EBC Markets Briefing | US stock futures gain on early election results

US stock futures and the dollar climbed in Asia on Wednesday as early results from the presidential election suggested the race remained too close to call, leaving investors jumping at shadows.

Some hedge funds favour currency options that will gain from a weaker dollar should Kamala Harris win the presidency. They also unwound some bullish greenback bets on Monday.

The one-week implied volatility for euro/dollar options was the highest since March 2023. A Trump victory could see the dollar rally 3%, whereas a Harris victory could see it fall around 2%, according to Citigroup strategists.

Markets generally assume Trump's plans for restricted immigration, tax cuts and sweeping tariffs if enacted would put more upward pressure on inflation and bond yields, than Harris' centre-left policies.

Wall St closed sharply higher in a broad rally on Tuesday after data signalled a solid economy. ISM non-manufacturing PMI accelerated to 56 last month, its highest since August 2022.

Congressional elections are closely watched to determine the balance of power in Washington. Many analysts predict a split government, which would limit the ability of the president to enact significant policy changes.

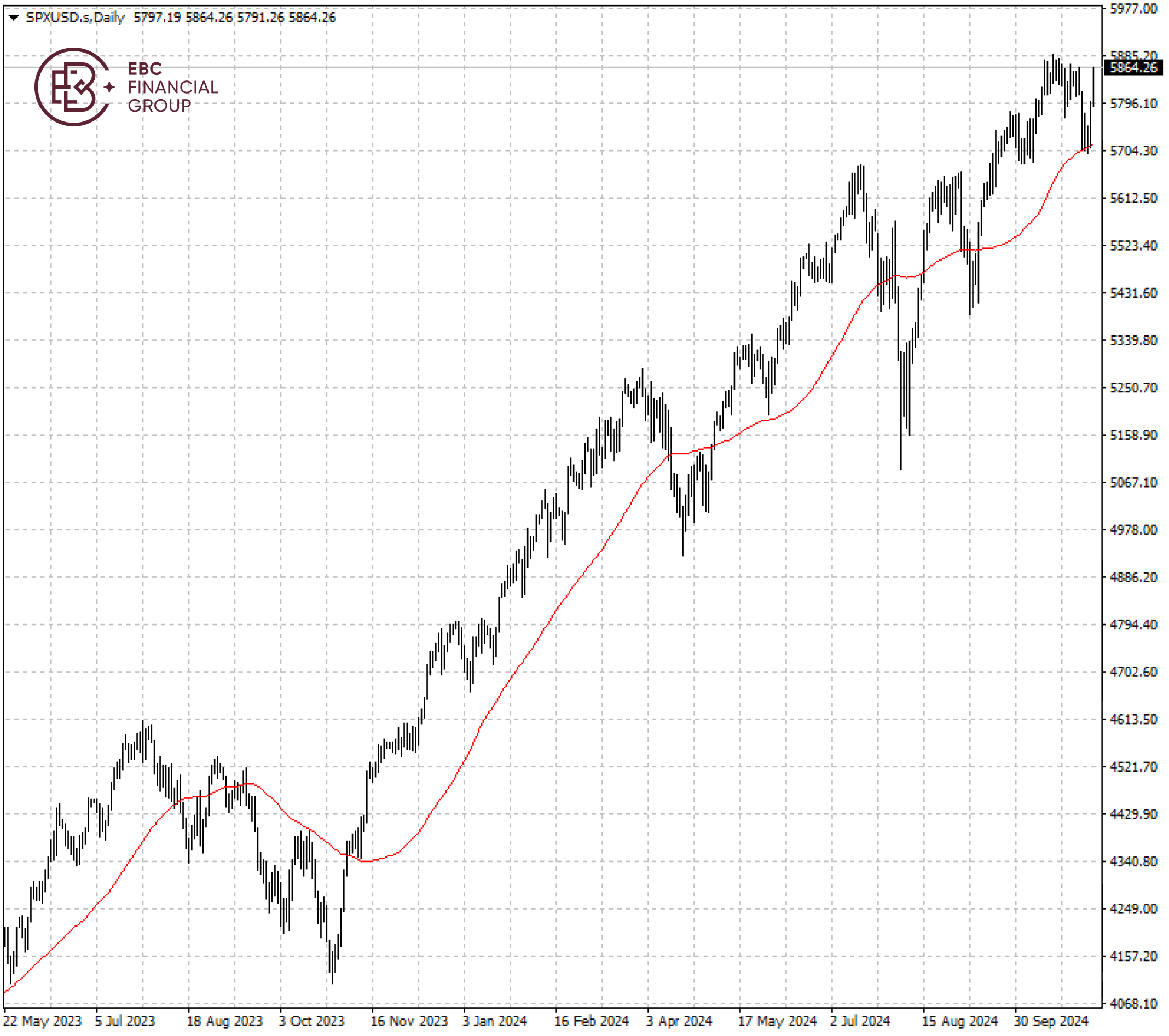

The S&P 500 sits comfortably above 50 SMA, suggesting the strong upside bias. It was near the historic high around 5,880 which appears to be the immediate resistance.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.