Edit Your Comment

Opinions on ESMA & Financial Markets

Member Since Apr 06, 2018

242 posts

Jul 09, 2018 at 05:44

Member Since Apr 06, 2018

242 posts

Professional4X posted:NottsBlade posted:

I'd opened an account with £100 and was trading with 2p a pip and I still lost my money.

You lost it because you are not using low risk trading, but instead you are trading with high leverage with the hope of getting rich quick.

You cannot do that, if you wish to make money over a sustained period of time.

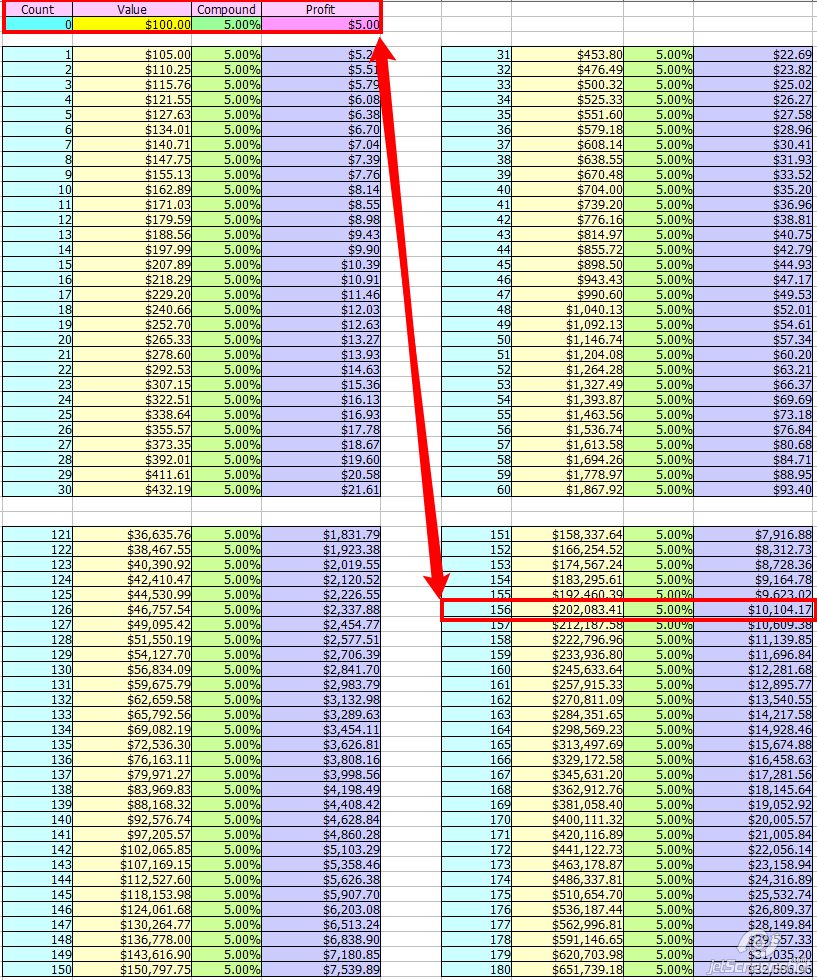

If you had of invested that $100.00 and used a low risk trading strategy, and properly evaluated the markets, you could have made a substantial income from it.

$100.00 invested with 5% ROI per week compounded over the period of 3 years.

Trading successfully does not require massive initial capital risks.

It does however required discipline and absolute emotional control, as well as an intimate understanding of how the markets really work.

You are absolutely correct.Low risk trading save trading account from potential disaster.If you are taking only 1-2% risk per trade then leverage you need to trade will be below 1:10 but brokers offer very high leverage such as 1:500 which is a recipe for disaster.

The market will trade through it’s path of least resistance .

forex_trader_524352

Member Since May 25, 2018

71 posts

Jul 09, 2018 at 07:00

Member Since May 25, 2018

71 posts

NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call "Elliott waves", or simply "waves". Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that "because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Member Since Jan 05, 2016

1097 posts

Jul 09, 2018 at 07:02

Member Since Jan 05, 2016

1097 posts

NottsBlade posted:

Financial Markets - Elliott Wave Theory

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Why do you keep just quote posting yourself over again?

Please don't do that, it makes it hard for others to read and understand the discussion thread.

