The dollar awaits the rate forecast

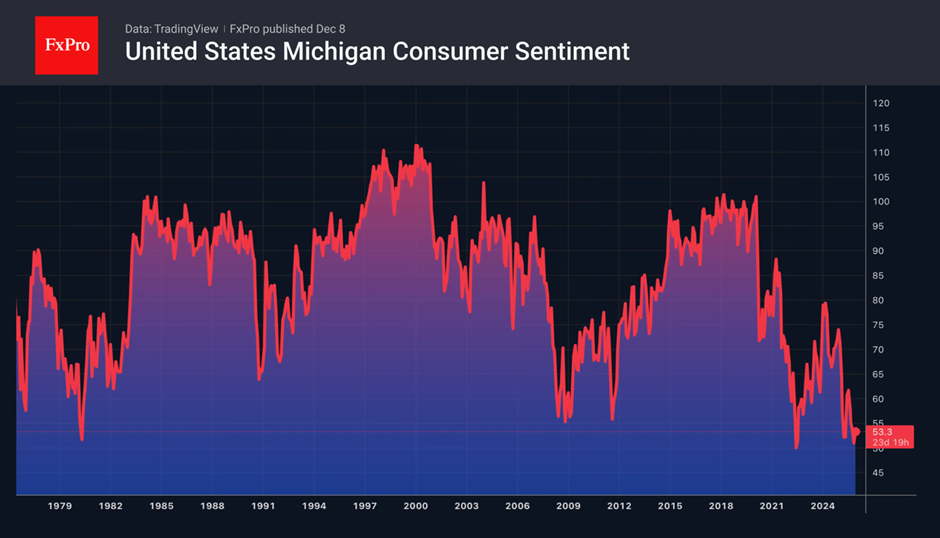

Americans are unhappy with high prices and tariffs and are sceptical about the economic outlook, but they continue to spend money. The University of Michigan Consumer Sentiment Index rose to 53.3 in December, driven by optimism about the end of the shutdown. Nevertheless, the index remains close to record lows. At the same time, Finance Minister Scott Bessent claims that US GDP will grow by 3% in 2025.

Foreign investors feel the same way about the US economy as Americans do. They are investing in securities but are sceptical about GDP growth prospects. As a result, the USD index could fall significantly lower, but it is not in a rush to do so. If the prospects for artificial intelligence technologies fade, capital flows from abroad will cease to support the dollar. On the contrary, the acceleration of gross domestic product under the influence of Donald Trump's Big and Beautiful Tax Cuts Act will allow the USD index to recover.

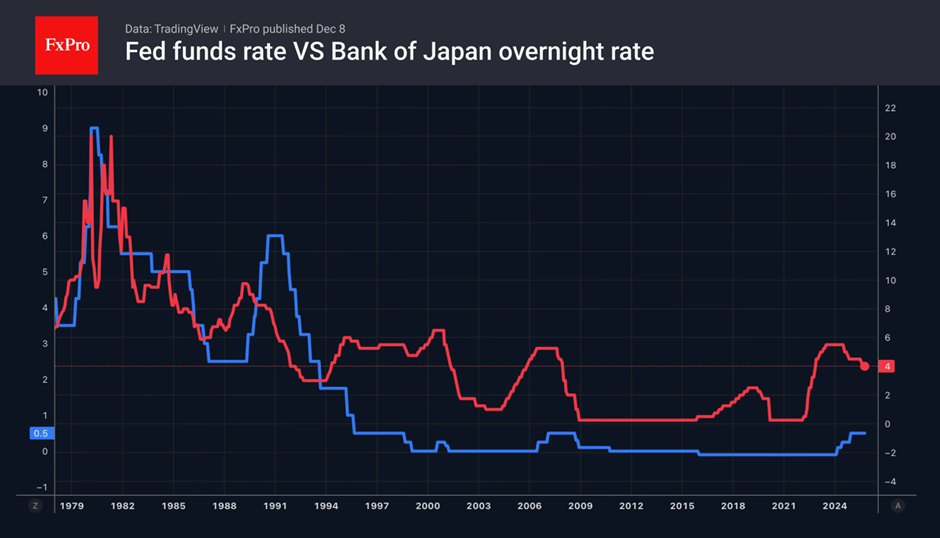

For now, investors are waiting for the December FOMC meeting and updated forecasts. The futures market is predicting two or three rate cuts in 2026. If the Fed expects fewer, the US dollar will likely strengthen, despite its weakening to 3.75% in December. This will be facilitated by Jerome Powell's hawkish rhetoric at the press conference.

Concerns about such an outcome of the Fed meeting are putting a spoke in the wheel of USDJPY bears. Markets are expecting an overnight rate hike to 0.75% at the Bank of Japan's December meeting. However, the weakness of the Land of the Rising Sun's economy may force the BoJ to signal a prolonged pause in the cycle, which will put pressure on the yen. In this regard, the downward revision of third-quarter GDP to -2.3% casts doubt on its status as the favourite for 2026.

The Australian dollar may become the favourite among traders. The futures market is confident that the Reserve Bank will keep its key rate at 3.6% at its meeting on 8-9 December and is beginning to price in expectations of a hike next year. The sooner Michelle Bullock and her colleagues make a hawkish turn, the higher the AUDUSD will rise.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)