Advertisement

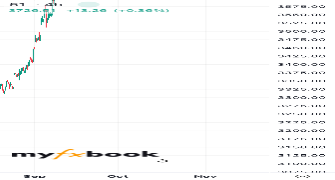

En son sistemler

| Sistem | Kazanma | Düşüş | Aylık | Performans | |

|---|---|---|---|---|---|

|

|

+478.25% | 27.00% | +478.25% | ||

|

|

+109,958.75% | 0.00% | +109,958.75% | ||

|

|

+11.54% | 5.54% | +2.94% | ||

|

|

+93.86% | 45.64% | +57.63% | ||

|

|

+124.28% | 26.70% | +4.98% | ||

|

|

+59.33% | 1.18% | +5.46% | ||

|

|

+28.59% | 0.01% | +28.59% | ||

|

|

+111.86% | 3.08% | +7.14% | ||

|

|

+10.16% | 2.88% | +1.92% | ||

|

|

+28.27% | 12.02% | +12.85% |

Ekonomik takvim

|

Etkinlik

|

Prev.

|

Cons.

|

Act.

|

|||

|---|---|---|---|---|---|---|

|

6m

Düşük

|

USD | 0.2% |

0.1%

|

|||

|

6m

Düşük

|

USD | 0.3% |

0.5%

|

|||

|

41m

Düşük

|

NZD | 2.854% | ||||

|

41m

Düşük

|

NZD | 2.966% | ||||

|

41m

Düşük

|

NZD | 2.827% | ||||

|

1h 6m

Düşük

|

IDR | 6.5% | ||||

|

2h 6m

Orta

|

MYR | 1.2% |

1.3%

|

|||

|

2h 6m

Orta

|

MYR | 0.1% |

0.1%

|

|||

|

2h 36m

Düşük

|

EUR | 0.3% |

0.1%

|

|||

|

2h 36m

Düşük

|

EUR | 2.2% |

1.5%

|

|||

|

3h 6m

Düşük

|

EUR | 9.3% |

9.5%

|

|||

|

3h 6m

Orta

|

INR | 62.9 |

62.5

|

|||

|

3h 6m

Orta

|

INR | 59.3 |

59.5

|

|||

|

3h 6m

Orta

|

INR | 63.2 |

62.9

|

|||

|

3h 6m

Düşük

|

SGD | 0.6% |

0.6%

|

|||

|

3h 6m

Düşük

|

SGD | -0.4% |

0.2%

|

|||

|

3h 6m

Düşük

|

SGD | 1.42% | ||||

|

3h 6m

Düşük

|

SGD | 1.39% | ||||

|

3h 6m

Düşük

|

SGD | 0.5% |

0.4%

|

|||

|

4h 6m

Düşük

|

EUR | 1.8% |

2.2%

|

|||

|

4h 6m

Düşük

|

EUR | -1.8% |

1.5%

|

|||

|

5h 6m

Orta

|

CHF | CHF19.4B |

CHF12.9B

|

|||

|

5h 6m

Düşük

|

ZAR | 0.4% |

-0.6%

|

|||

|

5h 21m

Orta

|

EUR | 49.8 |

49.9

|

|||

|

5h 21m

Yüksek

|

EUR | 49.8 |

49.6

|

|||

|

5h 21m

Yüksek

|

EUR | 50.4 |

50.2

|

|||

|

5h 36m

Orta

|

EUR | 50.5 |

50.5

|

|||

|

5h 36m

Yüksek

|

EUR | 49.3 |

49.5

|

|||

|

5h 36m

Yüksek

|

EUR | 49.8 |

50

|

|||

|

5h 36m

Orta

|

SEK | 2% |

2%

|

|||

|

6h 6m

Yüksek

|

EUR | 50.5 |

50.5

|

|||

|

6h 6m

Orta

|

EUR | 51 |

51.1

|

|||

|

6h 6m

Yüksek

|

EUR | 50.7 |

50.9

|

|||

|

6h 6m

Düşük

|

ILS | -$388.4M |

-$410M

|

|||

|

6h 6m

Orta

|

EUR | -€3.59B |

-€2.8B

|

|||

|

6h 6m

Orta

|

PLN | 5.4% |

5.5%

|

|||

|

6h 6m

Düşük

|

TWD | 15.2% |

14.5%

|

|||

|

6h 36m

Yüksek

|

GBP | 54.2 |

53.5

|

|||

|

6h 36m

Düşük

|

GBP | 53.5 |

52.7

|

|||

|

6h 36m

Yüksek

|

GBP | 47 |

47

|

|||

