China Exports Deflation

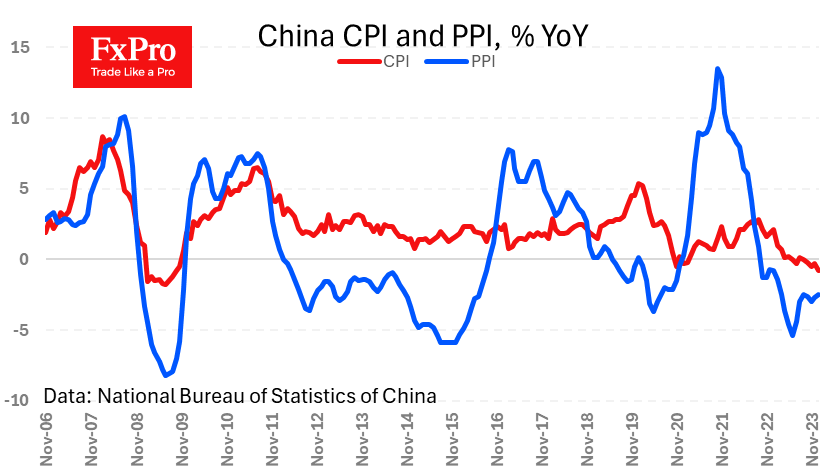

Inflation in China remains below expectations, adding to investor concerns about the world's second-largest economy. The consumer price index for January was 0.8% lower than a year earlier, more than the 0.3% drop in December and the 0.5% expected. Recall that the last peak in China's consumer inflation was in July 2022, as in many Western countries, but it was a more modest 2.7% year-on-year. For the past six months, China has been experiencing a year-on-year decline in prices. This is interpreted as a manifestation of subdued consumer demand and oversupply in the market. Problems in the real estate sector are also suspected, as they weigh on consumer sentiment.

The producer price index was 2.5% lower in January than a year earlier. This index has been in negative territory since October 2022, and in this case, it could be said that China is once again spreading deflation around the world, something it has been blamed for over the past decade. But that doesn't seem to be hurting the world now.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)