- Главная

- Сообщество

- Опытные трейдеры

- Gold & Silver Analyses

Advertisement

Edit Your Comment

Gold & Silver Analyses

Участник с Jan 04, 2014

8 комментариев

Jan 09, 2014 at 14:56

Участник с Jan 04, 2014

8 комментариев

9/Jan/2014 Gold & Silver Analyses

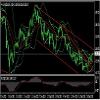

Gold:

The Fed's policy meeting minutes from 18 to 19 December published on Wednesday revealed that the Fed thought the economic boost brought by quantitative easing bond purchase monthly has begun to weaken. after the release of meeting minutes, the dollar briefly rose, but the impact did not kept for a long time, soon returned most rising. MMI GROUP Trust Fund Team considers gold is doing concussion run, currently trading is relatively light, waiting for the interest rates of European central bank and Bank of England today and non-farm performance on Friday, can consider light storehouse build more at low order in a day, but still short thinking mainly.

Upside resistance: 1233.10 / 1248.50

Downside support: 1212.70 / 1199

Silver:

Silver can do short-term bullish thinking in a day or two, but still short market below 20.50.

Upside resistance: 19.90 / 20.50 / 20.90

Downside support: 19.40 / 19 / 18.70

Gold:

The Fed's policy meeting minutes from 18 to 19 December published on Wednesday revealed that the Fed thought the economic boost brought by quantitative easing bond purchase monthly has begun to weaken. after the release of meeting minutes, the dollar briefly rose, but the impact did not kept for a long time, soon returned most rising. MMI GROUP Trust Fund Team considers gold is doing concussion run, currently trading is relatively light, waiting for the interest rates of European central bank and Bank of England today and non-farm performance on Friday, can consider light storehouse build more at low order in a day, but still short thinking mainly.

Upside resistance: 1233.10 / 1248.50

Downside support: 1212.70 / 1199

Silver:

Silver can do short-term bullish thinking in a day or two, but still short market below 20.50.

Upside resistance: 19.90 / 20.50 / 20.90

Downside support: 19.40 / 19 / 18.70

Участник с Jan 04, 2014

8 комментариев

Jan 14, 2014 at 16:07

Участник с Jan 04, 2014

8 комментариев

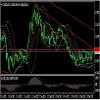

Gold:

The market was closed yesterday and is relatively light because of the Coming-of-Age Day in Europe and the United States. MMI GROUP Trust Fund Team thinks the concern on slowing down the QE speed by Fed was caused by the non-agricultural data last week, which is good for commodity currencies. Gold ended positively for three consecutive days, but the downward trend is still well-defined, short thinking is dominant. Currently focus on the top edge of the downlink channel, if effectively break, may be out of a large correction rally.

Upside resistance: 1267.80 / 1278.80

Downside support: 1238 / 1212.70

Silver:

The terrible non-agricultural report last week made silver shock upstream, but still below 20.50. The 20.50 line is the most important long-short watershed, short trend may remain if cannot break effectively.

Upside resistance: 20.50 / 20.40

Downside support: 19.90 / 19.40

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

The market was closed yesterday and is relatively light because of the Coming-of-Age Day in Europe and the United States. MMI GROUP Trust Fund Team thinks the concern on slowing down the QE speed by Fed was caused by the non-agricultural data last week, which is good for commodity currencies. Gold ended positively for three consecutive days, but the downward trend is still well-defined, short thinking is dominant. Currently focus on the top edge of the downlink channel, if effectively break, may be out of a large correction rally.

Upside resistance: 1267.80 / 1278.80

Downside support: 1238 / 1212.70

Silver:

The terrible non-agricultural report last week made silver shock upstream, but still below 20.50. The 20.50 line is the most important long-short watershed, short trend may remain if cannot break effectively.

