Edit Your Comment

USD/JPY

Apr 06, 2018 at 10:07

Member Since Nov 16, 2015

708 posts

The USD/JPY pair struggled to build on its intraday rebound from the 107.00 handle and was now seen oscillating in a range just below mid-107.00s, over 1-month tops.

The pair failed to capitalize on the Asian session uptick and was now being capped by bearish trading sentiment around European equity markets, which underpinned the Japanese Yen's safe-haven appeal.

The risk-off mood, further reinforced by the ongoing slide in the US Treasury bond yields, partly offset a strong follow-through US Dollar buying interest and was seen as one of the key factors keeping a lid on any additional up-move.

Heading into today's key event risk - the release of US monthly jobs data, investors' reluctance to place any aggressive bets further collaborated to the pair's range-bound/subdued price action during the early European session.

Apart from the keenly watched NFP report, the Fed Chair Jerome Powell's scheduled speech would be scrutinized for clues over the central bank's near-term monetary policy outlook and might also provide some meaningful impetus on the last trading day of the week.

The pair failed to capitalize on the Asian session uptick and was now being capped by bearish trading sentiment around European equity markets, which underpinned the Japanese Yen's safe-haven appeal.

The risk-off mood, further reinforced by the ongoing slide in the US Treasury bond yields, partly offset a strong follow-through US Dollar buying interest and was seen as one of the key factors keeping a lid on any additional up-move.

Heading into today's key event risk - the release of US monthly jobs data, investors' reluctance to place any aggressive bets further collaborated to the pair's range-bound/subdued price action during the early European session.

Apart from the keenly watched NFP report, the Fed Chair Jerome Powell's scheduled speech would be scrutinized for clues over the central bank's near-term monetary policy outlook and might also provide some meaningful impetus on the last trading day of the week.

Member Since Jul 06, 2017

9 posts

Apr 06, 2018 at 11:53

Member Since Jul 06, 2017

9 posts

the_who posted:

USD/JPY closed higher, but however bull should defend the 106.00 area. Immediate resistance is seen at 106.60 and the downside remains supported by 105.40.

Agreed :) I think usdjpy will go down too. If not today, on NFP for sure I think

535sjch@

Member Since Oct 02, 2014

905 posts

Member Since Dec 10, 2017

210 posts

Apr 08, 2018 at 06:41

Member Since Dec 10, 2017

210 posts

The US dollar initially fell against the Japanese yen during trading this past week, as the jobs number came out on Friday. However, we remain within the trading range that we had been in, so I think it’s going to be a “buy the dips” market.

Member Since Oct 11, 2013

769 posts

Apr 09, 2018 at 06:08

Member Since Oct 11, 2013

769 posts

The USDJPY rallies to the 55 day EMA around the 107.00 level, but it loses its bullish momentum at that zone. Now the pair is trying to correct to the downside, where the 106.00 level may act as its next support. To the upside, the USDJPY would have to break above the 108.00 level in order to reverse its trend completely to the upside.

Apr 10, 2018 at 09:57

Member Since Nov 16, 2015

708 posts

The US dollar recorded a modest decline against the Japanese yen on Monday. The session started at 106.93 and the dollar lost only 18 pips. The recent upward movement is impetuous but USD/JPY continues to find support from the 20-year moving average. Levels at 107.70 remain the primary objective.

Member Since Dec 10, 2017

210 posts

Apr 10, 2018 at 11:23

Member Since Dec 10, 2017

210 posts

The dollar/yen continued its bullish momentum last week, breaking through the downward channel. This fact should end the bears' phase and turn short-term bullish signals with the closest target seen in the 108.00-108.50 area. The first support is 106.50. A clear breakthrough and daily closure below this level may cause further downward pressure to test 106.00 or below. Basically, I remain neutral.

Member Since Feb 11, 2018

83 posts

Apr 12, 2018 at 06:52

Member Since Feb 11, 2018

83 posts

Unless a clearly close above 107.54, a potential short term head-should top formation still intact.

However, we see weekly bullish outside bar and monthly exhausting bar against recent low.

