USDJPY turns up, but is the rebound sustainable?

USDJPY found new buyers near its 200-day simple moving average (SMA) at 143.40 on Tuesday, drifting higher to close mildly positive on the day.

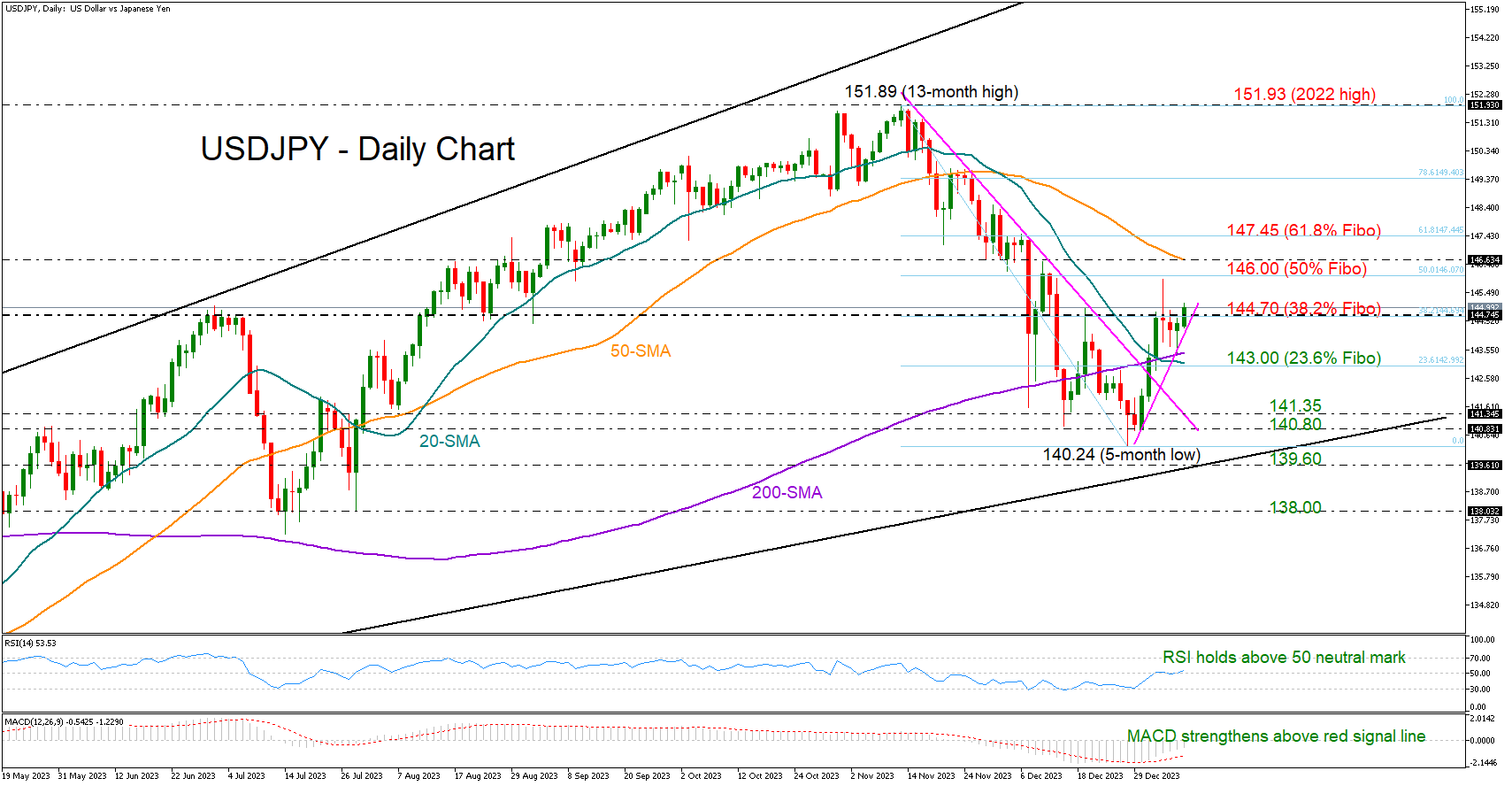

Upside pressures persisted early on Wednesday, bringing the important 144.70 region, which coincides with the 38.2% Fibonacci retracement of the previous downleg, back under examination. A durable move above that border could be the key for an extension towards the 146.00 round level and the 50-day SMA, while higher the door will open for the 61.8% Fibonacci mark of 147.45.

The upturn in the RSI and the MACD is a positive signal that buying confidence is improving. Yet, the negative risks have not faded yet as the pair is still struggling to overcome its 200-period SMA on the four-hour chart. Moreover, the bearish crossover between the 20- and 200-day SMAs and the narrowing gap between the 50- and 200-day SMAs could be an indication that the latest rebound may not be sustainable.

Hence, the 20- and 200-day SMAs will stay under the spotlight. Should the bears breach that floor, squeezing the price below the 143.00 number, they could revisit the broken resistance trendline from November’s highs around 141.35. If the previous downtrend resumes below 140.80, the next stop could be near the 2023 support trendline at 139.60.

In a nutshell, if the 144.70 area gives way, USDJPY could progress to higher levels in the coming sessions. Though, given the discouraging trend signals, buyers may need to see new higher highs in the market to raise their exposure.