 1.2330 remains.

I see resistance at 1.2440, if the resumption of growth.

RSI showed near 70 value, which means a higher probability to fall.

Membro Desde Jul 22, 2013

123 postagens

Apr 18, 2018 at 06:35

Membro Desde Jul 22, 2013

123 postagens

main target based on DAX index - 1,2600

after possible we get correction to 1,23 .. 1,2200

___

SNF-Complex system - build in 2007 \ Tested from 1970.

Membro Desde Feb 11, 2018

83 postagens

Apr 18, 2018 at 07:05

Membro Desde Feb 11, 2018

83 postagens

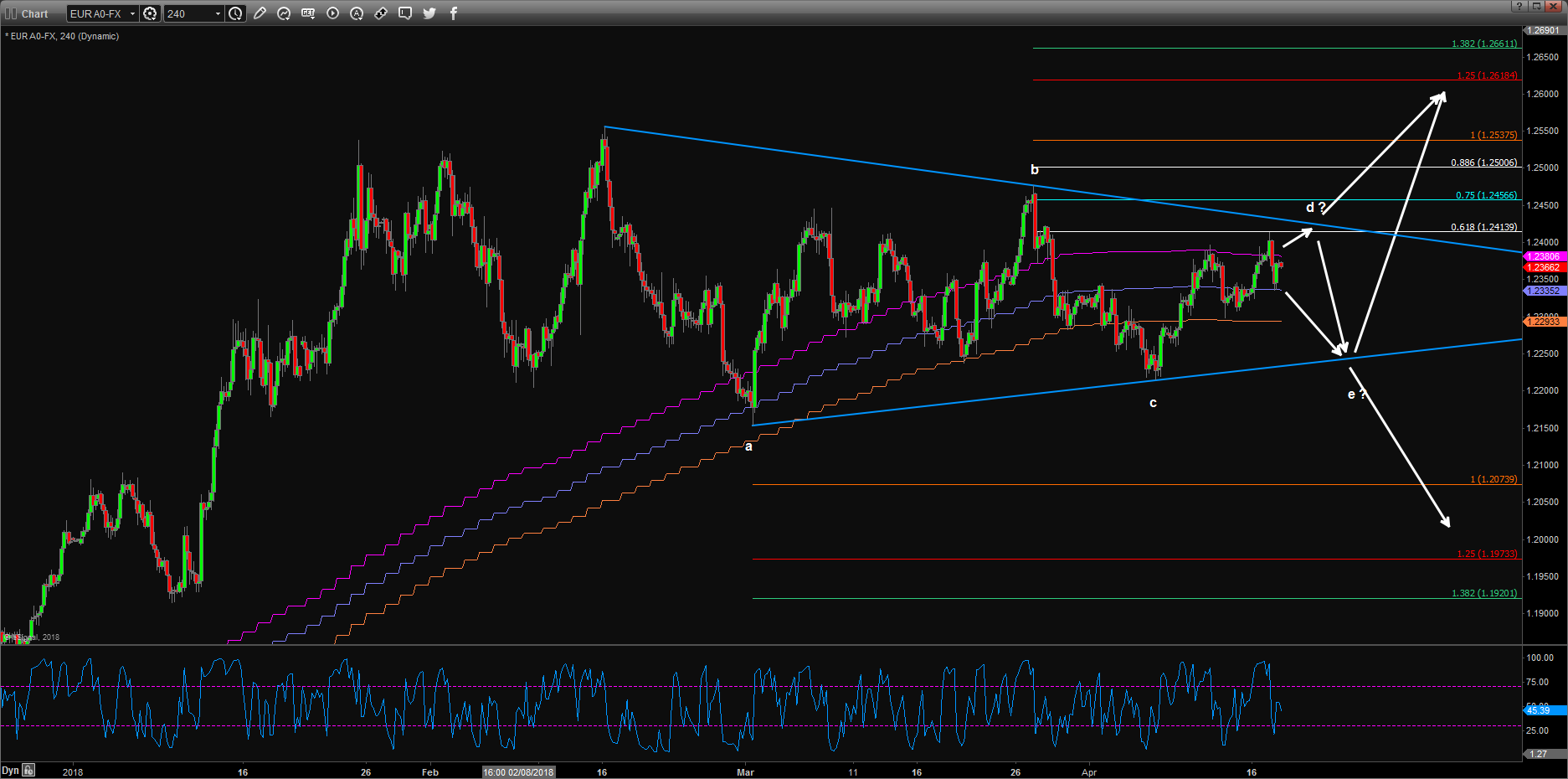

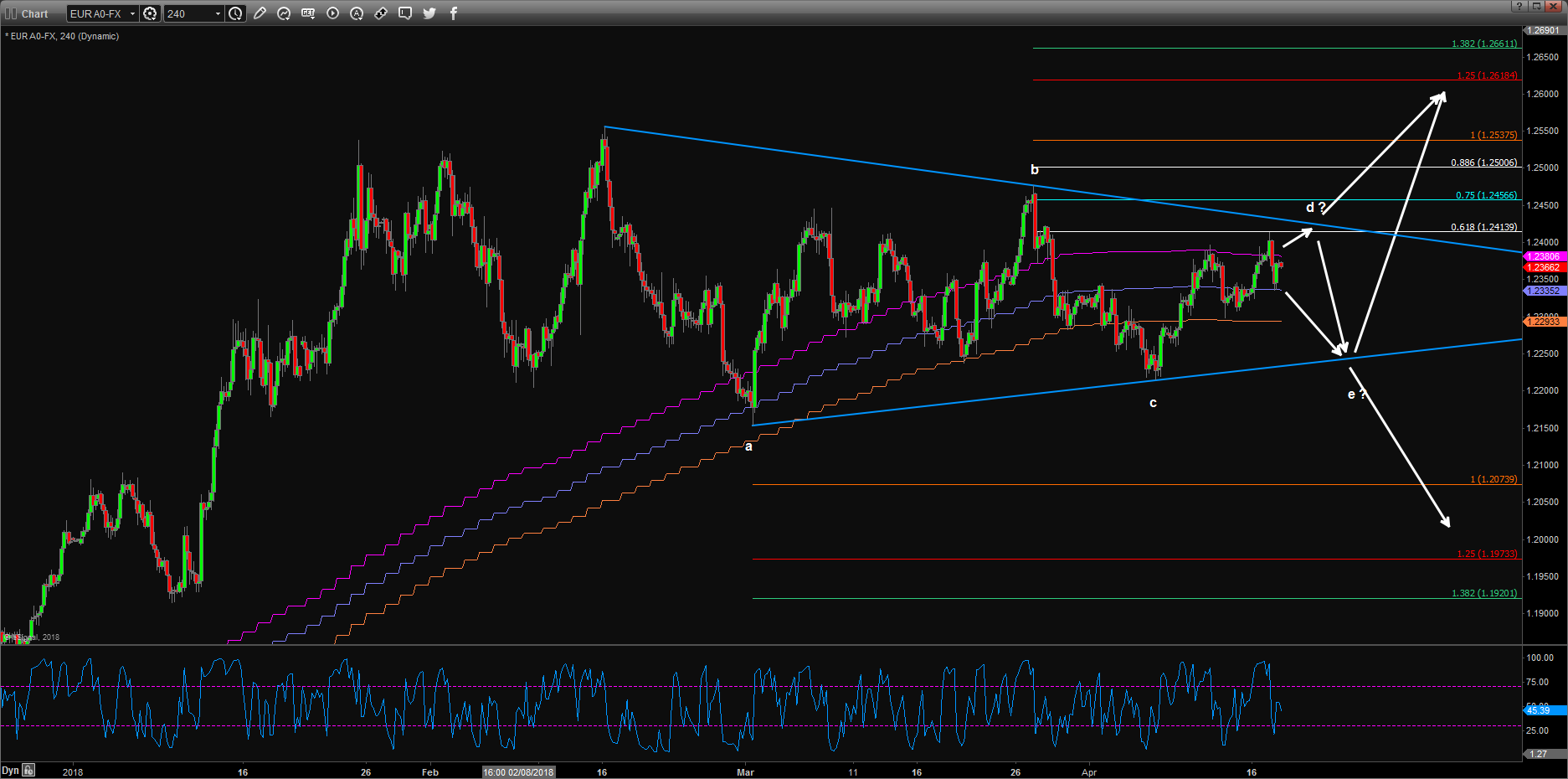

EURUSD: Quiet in the triangle

Yesterday EURUSD consolidated in the triangle within an 80 pips' range.

From an Elliottwave perspective, we still could not label the recent high of 1.2413 as wave d.

But daily oscillator already at the top of range.

We'll try to play short term extremes and wait for better opportunities.

If today close above 1.2410, that will indicate the uptrend acceleration.

Close below 1.2343 will be the first pullback sign.

EURUSD Trade Idea:

Sell limit @ 1.2424 stop 1.2461 for 1.2353

Yesterday EURUSD consolidated in the triangle within an 80 pips' range.

From an Elliottwave perspective, we still could not label the recent high of 1.2413 as wave d.

But daily oscillator already at the top of range.

We'll try to play short term extremes and wait for better opportunities.

If today close above 1.2410, that will indicate the uptrend acceleration.

Close below 1.2343 will be the first pullback sign.

EURUSD Trade Idea:

Sell limit @ 1.2424 stop 1.2461 for 1.2353

*Não serão tolerados uso comercial ou spam. O não cumprimento desta regra poderá resultar na exclusão da conta.

Dica: Ao adicionar uma URL de imagem/youtube, você estará automaticamente incorporando-a à sua postagem!

Dica: Digite o símbolo @ para que o nome de um usuário que participe desta discussão seja completado automaticamente.

.png)