Thank you.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Member Since Jan 05, 2016

1097 posts

Jul 09, 2018 at 07:05

(edited Jul 09, 2018 at 07:05)

Member Since Jan 05, 2016

1097 posts

NottsBlade posted:

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Please do not keep posting the same thing over and over again, it makes it hard for others to read and understand the discussion thread.

Thank you.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Jul 09, 2018 at 08:31

Member Since Jul 25, 2017

1 posts

When trading with leverage i always take in consideration of using tactics in tactic, You have to think outside the box.

Theres ways of getting rich quick and ways to take a calculated risk for example if u double your equity in one week, remove the initial equity from the battlefield and whatever you lost now you didnt really loose, this is House money.

Theres ways of getting rich quick and ways to take a calculated risk for example if u double your equity in one week, remove the initial equity from the battlefield and whatever you lost now you didnt really loose, this is House money.

fischer_jan@

Member Since Jan 05, 2016

1097 posts

Jul 09, 2018 at 08:41

Member Since Jan 05, 2016

1097 posts

nemin posted:

When trading with leverage i always take in consideration of using tactics in tactic, You have to think outside the box.

Theres ways of getting rich quick and ways to take a calculated risk for example if u double your equity in one week, remove the initial equity from the battlefield and whatever you lost now you didnt really loose, this is House money.

That's gambling, not long term safe investing.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_539132

Member Since Jul 10, 2018

6 posts

Jul 10, 2018 at 06:58

Member Since Jul 10, 2018

6 posts

NottsBlade posted:NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call "Elliott waves", or simply "waves". Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that "because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Well said Nottsblade Bernard Baruch an American financier 1870 – 1965 who advised a few of my predecessors Woodrow Wilson and Franklin D Roosevelt hit the nail on the head when he said 'what actually registers in the stock market's fluctuations, are not the events themselves, but the human reactions to these events. In short, how millions of individual men and women feel these happenings may affect their future. Baruch Added, ' Above all else, in other words, the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic arena, in which men and women pit their conflicting judgements, their hopes and fears, strengths and weaknesses, greeds and ideals.'

By the way your analysis is spot on!!!

forex_trader_539132

Member Since Jul 10, 2018

6 posts

Jul 10, 2018 at 07:00

Member Since Jul 10, 2018

6 posts

High Frequency Trading

HFT is controversial and has been met with some harsh criticism. It has replaced a large amount of broker-dealers and uses mathematical models and algorithms to make decisions, taking human decision and interaction out of the equation. Decisions happen in milliseconds, and this could result in big market moves without reason. As an example, on May 6, 2010, the Dow Jones Industrial Average (DJIA) suffered its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rising again. A government investigation blamed a massive order that triggered a sell-off for the crash.

An additional critique of HFT is it allows large companies to profit at the expense of the "little guys," or the institutional and retail investors. Another major complaint about HFT is the liquidity provided by HFT is "ghost liquidity," meaning it provides liquidity that is available to the market one second and gone the next, preventing traders from actually being able to trade this liquidity.

E.g. False Market

HFT is controversial and has been met with some harsh criticism. It has replaced a large amount of broker-dealers and uses mathematical models and algorithms to make decisions, taking human decision and interaction out of the equation. Decisions happen in milliseconds, and this could result in big market moves without reason. As an example, on May 6, 2010, the Dow Jones Industrial Average (DJIA) suffered its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rising again. A government investigation blamed a massive order that triggered a sell-off for the crash.

An additional critique of HFT is it allows large companies to profit at the expense of the "little guys," or the institutional and retail investors. Another major complaint about HFT is the liquidity provided by HFT is "ghost liquidity," meaning it provides liquidity that is available to the market one second and gone the next, preventing traders from actually being able to trade this liquidity.

E.g. False Market

forex_trader_539132

Member Since Jul 10, 2018

6 posts

Jul 10, 2018 at 07:02

Member Since Jul 10, 2018

6 posts

BREAKING DOWN 'Ghosting'

It is known as ghosting because, like a spectral image or a ghost, this collusion among market makers is difficult to detect. In developed markets, the consequences of ghosting can be severe.

Ghosting can be used to either drive a particular stock up or down, depending on the desired outcome. There must be a minimum of two participants involved, and those included are generally conspiring together. The goal is of mutual benefit, as those involved are looking to capitalize on the change in price for personal gain.