|

7h 6m

Düşük

|

GBP | |||||

|

7h 6m

Orta

|

GBP | |||||

|

7h 36m

Düşük

|

EUR | 1.96% | ||||

|

8h 6m

Düşük

|

ILS | 1.6% |

1.7%

|

|||

|

8h 6m

Düşük

|

EUR | €883M |

-€120M

|

|||

|

8h 6m

Düşük

|

MUR | 2.6% |

2.2%

|

|||

|

8h 6m

Düşük

|

EUR | €28.2B |

€20.2B

|

|||

|

8h 6m

Orta

|

GBP | -33 |

-30

|

|||

|

9h 6m

Orta

|

BRL | |||||

|

9h 6m

Düşük

|

EUR | -€576.4M | ||||

|

10h 6m

Düşük

|

HUF | 5.5% |

5.5%

|

|||

|

10h 6m

Düşük

|

HUF | 6.5% |

6.5%

|

|||

|

10h 6m

Düşük

|

MXN | 1.3% |

-0.7%

|

|||

|

10h 6m

Düşük

|

MXN | -0.4% |

-0.1%

|

|||

|

10h 6m

Düşük

|

MXN | 2.5% |

1.6%

|

|||

|

10h 6m

Düşük

|

MXN | 0.2% |

-0.7%

|

|||

|

10h 36m

Orta

|

CAD | -0.1% |

0%

|

|||

|

10h 36m

Orta

|

USD | -$450.2B |

-$270B

|

|||

|

11h 1m

Düşük

|

USD | 6.3% | ||||

|

11h 6m

Düşük

|

MAD | 2.25% |

2%

|

|||

|

11h 6m

Düşük

|

NGN | 27.5% |

26.5%

|

|||

|

11h 6m

Orta

|

USD | |||||

|

11h 51m

Yüksek

|

USD | 54.5 |

53.9

|

|||

|

11h 51m

Orta

|

USD | 55.1 |

54.6

|

|||

|

11h 51m

Yüksek

|

USD | 53 |

52

|

|||

|

12h 6m

Düşük

|

USD | -7 |

-5

|

|||

|

12h 6m

Düşük

|

USD | -5 |

-9

|

|||

|

12h 6m

Düşük

|

USD | 4 |

3

|

|||

|

12h 6m

Orta

|

USD | |||||

|

12h 26m

Düşük

|

EUR | |||||

|

14h 41m

Yüksek

|

USD | |||||

|

15h 6m

Düşük

|

USD | $22.12T | ||||

|

15h 6m

Düşük

|

USD | 3.641% | ||||

|

16h 36m

Düşük

|

CAD | |||||

|

17h 6m

Düşük

|

ARS | 27.8% |

25%

|

|||

|

18h 6m

Düşük

|

PYG | 6% |

6%

|

|||

|

18h 36m

Orta

|

USD | -3.42M | ||||

|

19h 6m

Orta

|

KRW | 111.4 |

112

|

|||

|

22h 6m

Hiçbiri

|

KHR |

Anayasa Günü

|

||||

|

22h 6m

Hiçbiri

|

DOP |

Las Mercedes Bayramı

|

||||

|

22h 6m

Hiçbiri

|

ILS |

Roş Aşana

|

||||

|

22h 6m

Hiçbiri

|

MVR |

Maldivlerin İslam'ı Kucakladığı Gün

|

||||

|

22h 6m

Hiçbiri

|

ZAR |

Miras Günü

|

||||

|

22h 6m

Düşük

|

USD | |||||

|

22h 36m

Düşük

|

JPY | 52 |

52.2

|

|||

|

22h 36m

Orta

|

JPY | 53.1 |

53.4

|

|||

|

22h 36m

Orta

|

JPY | 49.7 |

50.2

|

|||

|

23h 36m

Yüksek

|

AUD | 2.8% |

2.9%

|

|||

|

23h 36m

Düşük

|

AUD | |||||

|

1d

Düşük

|

LKR | 7.75% |

7.75%

|

|||

|

1d

Düşük

|

THB | 5.1% |

9.3%

|

|||

|

1d

Düşük

|

THB | 11% |

6.7%

|

|||

|

1d

Orta

|

THB | $0.32B |

$0.2B

|

|||

|

1d

Düşük

|

JPY | |||||

|

1d

Düşük

|

MYR | -0.5% |

0.3%

|

|||

|

1d

Düşük

|

MYR | 0.4% |

