Gold pushes into fresh record highs

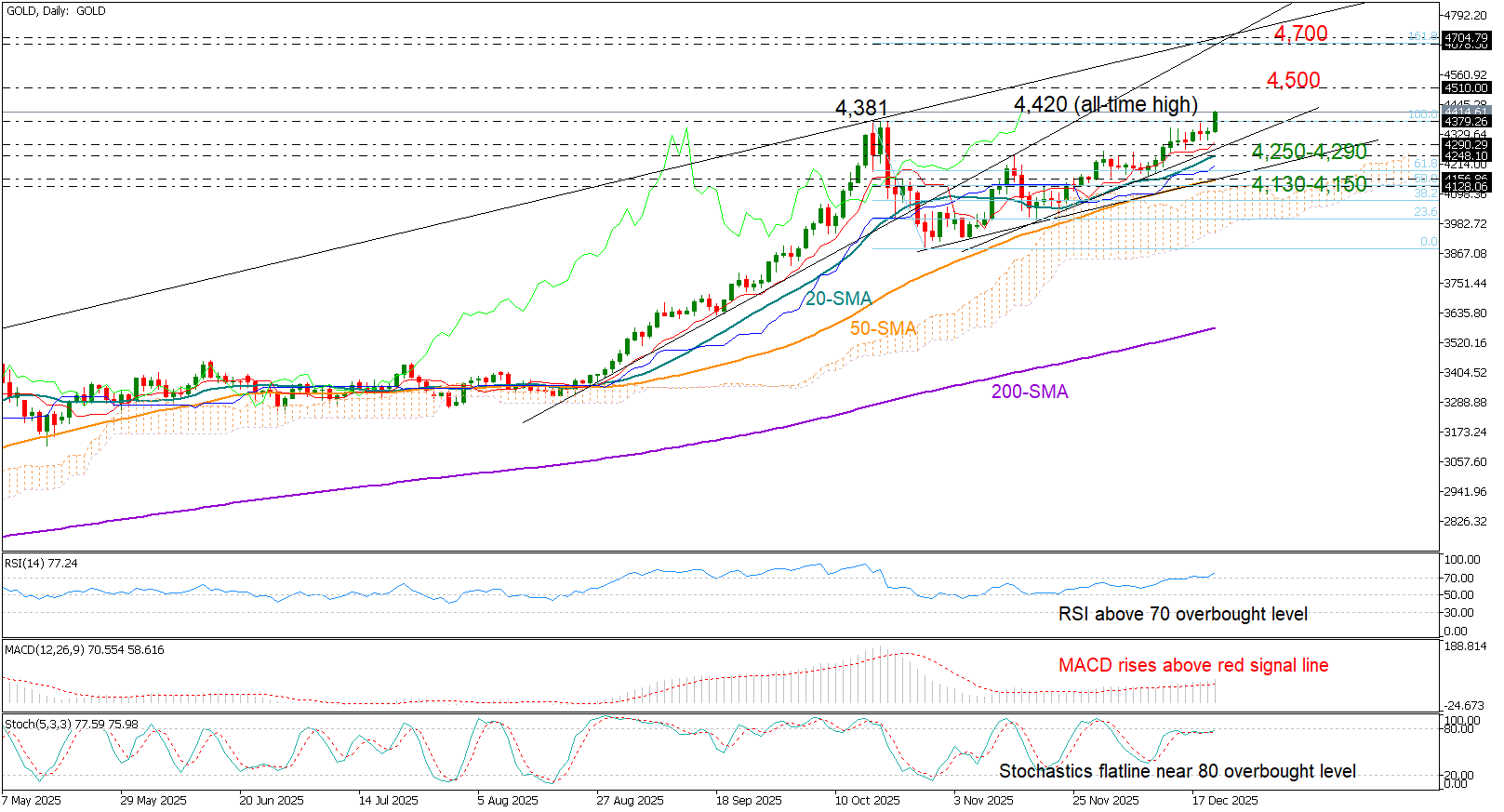

Gold was spotted at a new all-time high of 4,420 early on Monday, extending its two-month-old recovery phase from October’s low of 3,886. A combination of factors - including expectations of Fed rate cuts, headlines surrounding a potential renewed escalation in tensions between Israel and Iran, and another U.S. oil blockade against Venezuela – was sufficient to propel bullion to higher levels.

The bulls must now secure a clear close above the previous peak of 4,381 to stretch towards the 4,500 psychological level and then pick up steam towards the tentative resistance line from April 2025 at 4,700. Note that the 161.8% Fibonacci retracement level of the latest downfall is in the neighborhood too. Beyond that, the door could open for the 4,900 round-level.

From a technical perspective, the deviation from the Ichimoku cloud and the positive slope in the simple moving averages (SMAs) can fuel buying interest in the short-term. The rising MACD is another encouraging sign, though some caution might be warranted as the RSI is strengthening in the overbought territory.

In the event upside pressures fade immediately, support could initially emerge near the 4,250-4,290 zone and the 20-day SMA. Further declines could bring the 50-day SMA and the upper band of the Ichimoku back into play within the 4,130-4,150 region.

Summing up, the precious metal might be poised to enjoy a Santa Claus rally as it enters uncharted territory, with buyers likely awaiting a convincing move above 4,380 to drive the price higher.