Technical Analysis – EURUSD stays pressured near 1.1600

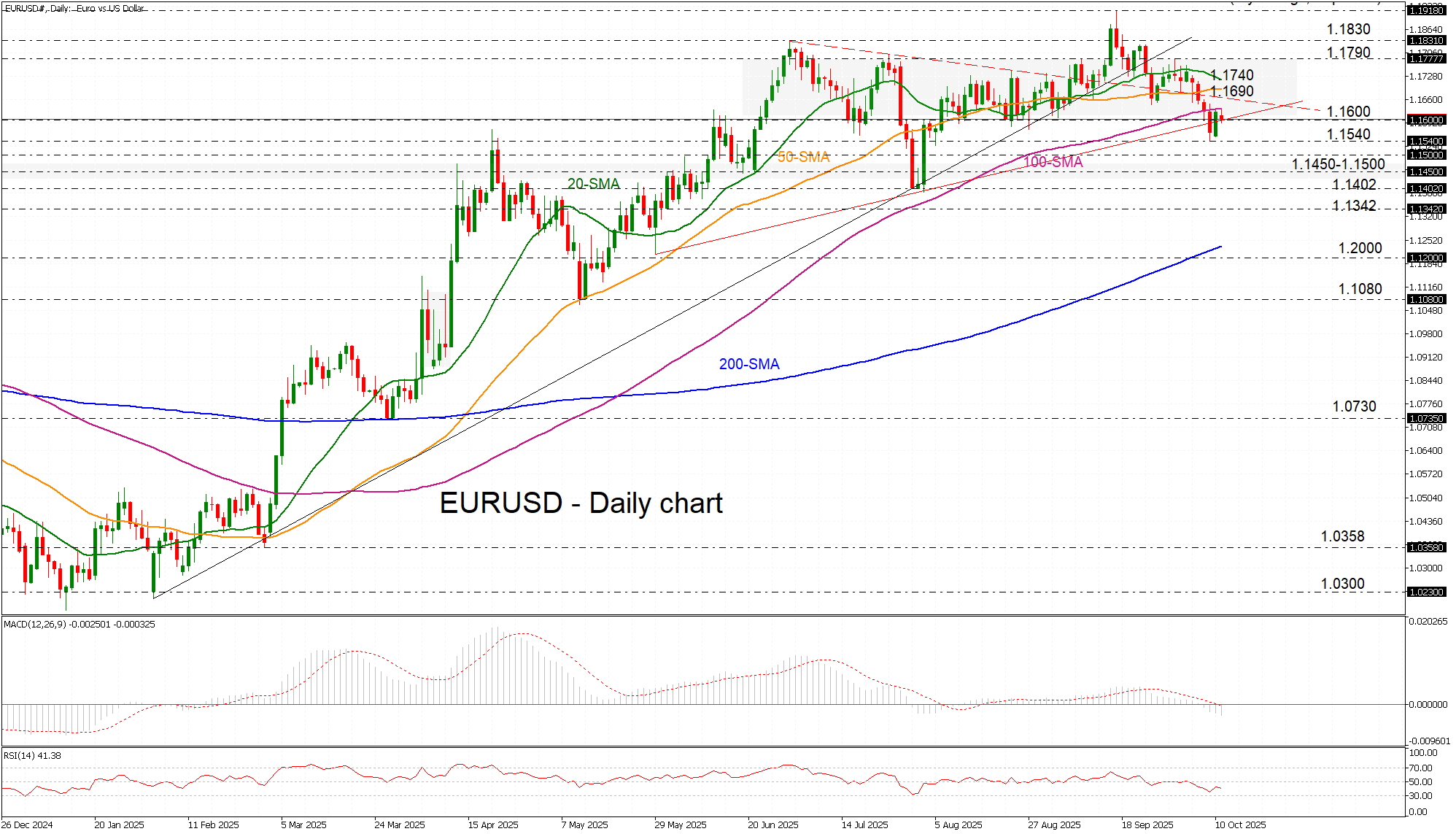

EURUSD remains under pressure near a key threshold, sensitive to ongoing political and policy developments in both France and the US. The pair recently dipped to a two-month low around 1.1540 before staging a modest rebound that briefly lifted the price above 1.1600. However, the technical indicators continue to point to bearish momentum, with the pair trading below the 20- and 50-day simple moving averages (SMAs), which are capping recovery attempts.

The broader structure still favors the downside. The MACD is trading in negative territory, showing only a marginal attempt to approach its red signal line, while the RSI is holding below the midline, suggesting that further downside cannot be ruled out in the near term.

A failure to hold above 1.1600 would reinforce the bearish bias, exposing the 1.1500-1.1450 support zone. A breach below this area could drag the pair toward 1.1403, the low from July 31, followed by a deeper decline toward the June 2 low of 1.1342.

Conversely, a sustained move above the 100-day SMA at 1.1635, which is currently being tested, could pave the way for a retest of the 20- and 50-day SMAs in the 1.1690-1.1740 region. A break above this area could target the monthly high of 1.1790 set on October 1, which also marks the ceiling of a medium-term range that has held intermittently since late June. Such a move could shift sentiment toward a more neutral or even bullish outlook.

Overall, EURUSD remains vulnerable as long as it trades below the key moving averages. A failure to reclaim 1.1700 increases the likelihood of the pair carving out a bottom around the 1.1450-1.1500 region.

.jpg)