0.2%

|

|||

|

1d

Düşük

|

EUR | -1.5% |

-1.3%

|

|||

|

1d

Düşük

|

EUR | -2.6% |

-2%

|

|||

|

1d

Düşük

|

EUR | -2.7% |

-2.4%

|

|||

|

1d

Düşük

|

DKK | 99.9 |

100

|

|||

|

1d

Düşük

|

PHP | -PHP18.9B |

-PHP55B

|

|||

|

1d

Düşük

|

CZK | 101.5 |

101.7

|

|||

|

1d

Düşük

|

CZK | 99 |

100

|

|||

|

1d

Düşük

|

EUR | |||||

|

1d

Düşük

|

EUR | 0.3% |

0.1%

|

|||

|

1d

Düşük

|

SEK | 91.1 |

90.5

|

|||

|

1d

Düşük

|

SEK | 99.8 |

99.1

|

|||

|

1d

Düşük

|

SEK | 7.8% |

8%

|

|||

|

1d

Düşük

|

SEK | 96 |

95.1

|

|||

|

1d

Düşük

|

TRY | 73.5% |

73.7%

|

|||

|

1d

Orta

|

TRY | 100.6 |

101

|

|||

|

1d

Düşük

|

EUR | |||||

|

1d

Düşük

|

DKK | 0.7% |

1.5%

|

|||

|

1d

Yüksek

|

EUR | 89 |

89.2

|

|||

|

1d

Düşük

|

EUR | 86.4 |

86.5

|

|||

|

1d

Düşük

|

EUR | 91.6 |

92

|

|||

|

1d

Düşük

|

TWD | 18.11% |

19%

|

|||

|

1d

Düşük

|

CHF | -53.8 |

-40

|

|||

|

1d

Düşük

|

EUR | -6 |

-6

|

|||

|

1d

Düşük

|

ISK | 4% |

3.6%

|

|||

|

1d

Düşük

|

GBP | 4.022% | ||||

|

1d

Düşük

|

EUR | 2.2% | ||||

|

1d

Düşük

|

EUR | 1.13% | ||||

|

1d

Düşük

|

EUR | 1.24% | ||||

|

1d

Düşük

|

EUR | 2.46% | ||||

|

1d

Düşük

|

RUB | |||||

|

1d

Düşük

|

BRL | 86.2 |

86

|

|||

|

1d

Düşük

|

USD | 174 | ||||

|

1d

Düşük

|

USD | 29.7% | ||||

|

1d

Düşük

|

USD | 386.1 | ||||

|

1d

Orta

|

USD | 6.39% | ||||

|

1d

Düşük

|

USD | 1596.7 | ||||

|

1d

Düşük

|

MXN | 3.49% |

3.78%

|

|||

|

1d

Düşük

|

MXN | 0.02% |

0.19%

|

|||

|

1d

Düşük

|

MXN | 0.09% |

0.21%

|

|||

|

1d

Düşük

|

MXN | 4.21% |

4.25%

|

|||

|

1d

Düşük

|

USD | -2.2% |

-3.7%

|

|||

|

1d

Düşük

|

USD | 1.362M |

1.312M

|

|||

|

1d

Düşük

|

CZK | 3.5% |

3.5%

|

|||

|

1d

Düşük

|

EUR | -8.9 |

-8

|

|||

|

1d

Düşük

|

CLP | 5.6% |

6%

|

|||

|

1d

Yüksek

|

USD | -0.6% |

-1.8%

|

|||

|

1d

Yüksek

|

USD | 0.652M |

0.65M

|

|||

|

1d

Orta

|

USD | -2.347M | ||||

|

1d

Düşük

|

USD | -3.111M | ||||

|

1d

Düşük

|

USD | -0.274M | ||||

|

1d

Düşük

|

USD | -0.18M | ||||

|

1d

Orta

|

USD | -9.285M | ||||

|

1d

Düşük

|

USD | 0.67M | ||||

|

1d

Düşük

|

USD | 4.046M | ||||

|

1d

Düşük

|

USD | -0.296M | ||||

|

1d

Düşük

|

USD | -0.394M | ||||

|

1d

Düşük

|

COP | 6.7 |

5

|

|||

|

1d

Düşük

|

USD | 3.815% | ||||

|

1d

Düşük

|

USD | 0.195% | ||||

|

1d

Düşük

|

CAD | 3.506% | ||||

|