Upside resistance: 20.50 / 20.40

Downside support: 19.90 / 19.40

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Участник с Jan 04, 2014

8 комментариев

Jan 16, 2014 at 11:05

Участник с Jan 04, 2014

8 комментариев

15/Jan/2014 Gold & Silver Analyses

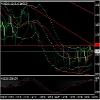

Gold:

Precious Metals sharply went downward yesterday after two hawks of Fed, Fisher and Plosser, newly won voting right and issued the strong views to support an early end to QE. MMI GROUP Trust Fund Team thinks the downward trend of Gold is in whole, without touching the lower edge of downlink channel yesterday, and has broken the recent upward trend, the short information is strong now. Our advice is to sell at high intraday, many holdings need be cautious, can consider longs to participate in until appears effectively break downward trend.

Upside resistance: 1245.50 / 1255.40 / 1267.90

Downside support: 1238.10 / 1227.10

Silver:

Silver peaked by the influence of Fed comments yesterday, but quickly fell back to the turbulence field, did not effectively breakthrough 20.50 line, showing bears power still prevail. Investors can consider empty single participate in at high intraday.

Upside resistance: 20.50 / 20.90 / 21.40

Downside support: 19.90 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Gold:

Precious Metals sharply went downward yesterday after two hawks of Fed, Fisher and Plosser, newly won voting right and issued the strong views to support an early end to QE. MMI GROUP Trust Fund Team thinks the downward trend of Gold is in whole, without touching the lower edge of downlink channel yesterday, and has broken the recent upward trend, the short information is strong now. Our advice is to sell at high intraday, many holdings need be cautious, can consider longs to participate in until appears effectively break downward trend.

Upside resistance: 1245.50 / 1255.40 / 1267.90

Downside support: 1238.10 / 1227.10

Silver:

Silver peaked by the influence of Fed comments yesterday, but quickly fell back to the turbulence field, did not effectively breakthrough 20.50 line, showing bears power still prevail. Investors can consider empty single participate in at high intraday.

Upside resistance: 20.50 / 20.90 / 21.40

Downside support: 19.90 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Участник с Jan 04, 2014

8 комментариев

Jan 16, 2014 at 11:05

Участник с Jan 04, 2014

8 комментариев

16/Jan/2014 Gold & Silver Analyses

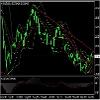

Gold

The performance of US banks is strong, while the US PPI and New York manufacturing PMI created new high in a year and a half. Market regained the confidence in Dollar, and suppressed Precious Metals. MMI GROUP Trust Fund Team thinks the price of gold operated under 1242.50 yesterday, but didn't hit 1246.50 line, showing short was strong. Still dominated by going short at high under 1246.50 intraday.

Upside resistance: 1242.50 / 1246.50 / 1255.40

Downside support: 1234.30 / 1227.10

Silver

The holdings up to January 16 of the global major silver, ETF-iSharesSilverTrust, held the line compared with the previous trading day, which was 9894.53 tons, and the total value was about $6.389 billion. After fell back yesterday sliver showed a narrow finishing. The suggestion is on processing due to the small range.

Upside resistance: 20.30 / 20.50

Downside support: 19.90 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Gold

The performance of US banks is strong, while the US PPI and New York manufacturing PMI created new high in a year and a half. Market regained the confidence in Dollar, and suppressed Precious Metals. MMI GROUP Trust Fund Team thinks the price of gold operated under 1242.50 yesterday, but didn't hit 1246.50 line, showing short was strong. Still dominated by going short at high under 1246.50 intraday.

Upside resistance: 1242.50 / 1246.50 / 1255.40

Downside support: 1234.30 / 1227.10

Silver

The holdings up to January 16 of the global major silver, ETF-iSharesSilverTrust, held the line compared with the previous trading day, which was 9894.53 tons, and the total value was about $6.389 billion. After fell back yesterday sliver showed a narrow finishing. The suggestion is on processing due to the small range.

