Crypto market looking for triggers

Market picture

The cryptocurrency market did not find the strength to accelerate and rolled back almost 2.3% on the day to $2.6 trillion, but that is still a gain of 3.5% in seven days. In other words, the market is holding on to its uptrend but needs drivers for further movement.

The US CPI report, which in recent years has caused a spike in volatility comparable to NFP, has an impressive potential to influence the market on Wednesday.

Renewed buying in Bitcoin and other leading altcoins since the start of the day on Wednesday indicates trader optimism. Still, this sentiment could change dramatically or intensify as early as this afternoon.

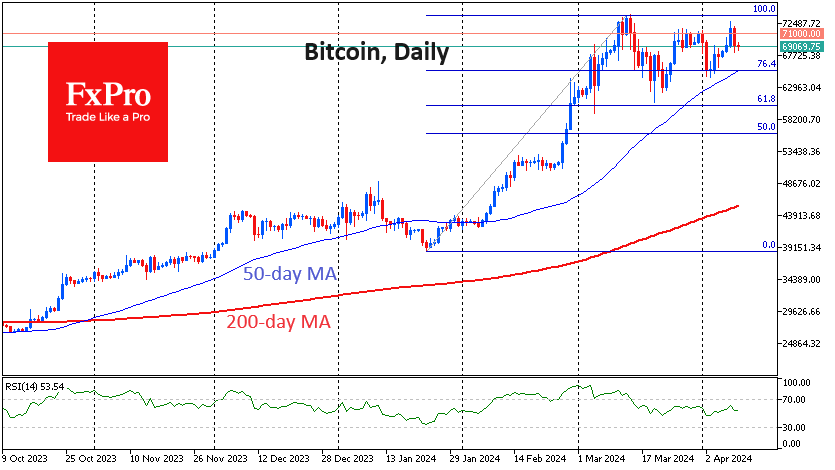

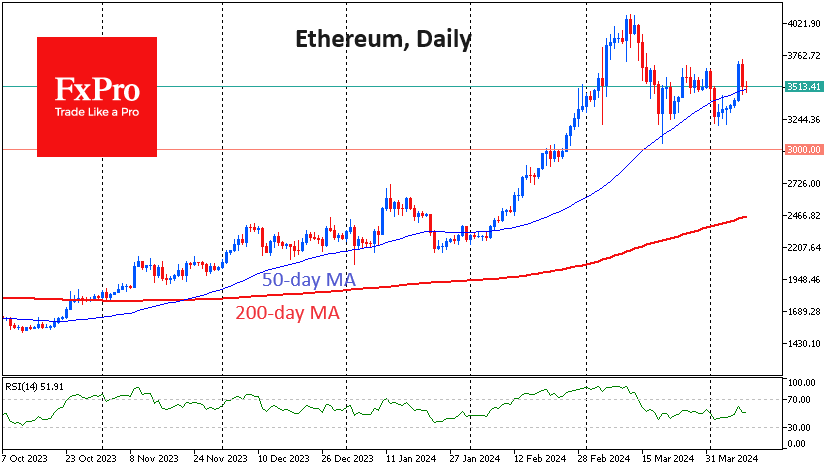

On the Bitcoin chart, a support line can be drawn through the lows from early March, the testing of which became more frequent in April. Ethereum is slightly above its 50-day moving average. Staying below this line in early April should not be dramatised, as a similar thing happened in late January and early February, only whetting buyers' appetite.

News background

Chinese financial giants Harvest Fund and Southern Fund intend to offer units of their future bitcoin-based spot exchange-traded funds to clients through their Hong Kong branches. Applications for BTC-ETF registration have been filed with Hong Kong's Securities and Futures Commission (SFC).

Deutsche Bank surveyed more than 3,600 of the bank's US, UK and EU customers. According to the survey, only 10 per cent of respondents believe Bitcoin will exceed $75K by the end of 2024.

The US Treasury Department intends to strengthen control over crypto exchanges, including foreign ones. The department lacks "legislative tools" to combat the illegal use of cryptocurrencies by terrorist groups and countries under US sanctions, said US Treasury Undersecretary Wally Adeyemo.

The cost of mining bitcoin with an Antminer S19 XP as a result of halving will rise from $40K to $80K, CryptoQuant has calculated. US miners widely use this model, and it is the top in terms of energy efficiency in the S19 lineup, representatives of which still generate most of the hashrate.

The Solana blockchain team said that the launch of new projects will be suspended until 15 April while technical issues related to network congestion and transaction errors are resolved.

According to Cointelegraph Magazine, meme coins account for the majority of activity on Base's L2 network, with one coin in six being a scam and 91% having vulnerabilities.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)