1d

Düşük

|

RUB | 0.7% |

0.8%

|

|||

|

1d

Düşük

|

RUB | RUB13.14T |

RUB17T

|

|||

|

1d

Orta

|

GBP | |||||

|

1d

Düşük

|

USD | 3.724% | ||||

|

1d

Düşük

|

ARS | 6.4% |

5%

|

|||

|

1d

Orta

|

USD | |||||

|

1d

Düşük

|

GBP | 5.6% |

5%

|

|||

|

1d

Orta

|

JPY |

Most Popular Challenges

_PN.png)

Gold Program 1 Phase | 40k

$280

$235.2

1 Step PRO | 100K

$549

$439.2

.png)

2 Phase | 200K

$1079

$809.25

FundingPips 1 Step | 5K

$59

$56.05

Haberler

Indonesia Bourse Likely To Remain Rangebound

The Indonesia stock market has finished lower in two of three trading days since the end of the seven-day winning streak in which it had surged almost 400 points or 5 percent. The Jakarta Composite Index sits just above the 8,040-point plateau and it figures to hold steady in that neighborhood again on Tuesday.

The global forecast for the Asian markets continued to be mildly positive on optimism over the outlook for interest rates. The European markets were mixed and the U.S. bourses were up and the Asian markets figure to split the difference.

The JCI finished slightly lower on Monday as losses from the financial shares and telecoms were mitigated by support from the resource and cement companies.

For the day, the index dipped 11.08 points or 0.14 percent to finish at 8,040.04 after trading between 8,005.35 and 8,087.93.

Among the actives, Bank CIMB Niaga fell 0.29 percent, while Bank Mandiri advanced 0.91 percent, Bank Danamon Indonesia collected 0.85 percent, Bank Negara Indonesia retreated 1.41 percent, Bank Central Asia and Astra Agro Lestari both dropped 0.96 percent, Bank Rakyat Indonesia tanked 2.12 percent, Indosat Ooredoo Hutchison retreated 1.59 percent, Indocement improved 0.72 percent, Semen Indonesia strengthened 1.39 percent, Indofood Sukses Makmur rose 0.32 percent, Astra International shed 0.44 percent, Energi Mega Persada surged 7.14 percent, Aneka Tambang rallied 3.77 percent, Vale Indonesia soared 3.71 percent, Timah spiked 5.00 percent, Bumi Resources skyrocketed 6.14 percent and United Tractors was unchanged.

RTTNews

|

22 dakika önce

Rebound Anticipated For Hong Kong Stock Market

The Hong Kong stock market has alternated between positive and negative finishes through the last five trading days since the end of the two-day winning streak in which it had jumped more than 360 points or 1.4 percent. The Hang Seng Index now sits just beneath the 26,350-point plateau although it's expected to bounce higher again on Tuesday.