Upside resistance: 20.30 / 20.50

Downside support: 19.90 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Участник с Jan 04, 2014

8 комментариев

Jan 17, 2014 at 11:07

Участник с Jan 04, 2014

8 комментариев

17/Jan/2014 Gold & Silver Analyses

Gold:

Gold went sideways after two days down, as data shows the U.S. job market enhanced, and the improvement of regional manufacturing activities suppressed gold buying. The speech of Mr. Bernanke on farewell feast in the morning had no new conception and did not affect the market. MMI GROUP Trust Fund Team thinks gold is running in a correction in the downward trend. Attention on the top edge of the downlink channel, if cannot break effectively, the downward trend will be completed. There is a certain space on the upside intraday, but still suggests short thinking in the downlink channel.

Upside resistance: 1246.50 / 1255.40 / 1263.40

Downside support: 1239.90 / 1234.30 / 1212.70

Silver:

US international capital inflows in November released yesterday to the US economy, silver rose rapidly, but didn’t affect for a long time. Currently silver is in shrinking running, the volatility is small. Our recommendation is watching.

Upside resistance: 20.20 / 20.50

Downside support: 20 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Gold:

Gold went sideways after two days down, as data shows the U.S. job market enhanced, and the improvement of regional manufacturing activities suppressed gold buying. The speech of Mr. Bernanke on farewell feast in the morning had no new conception and did not affect the market. MMI GROUP Trust Fund Team thinks gold is running in a correction in the downward trend. Attention on the top edge of the downlink channel, if cannot break effectively, the downward trend will be completed. There is a certain space on the upside intraday, but still suggests short thinking in the downlink channel.

Upside resistance: 1246.50 / 1255.40 / 1263.40

Downside support: 1239.90 / 1234.30 / 1212.70

Silver:

US international capital inflows in November released yesterday to the US economy, silver rose rapidly, but didn’t affect for a long time. Currently silver is in shrinking running, the volatility is small. Our recommendation is watching.

Upside resistance: 20.20 / 20.50

Downside support: 20 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.

Участник с Jan 04, 2014

8 комментариев

Jan 21, 2014 at 09:37

Участник с Jan 04, 2014

8 комментариев

21/Jan/2014 Gold & Silver Analyses

Gold:

The gold holdings of the largest global gold Exchange-Traded Fund (ETF) maintained at 797.05 tons until January 21, which the net reduction was 1.17 tons this month. Down of the dollar and stocks bo...osted investor’s confidence in gold, making gold supported. U.S. market was closed yesterday, thinly traded and amplitude is limited. MMI GROUP Trust Fund Team thinks currently gold was moving sideways at the top edge of downlink channel, and formed a contraction finish area with the small upward trend rebound. The trend remains intact now.

Upside resistance: 1262.30 / 1267.80 / 1294.40

Downside support: 1245.30 / 1234.30

U.S. market was suspended on Martin Luther King Day, Jan 20, and had no big news. Silver trend remained range-bound intraday, blocked below 20.50. Still dominated by short thinking.

Upside resistance: 20.50 / 20.90

Downside support: 20.10 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.See more

Gold:

The gold holdings of the largest global gold Exchange-Traded Fund (ETF) maintained at 797.05 tons until January 21, which the net reduction was 1.17 tons this month. Down of the dollar and stocks bo...osted investor’s confidence in gold, making gold supported. U.S. market was closed yesterday, thinly traded and amplitude is limited. MMI GROUP Trust Fund Team thinks currently gold was moving sideways at the top edge of downlink channel, and formed a contraction finish area with the small upward trend rebound. The trend remains intact now.

Upside resistance: 1262.30 / 1267.80 / 1294.40

Downside support: 1245.30 / 1234.30

U.S. market was suspended on Martin Luther King Day, Jan 20, and had no big news. Silver trend remained range-bound intraday, blocked below 20.50. Still dominated by short thinking.

Upside resistance: 20.50 / 20.90

Downside support: 20.10 / 19.30

This article only represents the personal point of author, for reference only, not as a basis for the investment. Enter the market accordingly at your own risk.See more

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.