USDJPY pauses before Fed call; BoJ rate hike speculation builds

USDJPY edged slightly lower on Wednesday ahead of the Federal Reserve’s interest rate decision later today, with the pair hovering below the 157.00 level after a sharp three-day increase. Sentiment was also influenced by comments from Bank of Japan Governor Kazuo Ueda, who signaled that the central bank is nearing its inflation target, fueling speculation of a possible rate hike as early as next week. Markets remain focused on Ueda’s post-meeting remarks for clues on the BoJ’s policy trajectory into 2026.

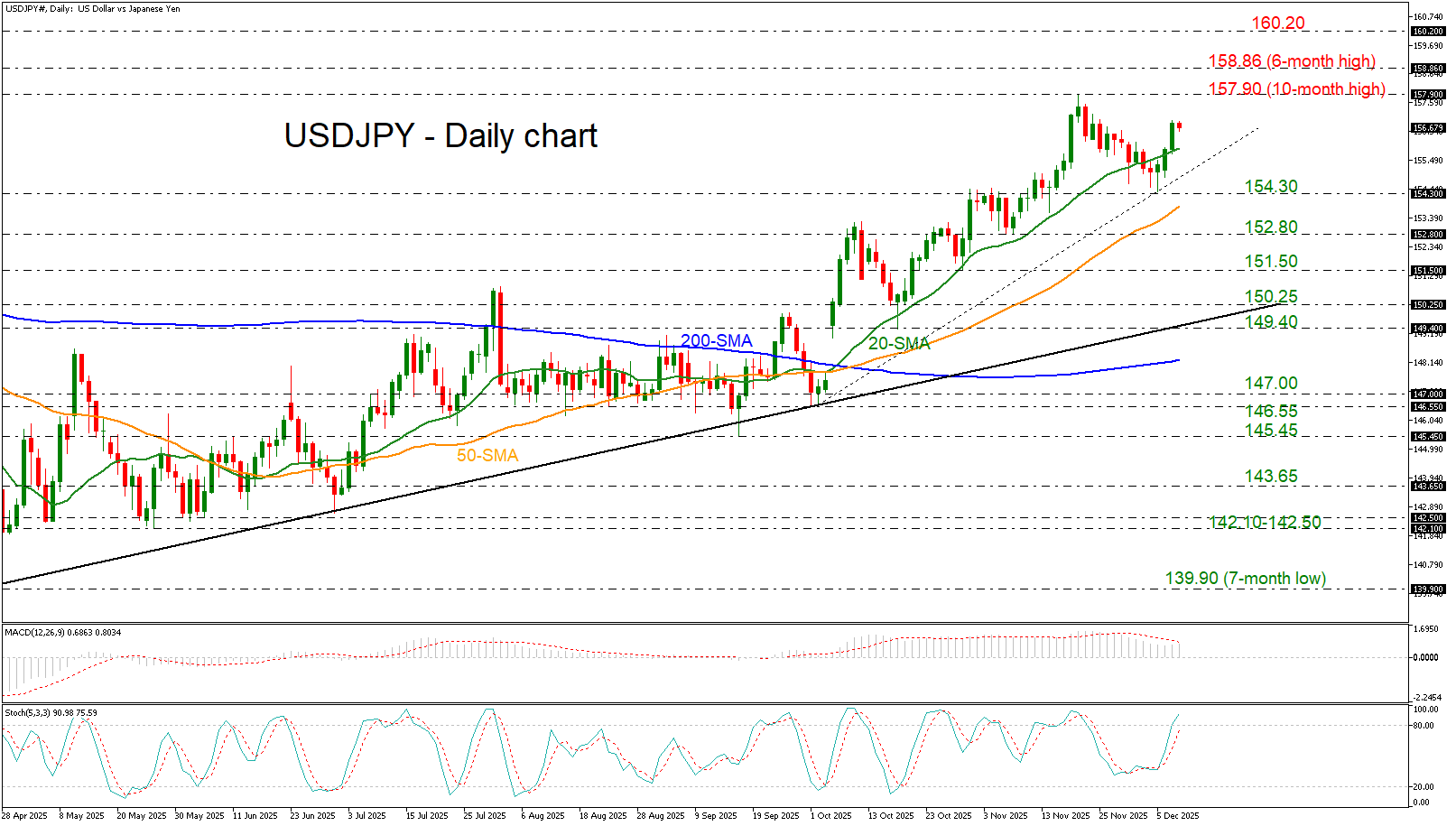

The pair is trading well above the short-term uptrend line and the 20-day simple moving average (SMA) at 155.90, with potential to reclaim the ten-month high of 157.90. If the rally extends, gains could pause near the 158.86 resistance.

On the downside, a rebound off 154.30 is expected if a correction occurs. However, deeper losses could lead traders to test the 50-day SMA at 153.80 ahead of the 152.80 support level.

From a technical standpoint, the MACD is flirting with its trigger line above the zero area, while the stochastic oscillator is ticking up above the 80 level, suggesting bullish momentum remains intact.

Overall, USDJPY maintains a strong bullish bias, supported by technical indicators and market expectations of diverging monetary policies. However, volatility may increase following the Fed’s decision and any signals from the BoJ, keeping traders alert for potential breakout or correction scenarios.