Holding above 104.54, further upside is still likely, but the consolidation maybe very complex.

To the downside, 103.56 will be the next support level.

However, we see weekly bullish outside bar and monthly exhausting bar against recent low.

Holding above 104.54, further upside is still likely, but the consolidation maybe very complex.

To the downside, 103.56 will be the next support level.

Member Since Feb 11, 2018

83 posts

Apr 13, 2018 at 07:20

Member Since Feb 11, 2018

83 posts

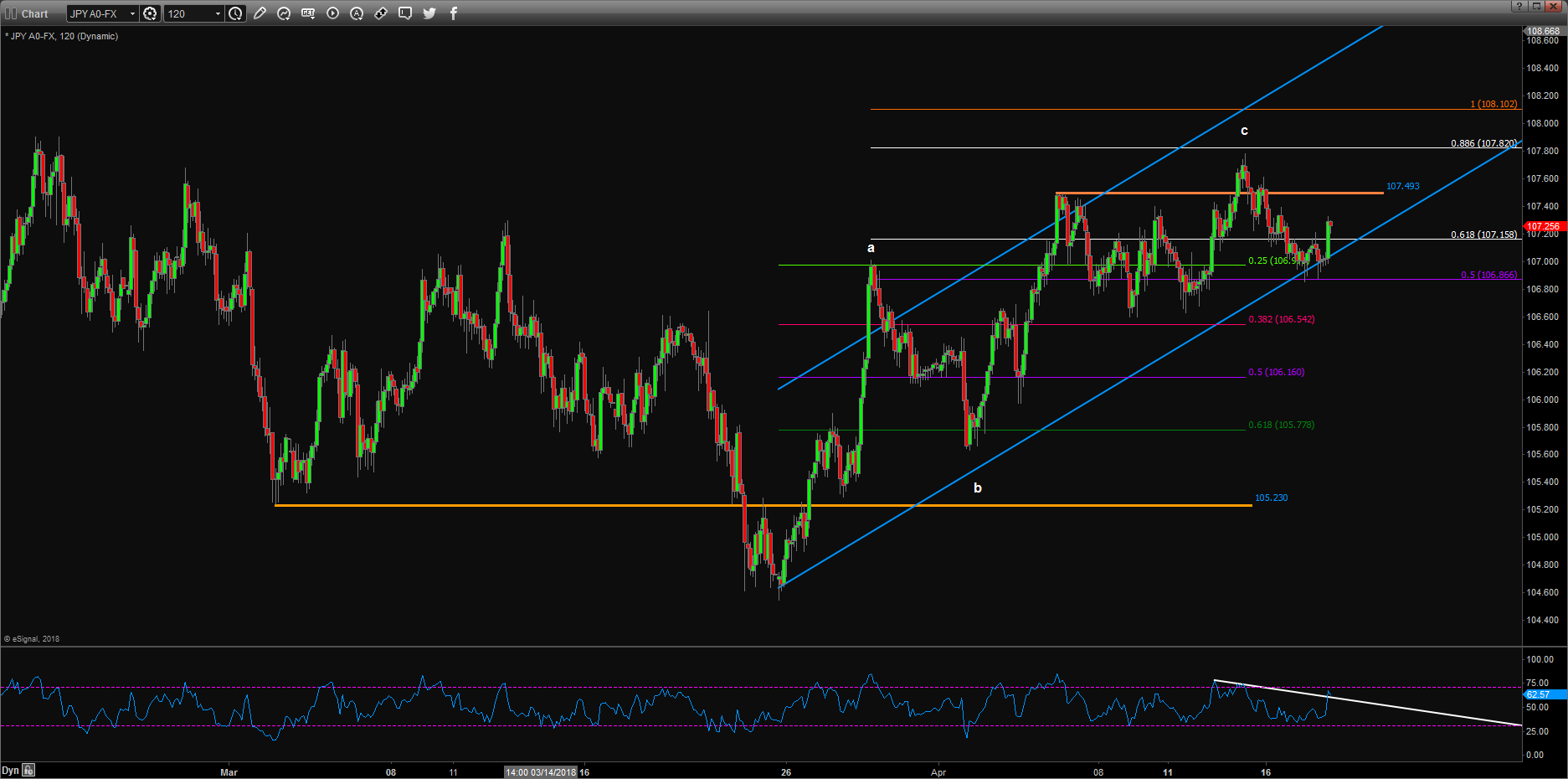

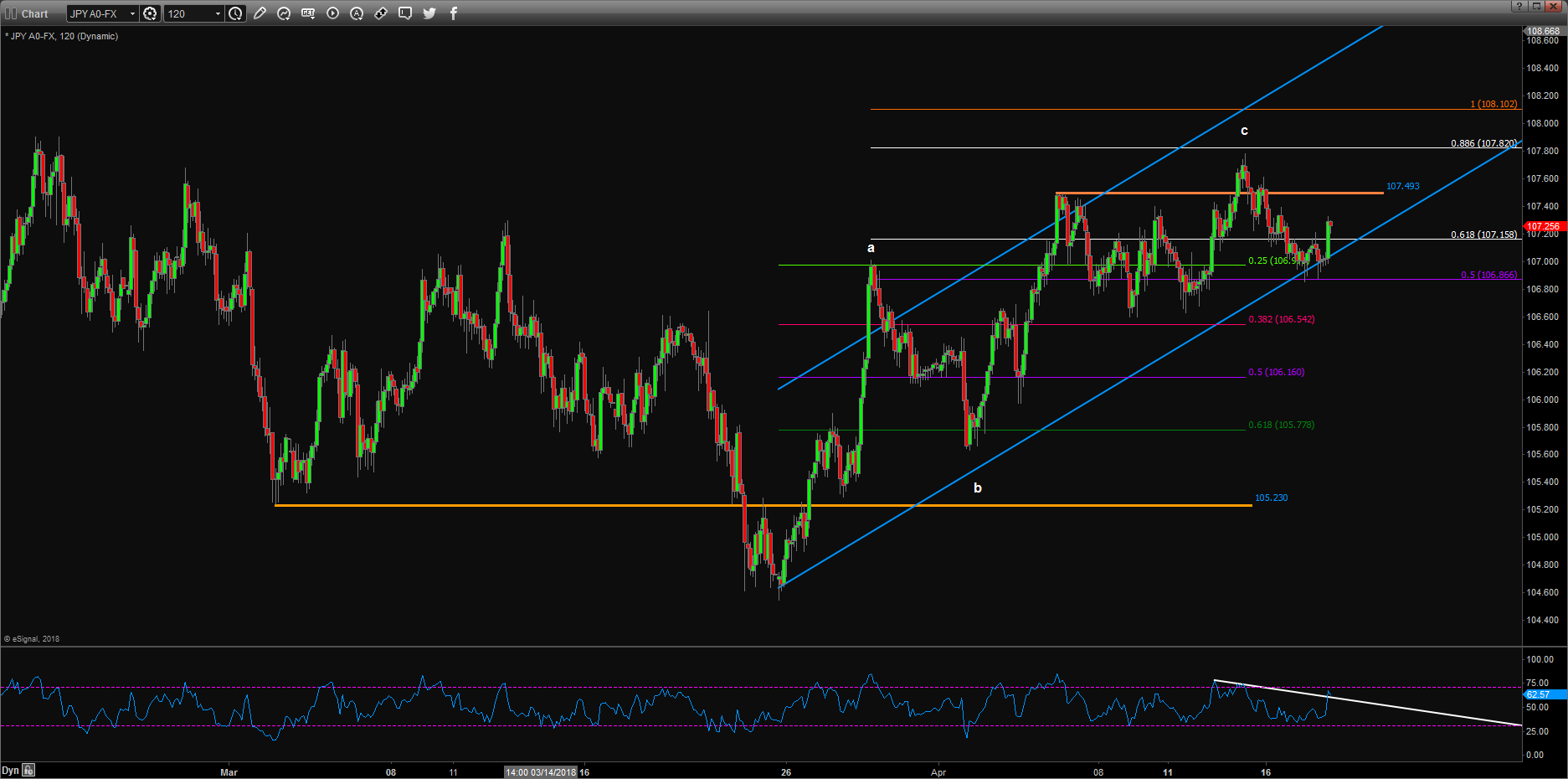

USDJPY

Already close back above the long trem trend line and break out from the downtrend channel.