Due to current laws and regulations, it is illegal for two firms to coordinate an event in an attempt to manipulate the market. By function, market makers are meant to be competitors and are required to act as such. Ghosting is illegal for reasons similar to those governing insider trading, as both provide investors with an unfair advantage within the marketplace.

Ghosting Versus Insider Trading

While both ghosting and insider trading give particular firms or investors the ability to profit through illegal mechanisms, they function differently. With ghosting, a change in market condition is essentially manufactured, spurred on by the sudden increase of buying or selling of a particular stock. This causes stock prices to rise or fall in response to the sudden increase in trade volume but for disingenuous reasons, as no event has transpired to instigate the change.

Insider trading gives those competitive firms informed of an actual upcoming event an unfair advantage, allowing them to buy or sell the corresponding stock prior to the new information being publicly released. The inside information can come from company employees or any third party that has particular knowledge of the inner workings of an organization and is barred from using that information for gain.

Process Involved in Ghosting

When ghosting the market, more than one firm may attempt to drive a buy or sell frenzy. This is often started by buying or selling large amounts of a particular stock by all parties included in the fraudulent activity. This sudden increase in activity often sparks similar activities in other stockholders who are unaware of the collusion. As a result, prices rise or fall dramatically, corresponding to the buying or selling frenzy respectively.

'Ghosting'

Ghosting is an illegal practice whereby two or more market makers collectively attempt to influence and change the price of a stock. Ghosting is used by corrupt companies to affect stock prices so they can profit from the price movement. This practice is illegal because market makers are required by law to act in competition with each other.

E.g. Manipulation of the Daily Averages

It is known as ghosting because, like a spectral image or a ghost, this collusion among market makers is difficult to detect. In developed markets, the consequences of ghosting can be severe.

Ghosting can be used to either drive a particular stock up or down, depending on the desired outcome. There must be a minimum of two participants involved, and those included are generally conspiring together. The goal is of mutual benefit, as those involved are looking to capitalize on the change in price for personal gain.

Due to current laws and regulations, it is illegal for two firms to coordinate an event in an attempt to manipulate the market. By function, market makers are meant to be competitors and are required to act as such. Ghosting is illegal for reasons similar to those governing insider trading, as both provide investors with an unfair advantage within the marketplace.

Ghosting Versus Insider Trading

While both ghosting and insider trading give particular firms or investors the ability to profit through illegal mechanisms, they function differently. With ghosting, a change in market condition is essentially manufactured, spurred on by the sudden increase of buying or selling of a particular stock. This causes stock prices to rise or fall in response to the sudden increase in trade volume but for disingenuous reasons, as no event has transpired to instigate the change.

Insider trading gives those competitive firms informed of an actual upcoming event an unfair advantage, allowing them to buy or sell the corresponding stock prior to the new information being publicly released. The inside information can come from company employees or any third party that has particular knowledge of the inner workings of an organization and is barred from using that information for gain.

Process Involved in Ghosting

When ghosting the market, more than one firm may attempt to drive a buy or sell frenzy. This is often started by buying or selling large amounts of a particular stock by all parties included in the fraudulent activity. This sudden increase in activity often sparks similar activities in other stockholders who are unaware of the collusion. As a result, prices rise or fall dramatically, corresponding to the buying or selling frenzy respectively.

'Ghosting'

Ghosting is an illegal practice whereby two or more market makers collectively attempt to influence and change the price of a stock. Ghosting is used by corrupt companies to affect stock prices so they can profit from the price movement. This practice is illegal because market makers are required by law to act in competition with each other.

E.g. Manipulation of the Daily Averages

forex_trader_539132

Member Since Jul 10, 2018

6 posts

Jul 10, 2018 at 10:43

Member Since Oct 15, 2014

51 posts

BluePanther posted:5astelija posted:

Lol that's EURCHF

For technical analysis to work, you need to trade an instrument that is popular among other trades. EURCHF is just a modified version of EURUSD and USDCHF - a version with very much noise and no technical opportunities.

Trade EURUSD for better technical reliability, but the random noise will surely be still there, especially on lower timeframes.

