Technical Analysis – AUD/USD poised for more upside

AUDUSD continues its recovery, extending toward October’s highs near 0.6625 after the Reserve Bank of Australia (RBA) downplayed the chances of further rate cuts while inflation ticked higher. The shift in expectations helped lift the currency out of a brief consolidation phase.

In contrast, the U.S. Federal Reserve is expected to maintain its easing stance. While rate reductions are already priced in for this year, markets are watching for hints of additional cuts in early 2026. If confirmed, such expectations could fuel further gains in AUDUSD. However, the Fed will not update its rate or economic projections when its two-day policy meeting concludes today.

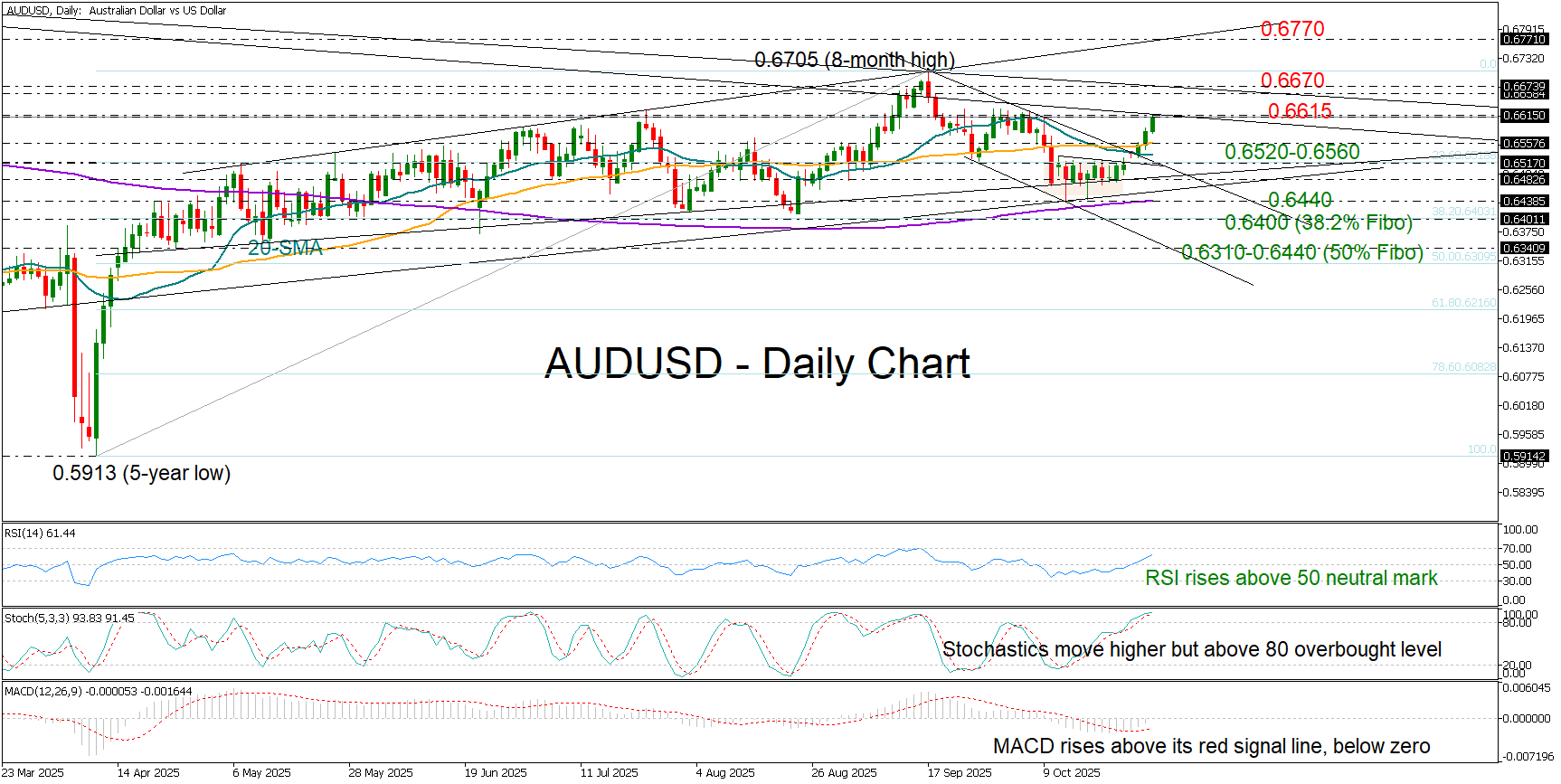

Technically, the pair’s break above the simple moving averages (SMAs) has improved the short-term picture. The positive trajectory in the RSI and the stochastic oscillator also support bullish momentum. Still, the pair remains capped below the long-term descending trendline connecting the 2021 and 2024 highs around 0.6615. The nearby 200-week SMA at 0.6660 is another critical resistance. A decisive move above these barriers could open the way toward 0.6770.

On the downside, the 0.6520–0.6560 region, containing the short-term SMAs and the 23.6% Fibonacci retracement of the April–September rally, may buffer downside movements. Further weakness below 0.6480 or 0.6400 could shift the outlook to bearish, shifting the spotlight to 0.6340.

Overall, the short-term bias for AUDUSD remains positive, with a close above 0.6615 likely to confirm renewed bullish momentum.

.jpg)