Also probe into daily Ichimoku cloud for the first time since Jan 09, 2018.

Above 107.54, Directly re-test 107.7/108.08 is very likely.

If so, today will not touch or close below 107.04/106.89.

Below here, may enter another consolidation period.

But due to Syria issue, we may have to re-assess the pair next week.

Already close back above the long trem trend line and break out from the downtrend channel.

Also probe into daily Ichimoku cloud for the first time since Jan 09, 2018.

Above 107.54, Directly re-test 107.7/108.08 is very likely.

If so, today will not touch or close below 107.04/106.89.

Below here, may enter another consolidation period.

But due to Syria issue, we may have to re-assess the pair next week.

Member Since Feb 11, 2018

83 posts

Member Since Oct 02, 2014

905 posts

Member Since Feb 11, 2018

83 posts

Apr 16, 2018 at 06:58

Member Since Feb 11, 2018

83 posts

USDJPY

Price was exactly rejected by the long term range low at 107.73.

Also a daily exhausting bar and small oscillator divergence was flagged on last Friday.

I suspect the 1st upside target may already met.

Seasonal Japanese Yen strength from April to May should also be taken into account.

However, according to my system, weekly trend is turning higher gradually.

Look for base signs between 106.53/105.50/35 is preferred.

Below 105.35, may re-test recent low or even break lower to 103.56.

Directly close above 107.73, there's no major resistance until 109.36.

Price was exactly rejected by the long term range low at 107.73.

Also a daily exhausting bar and small oscillator divergence was flagged on last Friday.

I suspect the 1st upside target may already met.

Seasonal Japanese Yen strength from April to May should also be taken into account.

However, according to my system, weekly trend is turning higher gradually.

Look for base signs between 106.53/105.50/35 is preferred.

Below 105.35, may re-test recent low or even break lower to 103.56.

Directly close above 107.73, there's no major resistance until 109.36.

Apr 17, 2018 at 06:01

Member Since Dec 06, 2017

256 posts

USD/JPY turned to bearish mode today and dropped to 107.05. On the four hour time frame the price is developing above its flat 100-day and 200-day SMAs while stochastic is showing storng bearish momentum. The pair is reparing to test 106.90 wich if broken to below 106.60 will be the next target for the bears.

Member Since Feb 11, 2018

83 posts

Apr 18, 2018 at 07:10

Member Since Feb 11, 2018

83 posts

USDJPY: We are buyers

Yesterday price already closed below daily Ichimoku Tenkan-sen.

The rally from 104.54 could be counted as an overlapped ABC correction.

It's too early to call a base formation.

Holding below 107.78, we could not rule out right shoulder building of a potential head-shoulder top formation.

However, according to my trading system, we have weekly buy signal.

As long as it is valid, deeper retracement toward 105.77 should be bought against 105.23.

If today close above 107.49, that will indicate uptrend resuming.

USDJPY Trade Idea:

Sell limit @ 107.54 stop 107.80 for 106.59

Buy limit @ 105.78 stop 105.2 for 109.37

Yesterday price already closed below daily Ichimoku Tenkan-sen.

The rally from 104.54 could be counted as an overlapped ABC correction.

It's too early to call a base formation.

Holding below 107.78, we could not rule out right shoulder building of a potential head-shoulder top formation.

However, according to my trading system, we have weekly buy signal.

As long as it is valid, deeper retracement toward 105.77 should be bought against 105.23.

If today close above 107.49, that will indicate uptrend resuming.

USDJPY Trade Idea:

Sell limit @ 107.54 stop 107.80 for 106.59

Buy limit @ 105.78 stop 105.2 for 109.37

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.

.png)