Random noise? EURCHF is definitely a manipulated pair - has everyone so soon forgotten the Swiss NB peg to the Euro, which eventually collapsed in January 2015? https://admiralmarkets.com/analytics/traders-blog/price-shock-when-the-swiss-national-bank-unpegged-the-swiss-franc-from-the-euro

Don’t think for a second what China does, does not also occur with other currencies. Although the SNB doesn’t hold a hard peg officially, they have a certain monetary stance, as do all central banks, and all currencies are manipulated as best as the respective central banks (The Fed, Bank of England, etc.) can achieve, considering their limited resources compared with the total daily forex volume of $6 trillion per day.

The fact that Swiss national bank can change their monetary policy does NOT mean minute to minute market manipulation....

As far as I know, ECB and Fed do not have any currency target prices, because that would just cause trade wars and a lose-lose situation to everyone. This is the reason we have the floating currencies in the first place.

There surely is some manipulation happening in the bigger timeframe, but it is not like what majority of those conspiracists say to blame their trading failures on.

forex_trader_539132

Member Since Jul 10, 2018

6 posts

Jul 11, 2018 at 07:44

Member Since Jul 10, 2018

6 posts

NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Well said Nottsblade Bernard Baruch an American financier 1870 – 1965 who advised a few of my predecessors Woodrow Wilson and Franklin D Roosevelt hit the nail on the head when he said 'what actually registers in the stock market's fluctuations, are not the events themselves, but the human reactions to these events. In short, how millions of individual men and women feel these happenings may affect their future. Baruch Added, ' Above all else, in other words, the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic arena, in which men and women pit their conflicting judgements, their hopes and fears, strengths and weaknesses, greeds and ideals.'

By the way your analysis is spot on!!!

High Frequency Trading

HFT is controversial and has been met with some harsh criticism. It has replaced a large amount of broker-dealers and uses mathematical models and algorithms to make decisions, taking human decision and interaction out of the equation. Decisions happen in milliseconds, and this could result in big market moves without reason. As an example, on May 6, 2010, the Dow Jones Industrial Average (DJIA) suffered its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rising again. A government investigation blamed a massive order that triggered a sell-off for the crash.

An additional critique of HFT is it allows large companies to profit at the expense of the 'little guys,' or the institutional and retail investors. Another major complaint about HFT is the liquidity provided by HFT is 'ghost liquidity,' meaning it provides liquidity that is available to the market one second and gone the next, preventing traders from actually being able to trade this liquidity.

E.g. Creates a False Market/Casino Like Conditions

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Well said Nottsblade Bernard Baruch an American financier 1870 – 1965 who advised a few of my predecessors Woodrow Wilson and Franklin D Roosevelt hit the nail on the head when he said 'what actually registers in the stock market's fluctuations, are not the events themselves, but the human reactions to these events. In short, how millions of individual men and women feel these happenings may affect their future. Baruch Added, ' Above all else, in other words, the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic arena, in which men and women pit their conflicting judgements, their hopes and fears, strengths and weaknesses, greeds and ideals.'

By the way your analysis is spot on!!!

High Frequency Trading

HFT is controversial and has been met with some harsh criticism. It has replaced a large amount of broker-dealers and uses mathematical models and algorithms to make decisions, taking human decision and interaction out of the equation. Decisions happen in milliseconds, and this could result in big market moves without reason. As an example, on May 6, 2010, the Dow Jones Industrial Average (DJIA) suffered its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rising again. A government investigation blamed a massive order that triggered a sell-off for the crash.

An additional critique of HFT is it allows large companies to profit at the expense of the 'little guys,' or the institutional and retail investors. Another major complaint about HFT is the liquidity provided by HFT is 'ghost liquidity,' meaning it provides liquidity that is available to the market one second and gone the next, preventing traders from actually being able to trade this liquidity.

E.g. Creates a False Market/Casino Like Conditions

Member Since Jul 12, 2018

12 posts

Jul 30, 2018 at 05:53

Member Since Dec 28, 2013

160 posts

The only concern is that I want to make it big time - big money (100k) out of small money (far less than 1k). Now I can't depo small amts and need more money per microlots for margin. Cent account may be the work around. Trial and err is a slow way of learning. Using leverage less than 10, of course. High leverage is not a big issue, trading with large lot sizes is. That ESMA got wrong.

Jul 30, 2018 at 05:54

Member Since Dec 28, 2013

160 posts

To clarify myself: Leverage controls the money required for traded lots, and traded lots in unison with stop loss controls risk. If leverage available is low more money is required for margin. Leverage offered by broker can be hight but leverage used can still be less than 10. Stupid ruling they made.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.