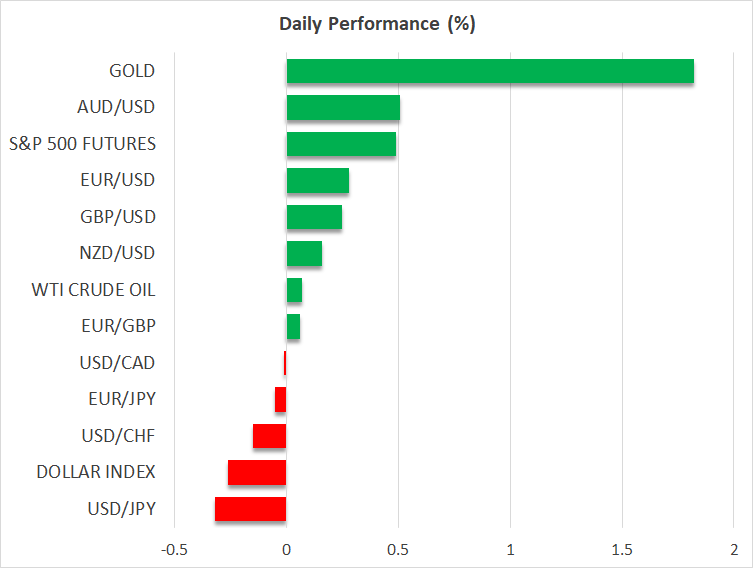

Fragile risk appetite fails to lift the dollar

Dollar is under pressure once again

Following a relatively volatile but positive period, the US dollar is once again on the back foot after failing to retest the 1.1500 area in euro/dollar. The risk-off reaction observed since last Friday, which boosted the greenback, has quickly evaporated even though risk markets are still not out of the woods.

Notably, the biggest moves in the FX space are currently seen in yen crosses. The dented chances of the new LDP leader becoming the next prime minister continue to drive dollar/yen lower, with the BoJ also contributing to this yen recovery with certain behind-the-scenes actions.

The October Fed rate cut is almost certain

One of the key reasons for this dollar reaction was probably Tuesday’s Fedspeak and, in particular, the Fed Chair’s appearance. Powell highlighted the rising downside risks to the US labour market, which essentially prompted the September rate cut. Despite his comments that there is “a risk that slow pass-through of tariffs could start to look like persistent inflation”, investors remain confident that the October 29 rate cut is a rather safe bet at this stage, with 96% probability assigned by the market to this outcome.

Interestingly, Boston Fed President Collins also highlighted the persistence of inflation worries, even stating that “inflation continues to be at top of my mind”, potentially laying the framework for the late October meeting: a rate cut due to a weakening labour market, with lots of caveats about inflation, which has been more or less the prevailing Fed stance since the Jackson Hole symposium.

Further Fed speakers are expected today, with board members Miran and Waller most likely carrying the dovish torch. It would be interesting to see if Waller comments on a newspaper survey showing him as the economists’ top choice for the Chair position. On the other hand, Kansas City Fed President Schmid might try to moderate the dovish Fedspeak, laying out some of the arguments the hawks are expected to put forward at the upcoming meeting.

Risk markets remain jittery

Meanwhile, US equity indices managed to curtail their initial losses yesterday, with the traditional Dow Jones index finishing in positive territory on Tuesday. Sentiment, though, remains fragile despite the dovish Fedspeak and a decent start to the current earnings round.

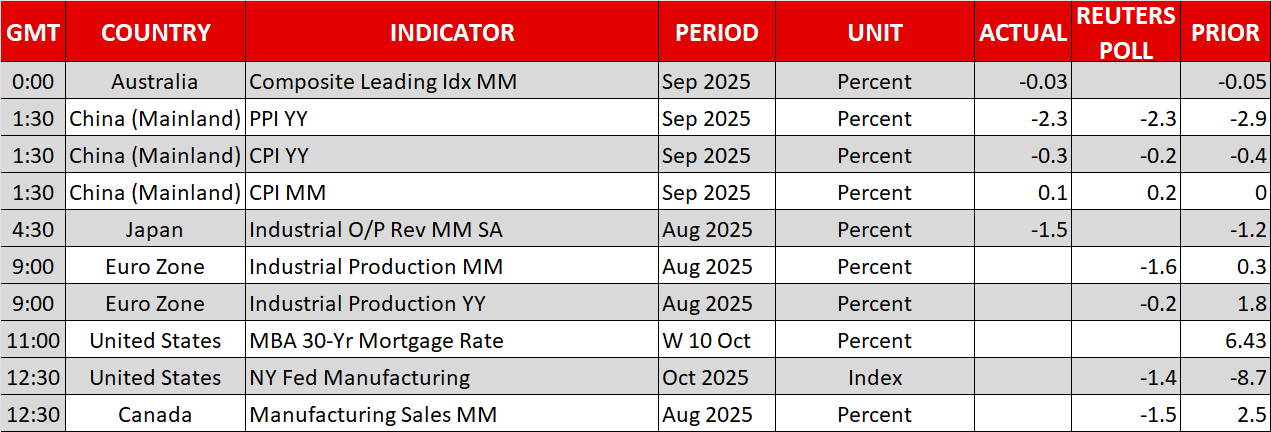

In particular, the current spat between the US and China regarding restrictions on rare earth metals has legs, with rhetoric from both expected to persist over the next few sessions, until a high-level meeting straightens out the current differences. US officials are trying to take advantage of China’s continued economic weakness, as seen in the latest CPI report. Headline CPI has now completed three years of negative annual growth, with the core CPI edging to 1%, a rare bright spot in recent Chinese data.

Notably, the GDP report for the third quarter of 2025 will be published next week, amidst the Fourth Plenum of the 20th Central Committee of the Communist Party, potentially unlocking further support programmes and a looser stance from the PBoC, with an LPR cut possibly on the cards.

Gold higher, oil is trying to stabilize

The dollar’s weakness, China’s continued economic hardship and reports about the fragile Israel-Hamas agreement are acting as tailwinds for gold at this juncture. The precious metal is edging closer to the $4,200 level, quickly overcoming yesterday’s challenging session.

The opposite is true for oil, though. Following a number of production hikes by the OPEC+ alliance and an unsatisfactory global growth rate, oil prices are hovering at their lowest level since May. However, back then, Trump’s reciprocal tariffs scared investors about the growth outlook. Is sentiment in the oil market too pessimistic or is global growth much weaker than currently perceived? Alternatively, could it be that oil traders are discounting some positive progress in the Ukraine-Russia conflict in the immediate future?

.jpg)