The global forecast for the Asian markets continued to be mildly positive on optimism over the outlook for interest rates. The European markets were mixed and the U.S. bourses were up and the Asian markets figure to split the difference.

The Hang Seng finished modestly lower on Monday following losses from the financial shares and property stocks, while the technology shares were mixed.

For the day, the index sank 200.96 points or 0.76 percent to finish at 26,344.14 after trading between 26,204.01 and 26,479.14.

Among the actives, Alibaba Group perked 0.06 percent, while Alibaba Health Info slipped 1.14 percent, ANTA Sports slumped 2.22 percent, China Life Insurance tumbled 3.05 percent, China Mengniu Dairy lost 1.31 percent, China Resources Land retreated 2.41 percent, CITIC plummeted 4.72 percent, CNOOC fell 1.24 percent, Galaxy Entertainment was down 1.18 percent, Haier Smart Home tanked 2.52 percent, Hang Lung Properties shed 1.35 percent, Henderson Land skidded 1.77 percent, Hong Kong & China Gas dropped 1.60 percent, Industrial and Commercial Bank of China declined 2.38 percent, JD.com stumbled 3.31 percent, Lenovo jumped 1.50 percent, Li Auto dipped 1.14 percent, Li Ning added 0.45 percent, Meituan contracted 2.26 percent, New World Development advanced 0.72 percent, Nongfu Spring sank 1.38 percent, Techtronic Industries plunged 4.03 percent, Xiaomi Corporation slid 1.06 percent, WuXi Biologics surged 6.09 percent and CSPC Pharmaceutical was unchanged.

RTTNews

|

37 dakika önce

Australian Market Modestly Higher

The Australian stock market is trading modestly higher on Tuesday, adding to the gains in the previous two sessions, following the broadly positive cues from Wall Street overnight. The benchmark S&P/ASX 200 is moving well above the 8,800 level, with gains across most sectors led by mining and technology shares.

RTTNews

|

42 dakika önce

China Stock Market May Tick Higher On Tuesday

The China stock market on Monday snapped the two-day slide in which it had dropped more than 55 points or 1.5 percent. The Shanghai Composite Index now rests just beneath the 3,830-point plateau and it's expected to open to the upside again on Tuesday.

The global forecast for the Asian markets continued to be mildly positive on optimism over the outlook for interest rates. The European markets were mixed and the U.S. bourses were up and the Asian markets figure to split the difference.

The SCI finished slightly higher on Monday as gains from the broader market were capped by weakness from the financials and resource stocks.

For the day, the index gained 8.49 points or 0.22 percent to finish at 3,828.58 after trading between 3,806.20 and 3,831.74. The Shenzhen Composite Index improved 13.80 points or 0.56 percent to end at 2,486.42.

Among the actives, Industrial and Commercial Bank of China was down 0.28 percent, while Bank of China contracted 1.51 percent, Agricultural Bank of China plunged 2.41 percent, China Merchants Bank eased 0.20 percent, Bank of Communications stumbled 2.01 percent, China Life Insurance skidded 1.02 percent, Jiangxi Copper declined 1.21 percent, Aluminum Corp of China (Chalco) lost 0.65 percent, Yankuang Energy slumped 0.96 percent, PetroChina shed 0.61 percent, China Petroleum and Chemical (Sinopec) sank 0.75 percent, Huaneng Power tumbled 1.90 percent, China Shenhua Energy dipped 0.23 percent, Gemdale dropped 0.95 percent, Poly Developments retreated 1.39 percent and China Vanke rose 0.29 percent.

RTTNews

|

52 dakika önce

Taiwan Shares Tipped To Open In The Green On Tuesday

The Taiwan stock market has alternated between positive and negative finishes through the last six trading days since the end of the eight-day winning streak in which it had surged more than 1,450 points or 5.8 percent. The Taiwan Stock Exchange now sits just above the 25,880-point plateau and it may see additional support on Tuesday.

The global forecast for the Asian markets continued to be mildly positive on optimism over the outlook for interest rates. The European markets were mixed and the U.S. bourses were up and the Asian markets figure to split the difference.

The TSE finished sharply higher on Monday following gains from the financial shares, technology stocks, plastics and cement companies.

For the day, the index jumped 302.23 points or 1.18 percent to finish at 25,880.60 after trading between 25,599.60 and 25,887.69.

Among the actives, Cathay Financial perked 0.17 percent, while Mega Financial fell 0.36 percent, First Financial collected 0.34 percent, Fubon Financial was up 0.16 percent, Taiwan Semiconductor Manufacturing Company soared 2.37 percent, United Microelectronics Corporation shed 0.46 percent, Hon Hai Precision advanced 0.93 percent, Largan Precision improved 0.85 percent, Catcher Technology gained 0.53 percent, MediaTek tanked 2.43 percent, Delta Electronics rallied 2.14 percent, Novatek Microelectronics stumbled 2.68 percent, Formosa Plastics added 0.65 percent, Nan Ya Plastics soared 3.31 percent, Asia Cement jumped 1.79 percent and CTBC Financial and E Sun Financial were unchanged.

The lead from Wall Street is mildly positive as the major averages opened in the red on Monday but quickly bounced higher and continued to trend that way throughout the session, ending near daily highs.

RTTNews

|

1s 22 dakika önce

Analiz

September Trading: Time to Drop the Excuses and Catch Institutional Market Trends

September often marks a turning point in global markets as institutional players return with fresh capital. Clearer trends and higher liquidity create opportunities across forex, indices, and commodities. Here’s why traders should stop waiting for the “perfect” moment and act on September’s unique conditions.

Rock-West

|

12s 58 dakika önce

US100, USDCHF, EURUSD

US Core PCE data could shake US100 after its record-breaking rally; SNB steady: No rate change expected as USDCHF eyes recovery; Eurozone PMIs: EURUSD dips as growth shows signs of life

XM Group

|

16s 16 dakika önce

USD/JPY Soars as Yen Weakens on BoJ Policy Concerns

The USD/JPY pair climbed to 148.31 on Monday, extending its gains from the previous week as the US dollar strengthened across the board. The yen faced additional pressure from heightened anticipation around upcoming comments from Federal Reserve officials and the release of critical US inflation data.

RoboForex

|

16s 26 dakika önce

Risk appetite wanes, gold rallies ahead of scheduled Fedspeak

Data and Fedspeak take center stage this week; US government shutdown is approaching; data releases could be affected; US equities gained last week, but under pressure today; Gold posts new all-time high; crypto decline carries momentum;

XM Group

|

16s 52 dakika önce

The crypto market is frightened by calm

Expert market comment made by Chief Market Analyst Alex Kuptsikevich of the FxPro Analyst Team: The crypto market is frightened by calm

FxPro

|

17s 5 dakika önce

Faiz oranları

Piyasa saatleri

Join our community

En Son Konular

41

2 saat önce

31

4 saat önce

18

4 saat önce

26

6 saat önce

78

12 saat önce

15

14 saat önce

62

15 saat önce

41

15 saat önce

0

15 saat önce

45

15 saat önce

Top Services

★

4.9

out of

5

(17)

★

4.5

out of

5

(21)

★

4.9

out of

5

(306)

★

5

out of

5

(1)

★

5

out of

5

(421)

★

5

out of

5

(20)

Döviz Çevirici

Order Book

Canlı Forex Spreadleri

| Brokerlar | EUR/USD | EUR/GBP |

|---|---|---|

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Forex Hassaslığı

Grafik Aktivitesi

-

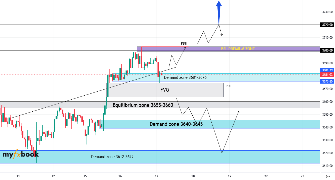

XAUUSD,H4 tarafından Porya_kh1379 14 saat önce

-

XAUUSD,M30 tarafından Porya_kh1379 21 saat önce

-

EURUSD,M30 tarafından Optin Sep 18 at 07:38

-

XAUUSD,H1 tarafından Usama_Bh Sep 17 at 03:29

-

XAUUSD,H4 tarafından VeeyFX Sep 16 at 06:54